The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

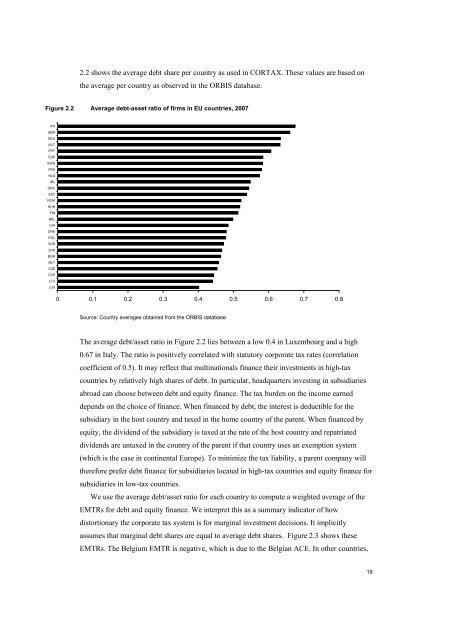

2.2 shows the average debt share per country as used <strong>in</strong> CORTAX. <strong>The</strong>se values are based on<br />

the average per country as observed <strong>in</strong> the ORBIS database.<br />

Figure 2.2 Average debt-asset ratio <strong>of</strong> firms <strong>in</strong> <strong>EU</strong> countries, 2007<br />

ITA<br />

GBR<br />

D<strong>EU</strong><br />

AUT<br />

PRT<br />

ESP<br />

SWE<br />

FRA<br />

NLD<br />

IRL<br />

GRC<br />

EST<br />

ROM<br />

HUN<br />

FIN<br />

BEL<br />

LVA<br />

DNK<br />

POL<br />

SVN<br />

SVK<br />

BGR<br />

MLT<br />

CZE<br />

CYP<br />

LTU<br />

LUX<br />

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8<br />

Source: Country averages obta<strong>in</strong>ed from the ORBIS database<br />

<strong>The</strong> average debt/asset ratio <strong>in</strong> Figure 2.2 lies between a low 0.4 <strong>in</strong> Luxembourg and a high<br />

0.67 <strong>in</strong> Italy. <strong>The</strong> ratio is positively correlated with statutory <strong>corporate</strong> <strong>tax</strong> rates (correlation<br />

coefficient <strong>of</strong> 0.5). It may reflect that mult<strong>in</strong>ationals f<strong>in</strong>ance their <strong>in</strong>vestments <strong>in</strong> high-<strong>tax</strong><br />

countries by relatively high shares <strong>of</strong> debt. In particular, headquarters <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> subsidiaries<br />

abroad can choose between debt and equity f<strong>in</strong>ance. <strong>The</strong> <strong>tax</strong> burden on the <strong>in</strong>come earned<br />

depends on the choice <strong>of</strong> f<strong>in</strong>ance. When f<strong>in</strong>anced by debt, the <strong>in</strong>terest is deductible for the<br />

subsidiary <strong>in</strong> the host country and <strong>tax</strong>ed <strong>in</strong> the home country <strong>of</strong> the parent. When f<strong>in</strong>anced by<br />

equity, the dividend <strong>of</strong> the subsidiary is <strong>tax</strong>ed at the rate <strong>of</strong> the host country and repatriated<br />

dividends are un<strong>tax</strong>ed <strong>in</strong> the country <strong>of</strong> the parent if that country uses an exemption system<br />

(which is the case <strong>in</strong> cont<strong>in</strong>ental Europe). To m<strong>in</strong>imize the <strong>tax</strong> liability, a parent company will<br />

therefore prefer debt f<strong>in</strong>ance for subsidiaries located <strong>in</strong> high-<strong>tax</strong> countries and equity f<strong>in</strong>ance for<br />

subsidiaries <strong>in</strong> low-<strong>tax</strong> countries.<br />

We use the average debt/asset ratio for each country to compute a weighted average <strong>of</strong> the<br />

EMTRs for debt and equity f<strong>in</strong>ance. We <strong>in</strong>terpret this as a summary <strong>in</strong>dicator <strong>of</strong> how<br />

distortionary the <strong>corporate</strong> <strong>tax</strong> system is for marg<strong>in</strong>al <strong>in</strong>vestment decisions. It implicitly<br />

assumes that marg<strong>in</strong>al debt shares are equal to average debt shares. Figure 2.3 shows these<br />

EMTRs. <strong>The</strong> Belgium EMTR is negative, which is due to the Belgian ACE. In other countries,<br />

19