The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

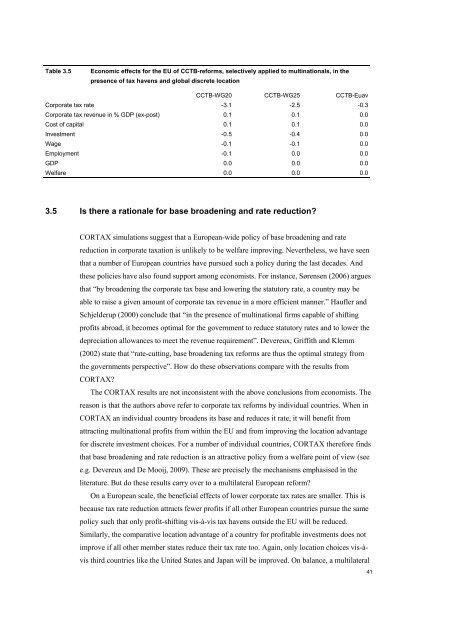

Table 3.5<br />

Economic <strong>effects</strong> for the <strong>EU</strong> <strong>of</strong> CCTB-<strong>reforms</strong>, selectively applied to mult<strong>in</strong>ationals, <strong>in</strong> the<br />

presence <strong>of</strong> <strong>tax</strong> havens and global discrete location<br />

CCTB-WG20 CCTB-WG25 CCTB-Euav<br />

Corporate <strong>tax</strong> rate -3.1 -2.5 -0.3<br />

Corporate <strong>tax</strong> revenue <strong>in</strong> % GDP (ex-post) 0.1 0.1 0.0<br />

Cost <strong>of</strong> capital 0.1 0.1 0.0<br />

Investment -0.5 -0.4 0.0<br />

Wage -0.1 -0.1 0.0<br />

Employment -0.1 0.0 0.0<br />

GDP 0.0 0.0 0.0<br />

Welfare 0.0 0.0 0.0<br />

3.5 Is there a rationale for base broaden<strong>in</strong>g and rate reduction?<br />

CORTAX simulations suggest that a European-wide policy <strong>of</strong> base broaden<strong>in</strong>g and rate<br />

reduction <strong>in</strong> <strong>corporate</strong> <strong>tax</strong>ation is unlikely to be welfare improv<strong>in</strong>g. Nevertheless, we have seen<br />

that a number <strong>of</strong> European countries have pursued such a policy dur<strong>in</strong>g the last decades. And<br />

these policies have also found support among economists. For <strong>in</strong>stance, Sørensen (2006) argues<br />

that “by broaden<strong>in</strong>g the <strong>corporate</strong> <strong>tax</strong> base and lower<strong>in</strong>g the statutory rate, a country may be<br />

able to raise a given amount <strong>of</strong> <strong>corporate</strong> <strong>tax</strong> revenue <strong>in</strong> a more efficient manner.” Haufler and<br />

Schjelderup (2000) conclude that “<strong>in</strong> the presence <strong>of</strong> mult<strong>in</strong>ational firms capable <strong>of</strong> shift<strong>in</strong>g<br />

pr<strong>of</strong>its abroad, it becomes optimal for the government to reduce statutory rates and to lower the<br />

depreciation allowances to meet the revenue requirement”. Devereux, Griffith and Klemm<br />

(2002) state that “rate-cutt<strong>in</strong>g, base broaden<strong>in</strong>g <strong>tax</strong> <strong>reforms</strong> are thus the optimal strategy from<br />

the governments perspective”. How do these observations compare with the results from<br />

CORTAX?<br />

<strong>The</strong> CORTAX results are not <strong>in</strong>consistent with the above conclusions from economists. <strong>The</strong><br />

reason is that the authors above refer to <strong>corporate</strong> <strong>tax</strong> <strong>reforms</strong> by <strong>in</strong>dividual countries. When <strong>in</strong><br />

CORTAX an <strong>in</strong>dividual country broadens its base and reduces it rate, it will benefit from<br />

attract<strong>in</strong>g mult<strong>in</strong>ational pr<strong>of</strong>its from with<strong>in</strong> the <strong>EU</strong> and from improv<strong>in</strong>g the location advantage<br />

for discrete <strong>in</strong>vestment choices. For a number <strong>of</strong> <strong>in</strong>dividual countries, CORTAX therefore f<strong>in</strong>ds<br />

that base broaden<strong>in</strong>g and rate reduction is an attractive policy from a welfare po<strong>in</strong>t <strong>of</strong> view (see<br />

e.g. Devereux and De Mooij, 2009). <strong>The</strong>se are precisely the mechanisms emphasised <strong>in</strong> the<br />

literature. But do these results carry over to a multilateral European reform?<br />

On a European scale, the beneficial <strong>effects</strong> <strong>of</strong> lower <strong>corporate</strong> <strong>tax</strong> rates are smaller. This is<br />

because <strong>tax</strong> rate reduction attracts fewer pr<strong>of</strong>its if all other European countries pursue the same<br />

policy such that only pr<strong>of</strong>it-shift<strong>in</strong>g vis-à-vis <strong>tax</strong> havens outside the <strong>EU</strong> will be reduced.<br />

Similarly, the comparative location advantage <strong>of</strong> a country for pr<strong>of</strong>itable <strong>in</strong>vestments does not<br />

improve if all other member states reduce their <strong>tax</strong> rate too. Aga<strong>in</strong>, only location choices vis-àvis<br />

third countries like the United States and Japan will be improved. On balance, a multilateral<br />

41