Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

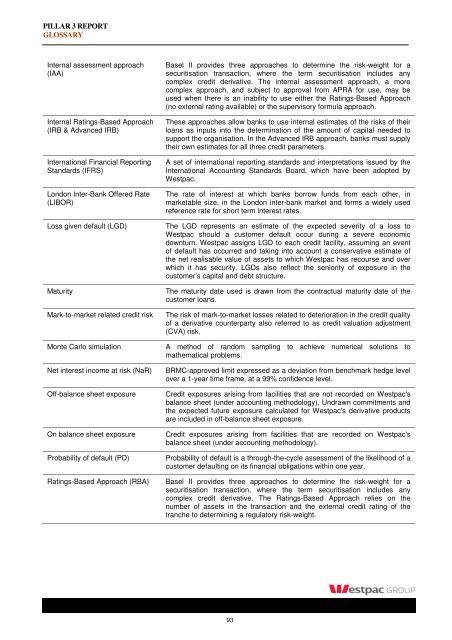

PILLAR 3 REPORT<br />

GLOSSARY<br />

Internal assessment approach<br />

(IAA)<br />

Internal Ratings-Based Approach<br />

(<strong>IR</strong>B & Advanced <strong>IR</strong>B)<br />

International Financial <strong>Report</strong>ing<br />

Standards (IFRS)<br />

London Inter-Bank Offered Rate<br />

(LIBOR)<br />

Loss given default (LGD)<br />

Maturity<br />

Mark-to-market related credit risk<br />

Monte Carlo simulation<br />

Net interest income at risk (NaR)<br />

Off-balance sheet exposure<br />

On balance sheet exposure<br />

Probability of default (PD)<br />

Ratings-Based Approach (RBA)<br />

Basel II provides three approaches to determine the risk-weight for a<br />

securitisation transaction, where the term securitisation includes any<br />

complex credit derivative. The internal assessment approach, a more<br />

complex approach, and subject to approval from APRA for use, may be<br />

used when there is an inability to use either the Ratings-Based Approach<br />

(no external rating available) or the supervisory formula approach.<br />

These approaches allow banks to use internal estimates of the risks of their<br />

loans as inputs into the determination of the amount of capital needed to<br />

support the organisation. In the Advanced <strong>IR</strong>B approach, banks must supply<br />

their own estimates for all three credit parameters.<br />

A set of international reporting standards and interpretations issued by the<br />

International Accounting Standards Board, which have been adopted by<br />

<strong>Westpac</strong>.<br />

The rate of interest at which banks borrow funds from each other, in<br />

marketable size, in the London inter-bank market and forms a widely used<br />

reference rate for short term interest rates.<br />

The LGD represents an estimate of the expected severity of a loss to<br />

<strong>Westpac</strong> should a customer default occur during a severe economic<br />

downturn. <strong>Westpac</strong> assigns LGD to each credit facility, assuming an event<br />

of default has occurred and taking into account a conservative estimate of<br />

the net realisable value of assets to which <strong>Westpac</strong> has recourse and over<br />

which it has security. LGDs also reflect the seniority of exposure in the<br />

customer’s capital and debt structure.<br />

The maturity date used is drawn from the contractual maturity date of the<br />

customer loans.<br />

The risk of mark-to-market losses related to deterioration in the credit quality<br />

of a derivative counterparty also referred to as credit valuation adjustment<br />

(CVA) risk.<br />

A method of random sampling to achieve numerical solutions to<br />

mathematical problems.<br />

BRMC-approved limit expressed as a deviation from benchmark hedge level<br />

over a 1-year time frame, at a 99% confidence level.<br />

Credit exposures arising from facilities that are not recorded on <strong>Westpac</strong>'s<br />

balance sheet (under accounting methodology). Undrawn commitments and<br />

the expected future exposure calculated for <strong>Westpac</strong>'s derivative products<br />

are included in off-balance sheet exposure.<br />

Credit exposures arising from facilities that are recorded on <strong>Westpac</strong>'s<br />

balance sheet (under accounting methodology).<br />

Probability of default is a through-the-cycle assessment of the likelihood of a<br />

customer defaulting on its financial obligations within one year.<br />

Basel II provides three approaches to determine the risk-weight for a<br />

securitisation transaction, where the term securitisation includes any<br />

complex credit derivative. The Ratings-Based Approach relies on the<br />

number of assets in the transaction and the external credit rating of the<br />

tranche to determining a regulatory risk-weight.<br />

93