The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

The economic effects of EU-reforms in corporate income tax systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.2 CCCTB for mult<strong>in</strong>ationals<br />

We illustrate the effect <strong>of</strong> consolidation and formula apportionment for CCCTB <strong>reforms</strong> where<br />

the common base applies to mult<strong>in</strong>ationals. <strong>The</strong> common bases are the same as under the CCTB<br />

and are now referred to as CCCTB-WG20, CCCTB-WG25 and CCCTB-<strong>EU</strong>av. We explore the<br />

reform us<strong>in</strong>g the basic version <strong>of</strong> CORTAX, exclud<strong>in</strong>g <strong>tax</strong> havens and discrete location.<br />

Alternative simulations (broader coverage and extended model) are discussed <strong>in</strong> section 4.3.<br />

<strong>The</strong> average <strong>effects</strong> for the <strong>EU</strong> are summarised <strong>in</strong> Table 4.1. <strong>The</strong> outcomes for <strong>in</strong>dividual<br />

countries are presented <strong>in</strong> appendix C.<br />

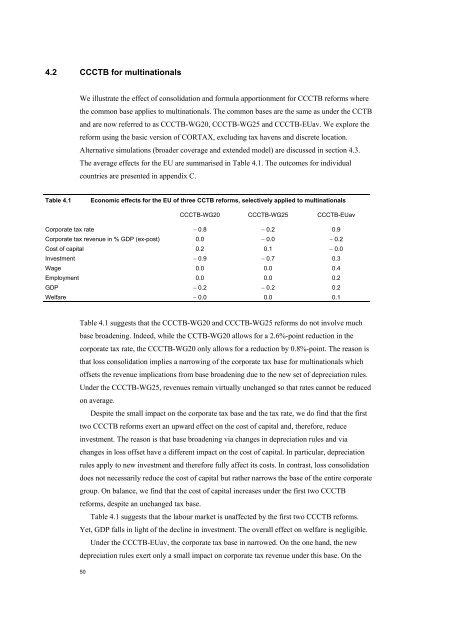

Table 4.1<br />

Economic <strong>effects</strong> for the <strong>EU</strong> <strong>of</strong> three CCTB <strong>reforms</strong>, selectively applied to mult<strong>in</strong>ationals<br />

CCCTB-WG20 CCCTB-WG25 CCCTB-<strong>EU</strong>av<br />

Corporate <strong>tax</strong> rate − 0.8 − 0.2 0.9<br />

Corporate <strong>tax</strong> revenue <strong>in</strong> % GDP (ex-post) 0.0 − 0.0 − 0.2<br />

Cost <strong>of</strong> capital 0.2 0.1 − 0.0<br />

Investment − 0.9 − 0.7 0.3<br />

Wage 0.0 0.0 0.4<br />

Employment 0.0 0.0 0.2<br />

GDP − 0.2 − 0.2 0.2<br />

Welfare − 0.0 0.0 0.1<br />

Table 4.1 suggests that the CCCTB-WG20 and CCCTB-WG25 <strong>reforms</strong> do not <strong>in</strong>volve much<br />

base broaden<strong>in</strong>g. Indeed, while the CCTB-WG20 allows for a 2.6%-po<strong>in</strong>t reduction <strong>in</strong> the<br />

<strong>corporate</strong> <strong>tax</strong> rate, the CCCTB-WG20 only allows for a reduction by 0.8%-po<strong>in</strong>t. <strong>The</strong> reason is<br />

that loss consolidation implies a narrow<strong>in</strong>g <strong>of</strong> the <strong>corporate</strong> <strong>tax</strong> base for mult<strong>in</strong>ationals which<br />

<strong>of</strong>fsets the revenue implications from base broaden<strong>in</strong>g due to the new set <strong>of</strong> depreciation rules.<br />

Under the CCCTB-WG25, revenues rema<strong>in</strong> virtually unchanged so that rates cannot be reduced<br />

on average.<br />

Despite the small impact on the <strong>corporate</strong> <strong>tax</strong> base and the <strong>tax</strong> rate, we do f<strong>in</strong>d that the first<br />

two CCCTB <strong>reforms</strong> exert an upward effect on the cost <strong>of</strong> capital and, therefore, reduce<br />

<strong>in</strong>vestment. <strong>The</strong> reason is that base broaden<strong>in</strong>g via changes <strong>in</strong> depreciation rules and via<br />

changes <strong>in</strong> loss <strong>of</strong>fset have a different impact on the cost <strong>of</strong> capital. In particular, depreciation<br />

rules apply to new <strong>in</strong>vestment and therefore fully affect its costs. In contrast, loss consolidation<br />

does not necessarily reduce the cost <strong>of</strong> capital but rather narrows the base <strong>of</strong> the entire <strong>corporate</strong><br />

group. On balance, we f<strong>in</strong>d that the cost <strong>of</strong> capital <strong>in</strong>creases under the first two CCCTB<br />

<strong>reforms</strong>, despite an unchanged <strong>tax</strong> base.<br />

Table 4.1 suggests that the labour market is unaffected by the first two CCCTB <strong>reforms</strong>.<br />

Yet, GDP falls <strong>in</strong> light <strong>of</strong> the decl<strong>in</strong>e <strong>in</strong> <strong>in</strong>vestment. <strong>The</strong> overall effect on welfare is negligible.<br />

Under the CCCTB-<strong>EU</strong>av, the <strong>corporate</strong> <strong>tax</strong> base <strong>in</strong> narrowed. On the one hand, the new<br />

depreciation rules exert only a small impact on <strong>corporate</strong> <strong>tax</strong> revenue under this base. On the<br />

50