The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

capital requires that the marg<strong>in</strong>al product <strong>of</strong> capital <strong>in</strong>creases. In light <strong>of</strong> decreas<strong>in</strong>g returns to<br />

scale with respect to capital <strong>in</strong> production, a smaller capital stock is required to achieve this.<br />

Consequently, a higher cost <strong>of</strong> capital <strong>in</strong>duced by a higher <strong>corporate</strong> <strong>tax</strong> rate will reduce<br />

<strong>in</strong>vestment.<br />

If part <strong>of</strong> <strong>in</strong>vestment is f<strong>in</strong>anced by debt (d b > 0), (A.15) is modified as the f<strong>in</strong>ancial cost <strong>of</strong><br />

<strong>in</strong>vestment is now a weighted average <strong>of</strong> the cost <strong>of</strong> debt and the cost <strong>of</strong> equity. We see that the<br />

cost <strong>of</strong> debt is reduced by the deductibility <strong>of</strong> nom<strong>in</strong>al <strong>in</strong>terest costs. <strong>The</strong> <strong>in</strong>terest deductibility<br />

thus reduces the cost <strong>of</strong> capital, perhaps even below the level obta<strong>in</strong>ed <strong>in</strong> the absence <strong>of</strong> <strong>tax</strong>.<br />

Pr<strong>of</strong>it shift<strong>in</strong>g behaviour<br />

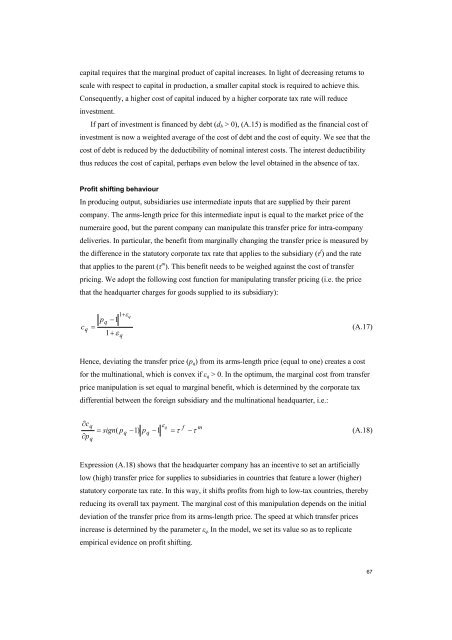

In produc<strong>in</strong>g output, subsidiaries use <strong>in</strong>termediate <strong>in</strong>puts that are supplied by their parent<br />

company. <strong>The</strong> arms-length price for this <strong>in</strong>termediate <strong>in</strong>put is equal to the market price <strong>of</strong> the<br />

numeraire good, but the parent company can manipulate this transfer price for <strong>in</strong>tra-company<br />

deliveries. In particular, the benefit from marg<strong>in</strong>ally chang<strong>in</strong>g the transfer price is measured by<br />

the difference <strong>in</strong> the statutory <strong>corporate</strong> <strong>tax</strong> rate that applies to the subsidiary (τ f ) and the rate<br />

that applies to the parent (τ m ). This benefit needs to be weighed aga<strong>in</strong>st the cost <strong>of</strong> transfer<br />

pric<strong>in</strong>g. We adopt the follow<strong>in</strong>g cost function for manipulat<strong>in</strong>g transfer pric<strong>in</strong>g (i.e. the price<br />

that the headquarter charges for goods supplied to its subsidiary):<br />

c<br />

q<br />

=<br />

+ εq<br />

pq<br />

−1 1 (A.17)<br />

1+<br />

ε<br />

q<br />

Hence, deviat<strong>in</strong>g the transfer price (p q ) from its arms-length price (equal to one) creates a cost<br />

for the mult<strong>in</strong>ational, which is convex if ε q > 0. In the optimum, the marg<strong>in</strong>al cost from transfer<br />

price manipulation is set equal to marg<strong>in</strong>al benefit, which is determ<strong>in</strong>ed by the <strong>corporate</strong> <strong>tax</strong><br />

differential between the foreign subsidiary and the mult<strong>in</strong>ational headquarter, i.e.:<br />

∂cq<br />

∂pq<br />

εq<br />

f m<br />

= sign( pq<br />

−1)<br />

pq<br />

−1<br />

= τ −τ<br />

(A.18)<br />

Expression (A.18) shows that the headquarter company has an <strong>in</strong>centive to set an artificially<br />

low (high) transfer price for supplies to subsidiaries <strong>in</strong> countries that feature a lower (higher)<br />

statutory <strong>corporate</strong> <strong>tax</strong> rate. In this way, it shifts pr<strong>of</strong>its from high to low-<strong>tax</strong> countries, thereby<br />

reduc<strong>in</strong>g its overall <strong>tax</strong> payment. <strong>The</strong> marg<strong>in</strong>al cost <strong>of</strong> this manipulation depends on the <strong>in</strong>itial<br />

deviation <strong>of</strong> the transfer price from its arms-length price. <strong>The</strong> speed at which transfer prices<br />

<strong>in</strong>crease is determ<strong>in</strong>ed by the parameter ε q. In the model, we set its value so as to replicate<br />

empirical evidence on pr<strong>of</strong>it shift<strong>in</strong>g.<br />

67