The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

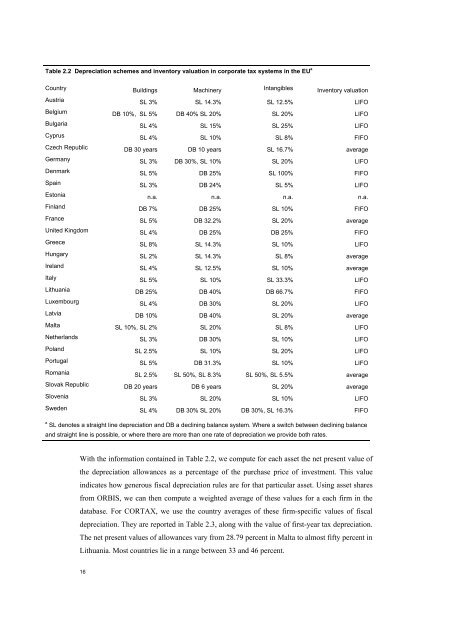

Table 2.2 Depreciation schemes and <strong>in</strong>ventory valuation <strong>in</strong> <strong>corporate</strong> <strong>tax</strong> <strong>systems</strong> <strong>in</strong> the <strong>EU</strong> a<br />

Country Build<strong>in</strong>gs Mach<strong>in</strong>ery Intangibles Inventory valuation<br />

Austria SL 3% SL 14.3% SL 12.5% LIFO<br />

Belgium DB 10%, SL 5% DB 40% SL 20% SL 20% LIFO<br />

Bulgaria SL 4% SL 15% SL 25% LIFO<br />

Cyprus SL 4% SL 10% SL 8% FIFO<br />

Czech Republic DB 30 years DB 10 years SL 16.7% average<br />

Germany SL 3% DB 30%, SL 10% SL 20% LIFO<br />

Denmark SL 5% DB 25% SL 100% FIFO<br />

Spa<strong>in</strong> SL 3% DB 24% SL 5% LIFO<br />

Estonia n.a. n.a. n.a. n.a.<br />

F<strong>in</strong>land DB 7% DB 25% SL 10% FIFO<br />

France SL 5% DB 32.2% SL 20% average<br />

United K<strong>in</strong>gdom SL 4% DB 25% DB 25% FIFO<br />

Greece SL 8% SL 14.3% SL 10% LIFO<br />

Hungary SL 2% SL 14.3% SL 8% average<br />

Ireland SL 4% SL 12.5% SL 10% average<br />

Italy SL 5% SL 10% SL 33.3% LIFO<br />

Lithuania DB 25% DB 40% DB 66.7% FIFO<br />

Luxembourg SL 4% DB 30% SL 20% LIFO<br />

Latvia DB 10% DB 40% SL 20% average<br />

Malta SL 10%, SL 2% SL 20% SL 8% LIFO<br />

Netherlands SL 3% DB 30% SL 10% LIFO<br />

Poland SL 2.5% SL 10% SL 20% LIFO<br />

Portugal SL 5% DB 31.3% SL 10% LIFO<br />

Romania SL 2.5% SL 50%, SL 8.3% SL 50%, SL 5.5% average<br />

Slovak Republic DB 20 years DB 6 years SL 20% average<br />

Slovenia SL 3% SL 20% SL 10% LIFO<br />

Sweden SL 4% DB 30% SL 20% DB 30%, SL 16.3% FIFO<br />

a<br />

SL denotes a straight l<strong>in</strong>e depreciation and DB a decl<strong>in</strong><strong>in</strong>g balance system. Where a switch between decl<strong>in</strong><strong>in</strong>g balance<br />

and straight l<strong>in</strong>e is possible, or where there are more than one rate <strong>of</strong> depreciation we provide both rates.<br />

With the <strong>in</strong>formation conta<strong>in</strong>ed <strong>in</strong> Table 2.2, we compute for each asset the net present value <strong>of</strong><br />

the depreciation allowances as a percentage <strong>of</strong> the purchase price <strong>of</strong> <strong>in</strong>vestment. This value<br />

<strong>in</strong>dicates how generous fiscal depreciation rules are for that particular asset. Us<strong>in</strong>g asset shares<br />

from ORBIS, we can then compute a weighted average <strong>of</strong> these values for a each firm <strong>in</strong> the<br />

database. For CORTAX, we use the country averages <strong>of</strong> these firm-specific values <strong>of</strong> fiscal<br />

depreciation. <strong>The</strong>y are reported <strong>in</strong> Table 2.3, along with the value <strong>of</strong> first-year <strong>tax</strong> depreciation.<br />

<strong>The</strong> net present values <strong>of</strong> allowances vary from 28.79 percent <strong>in</strong> Malta to almost fifty percent <strong>in</strong><br />

Lithuania. Most countries lie <strong>in</strong> a range between 33 and 46 percent.<br />

16