The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

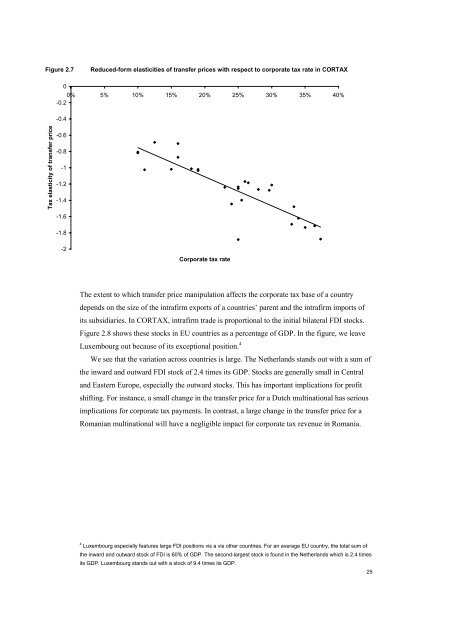

Figure 2.7<br />

Reduced-form elasticities <strong>of</strong> transfer prices with respect to <strong>corporate</strong> <strong>tax</strong> rate <strong>in</strong> CORTAX<br />

0<br />

0% 5% 10% 15% 20% 25% 30% 35% 40%<br />

-0.2<br />

-0.4<br />

Tax elasticity <strong>of</strong> transfer price<br />

-0.6<br />

-0.8<br />

-1<br />

-1.2<br />

-1.4<br />

-1.6<br />

-1.8<br />

-2<br />

Corporate <strong>tax</strong> rate<br />

<strong>The</strong> extent to which transfer price manipulation affects the <strong>corporate</strong> <strong>tax</strong> base <strong>of</strong> a country<br />

depends on the size <strong>of</strong> the <strong>in</strong>trafirm exports <strong>of</strong> a countries’ parent and the <strong>in</strong>trafirm imports <strong>of</strong><br />

its subsidiaries. In CORTAX, <strong>in</strong>trafirm trade is proportional to the <strong>in</strong>itial bilateral FDI stocks.<br />

Figure 2.8 shows these stocks <strong>in</strong> <strong>EU</strong> countries as a percentage <strong>of</strong> GDP. In the figure, we leave<br />

Luxembourg out because <strong>of</strong> its exceptional position. 4<br />

We see that the variation across countries is large. <strong>The</strong> Netherlands stands out with a sum <strong>of</strong><br />

the <strong>in</strong>ward and outward FDI stock <strong>of</strong> 2.4 times its GDP. Stocks are generally small <strong>in</strong> Central<br />

and Eastern Europe, especially the outward stocks. This has important implications for pr<strong>of</strong>it<br />

shift<strong>in</strong>g. For <strong>in</strong>stance, a small change <strong>in</strong> the transfer price for a Dutch mult<strong>in</strong>ational has serious<br />

implications for <strong>corporate</strong> <strong>tax</strong> payments. In contrast, a large change <strong>in</strong> the transfer price for a<br />

Romanian mult<strong>in</strong>ational will have a negligible impact for <strong>corporate</strong> <strong>tax</strong> revenue <strong>in</strong> Romania.<br />

4 Luxembourg especially features large FDI positions vis a vis other countries. For an average <strong>EU</strong> country, the total sum <strong>of</strong><br />

the <strong>in</strong>ward and outward stock <strong>of</strong> FDI is 60% <strong>of</strong> GDP. <strong>The</strong> second-largest stock is found <strong>in</strong> the Netherlands which is 2.4 times<br />

its GDP. Luxembourg stands out with a stock <strong>of</strong> 9.4 times its GDP.<br />

25