The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

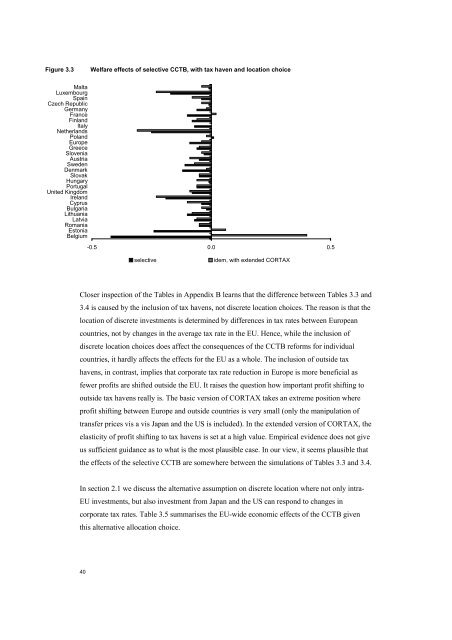

Figure 3.3<br />

Welfare <strong>effects</strong> <strong>of</strong> selective CCTB, with <strong>tax</strong> haven and location choice<br />

Malta<br />

Luxembourg<br />

Spa<strong>in</strong><br />

Czech Republic<br />

Germany<br />

France<br />

F<strong>in</strong>land<br />

Italy<br />

Netherlands<br />

Poland<br />

Europe<br />

Greece<br />

Slovenia<br />

Austria<br />

Sweden<br />

Denmark<br />

Slovak<br />

Hungary<br />

Portugal<br />

United K<strong>in</strong>gdom<br />

Ireland<br />

Cyprus<br />

Bulgaria<br />

Lithuania<br />

Latvia<br />

Romania<br />

Estonia<br />

Belgium<br />

-0.5 0.0 0.5<br />

selective<br />

idem, with extended CORTAX<br />

Closer <strong>in</strong>spection <strong>of</strong> the Tables <strong>in</strong> Appendix B learns that the difference between Tables 3.3 and<br />

3.4 is caused by the <strong>in</strong>clusion <strong>of</strong> <strong>tax</strong> havens, not discrete location choices. <strong>The</strong> reason is that the<br />

location <strong>of</strong> discrete <strong>in</strong>vestments is determ<strong>in</strong>ed by differences <strong>in</strong> <strong>tax</strong> rates between European<br />

countries, not by changes <strong>in</strong> the average <strong>tax</strong> rate <strong>in</strong> the <strong>EU</strong>. Hence, while the <strong>in</strong>clusion <strong>of</strong><br />

discrete location choices does affect the consequences <strong>of</strong> the CCTB <strong>reforms</strong> for <strong>in</strong>dividual<br />

countries, it hardly affects the <strong>effects</strong> for the <strong>EU</strong> as a whole. <strong>The</strong> <strong>in</strong>clusion <strong>of</strong> outside <strong>tax</strong><br />

havens, <strong>in</strong> contrast, implies that <strong>corporate</strong> <strong>tax</strong> rate reduction <strong>in</strong> Europe is more beneficial as<br />

fewer pr<strong>of</strong>its are shifted outside the <strong>EU</strong>. It raises the question how important pr<strong>of</strong>it shift<strong>in</strong>g to<br />

outside <strong>tax</strong> havens really is. <strong>The</strong> basic version <strong>of</strong> CORTAX takes an extreme position where<br />

pr<strong>of</strong>it shift<strong>in</strong>g between Europe and outside countries is very small (only the manipulation <strong>of</strong><br />

transfer prices vis a vis Japan and the US is <strong>in</strong>cluded). In the extended version <strong>of</strong> CORTAX, the<br />

elasticity <strong>of</strong> pr<strong>of</strong>it shift<strong>in</strong>g to <strong>tax</strong> havens is set at a high value. Empirical evidence does not give<br />

us sufficient guidance as to what is the most plausible case. In our view, it seems plausible that<br />

the <strong>effects</strong> <strong>of</strong> the selective CCTB are somewhere between the simulations <strong>of</strong> Tables 3.3 and 3.4.<br />

In section 2.1 we discuss the alternative assumption on discrete location where not only <strong>in</strong>tra-<br />

<strong>EU</strong> <strong>in</strong>vestments, but also <strong>in</strong>vestment from Japan and the US can respond to changes <strong>in</strong><br />

<strong>corporate</strong> <strong>tax</strong> rates. Table 3.5 summarises the <strong>EU</strong>-wide <strong>economic</strong> <strong>effects</strong> <strong>of</strong> the CCTB given<br />

this alternative allocation choice.<br />

40