The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

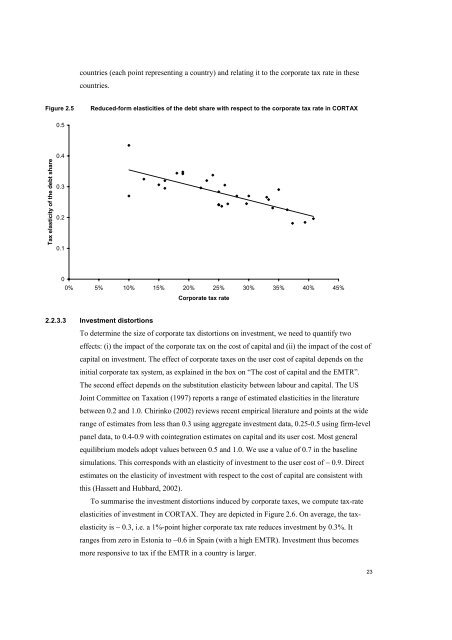

countries (each po<strong>in</strong>t represent<strong>in</strong>g a country) and relat<strong>in</strong>g it to the <strong>corporate</strong> <strong>tax</strong> rate <strong>in</strong> these<br />

countries.<br />

Figure 2.5<br />

Reduced-form elasticities <strong>of</strong> the debt share with respect to the <strong>corporate</strong> <strong>tax</strong> rate <strong>in</strong> CORTAX<br />

0.5<br />

Tax elasticity <strong>of</strong> the debt share<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%<br />

Corporate <strong>tax</strong> rate<br />

2.2.3.3 Investment distortions<br />

To determ<strong>in</strong>e the size <strong>of</strong> <strong>corporate</strong> <strong>tax</strong> distortions on <strong>in</strong>vestment, we need to quantify two<br />

<strong>effects</strong>: (i) the impact <strong>of</strong> the <strong>corporate</strong> <strong>tax</strong> on the cost <strong>of</strong> capital and (ii) the impact <strong>of</strong> the cost <strong>of</strong><br />

capital on <strong>in</strong>vestment. <strong>The</strong> effect <strong>of</strong> <strong>corporate</strong> <strong>tax</strong>es on the user cost <strong>of</strong> capital depends on the<br />

<strong>in</strong>itial <strong>corporate</strong> <strong>tax</strong> system, as expla<strong>in</strong>ed <strong>in</strong> the box on “<strong>The</strong> cost <strong>of</strong> capital and the EMTR”.<br />

<strong>The</strong> second effect depends on the substitution elasticity between labour and capital. <strong>The</strong> US<br />

Jo<strong>in</strong>t Committee on Taxation (1997) reports a range <strong>of</strong> estimated elasticities <strong>in</strong> the literature<br />

between 0.2 and 1.0. Chir<strong>in</strong>ko (2002) reviews recent empirical literature and po<strong>in</strong>ts at the wide<br />

range <strong>of</strong> estimates from less than 0.3 us<strong>in</strong>g aggregate <strong>in</strong>vestment data, 0.25-0.5 us<strong>in</strong>g firm-level<br />

panel data, to 0.4-0.9 with co<strong>in</strong>tegration estimates on capital and its user cost. Most general<br />

equilibrium models adopt values between 0.5 and 1.0. We use a value <strong>of</strong> 0.7 <strong>in</strong> the basel<strong>in</strong>e<br />

simulations. This corresponds with an elasticity <strong>of</strong> <strong>in</strong>vestment to the user cost <strong>of</strong> − 0.9. Direct<br />

estimates on the elasticity <strong>of</strong> <strong>in</strong>vestment with respect to the cost <strong>of</strong> capital are consistent with<br />

this (Hassett and Hubbard, 2002).<br />

To summarise the <strong>in</strong>vestment distortions <strong>in</strong>duced by <strong>corporate</strong> <strong>tax</strong>es, we compute <strong>tax</strong>-rate<br />

elasticities <strong>of</strong> <strong>in</strong>vestment <strong>in</strong> CORTAX. <strong>The</strong>y are depicted <strong>in</strong> Figure 2.6. On average, the <strong>tax</strong>elasticity<br />

is − 0.3, i.e. a 1%-po<strong>in</strong>t higher <strong>corporate</strong> <strong>tax</strong> rate reduces <strong>in</strong>vestment by 0.3%. It<br />

ranges from zero <strong>in</strong> Estonia to −0.6 <strong>in</strong> Spa<strong>in</strong> (with a high EMTR). Investment thus becomes<br />

more responsive to <strong>tax</strong> if the EMTR <strong>in</strong> a country is larger.<br />

23