The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

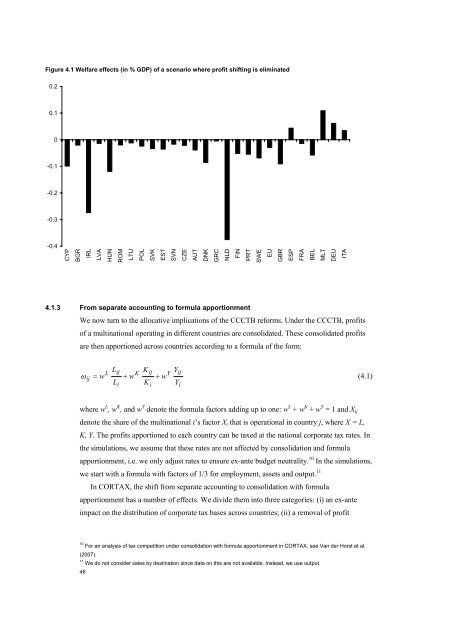

Figure 4.1 Welfare <strong>effects</strong> (<strong>in</strong> % GDP) <strong>of</strong> a scenario where pr<strong>of</strong>it shift<strong>in</strong>g is elim<strong>in</strong>ated<br />

0.2<br />

0.1<br />

0<br />

-0.1<br />

-0.2<br />

-0.3<br />

-0.4<br />

CYP<br />

BGR<br />

IRL<br />

LVA<br />

HUN<br />

ROM<br />

LTU<br />

POL<br />

SVK<br />

EST<br />

SVN<br />

CZE<br />

AUT<br />

DNK<br />

GRC<br />

NLD<br />

FIN<br />

PRT<br />

SWE<br />

<strong>EU</strong><br />

GBR<br />

ESP<br />

FRA<br />

BEL<br />

MLT<br />

D<strong>EU</strong><br />

ITA<br />

4.1.3 From separate account<strong>in</strong>g to formula apportionment<br />

We now turn to the allocative implications <strong>of</strong> the CCCTB <strong>reforms</strong>. Under the CCCTB, pr<strong>of</strong>its<br />

<strong>of</strong> a mult<strong>in</strong>ational operat<strong>in</strong>g <strong>in</strong> different countries are consolidated. <strong>The</strong>se consolidated pr<strong>of</strong>its<br />

are then apportioned across countries accord<strong>in</strong>g to a formula <strong>of</strong> the form:<br />

Lij<br />

Kij<br />

Y<br />

L K Y ij<br />

ij = w + w + w<br />

Li<br />

Ki<br />

Yi<br />

ω (4.1)<br />

where w L , w K , and w Y denote the formula factors add<strong>in</strong>g up to one: w L + w K + w Y = 1 and X ij<br />

denote the share <strong>of</strong> the mult<strong>in</strong>ational i’s factor X i that is operational <strong>in</strong> country j, where X = L,<br />

K, Y. <strong>The</strong> pr<strong>of</strong>its apportioned to each country can be <strong>tax</strong>ed at the national <strong>corporate</strong> <strong>tax</strong> rates. In<br />

the simulations, we assume that these rates are not affected by consolidation and formula<br />

apportionment, i.e. we only adjust rates to ensure ex-ante budget neutrality. 10 In the simulations,<br />

we start with a formula with factors <strong>of</strong> 1/3 for employment, assets and output. 11<br />

In CORTAX, the shift from separate account<strong>in</strong>g to consolidation with formula<br />

apportionment has a number <strong>of</strong> <strong>effects</strong>. We divide them <strong>in</strong>to three categories: (i) an ex-ante<br />

impact on the distribution <strong>of</strong> <strong>corporate</strong> <strong>tax</strong> bases across countries; (ii) a removal <strong>of</strong> pr<strong>of</strong>it<br />

10 For an analysis <strong>of</strong> <strong>tax</strong> competition under consolidation with formula apportionment <strong>in</strong> CORTAX, see Van der Horst et al.<br />

(2007).<br />

11 We do not consider sales by dest<strong>in</strong>ation s<strong>in</strong>ce data on this are not available. Instead, we use output.<br />

46