RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

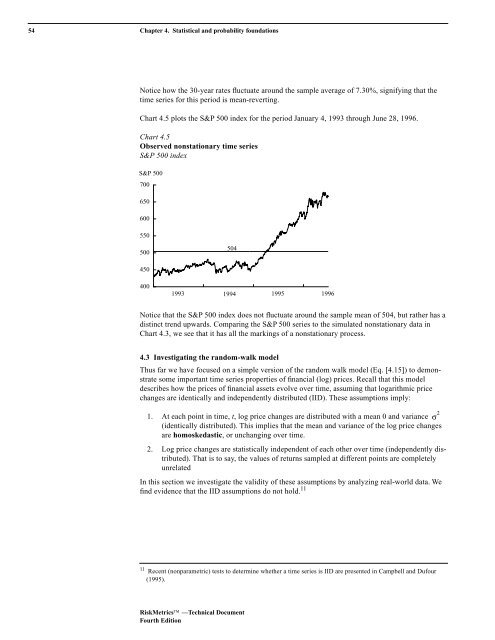

54 Chapter 4. Statistical and probability foundations<br />

Notice how the 30-year rates fluctuate around the sample average of 7.30%, signifying that the<br />

time series for this period is mean-reverting.<br />

Chart 4.5 plots the S&P 500 index for the period January 4, 1993 through June 28, 1996.<br />

Chart 4.5<br />

Observed nonstationary time series<br />

S&P 500 index<br />

S&P 500<br />

700<br />

650<br />

600<br />

550<br />

500<br />

504<br />

450<br />

400<br />

1993 1994 1995 1996<br />

Notice that the S&P 500 index does not fluctuate around the sample mean of 504, but rather has a<br />

distinct trend upwards. Comparing the S&P 500 series to the simulated nonstationary data in<br />

Chart 4.3, we see that it has all the markings of a nonstationary process.<br />

4.3 Investigating the random-walk model<br />

Thus far we have focused on a simple version of the random walk model (Eq. [4.15]) to demonstrate<br />

some important time series properties of financial (log) prices. Recall that this model<br />

describes how the prices of financial assets evolve over time, assuming that logarithmic price<br />

changes are identically and independently distributed (IID). These assumptions imply:<br />

1. At each point in time, t, log price changes are distributed with a mean 0 and variance<br />

(identically distributed). This implies that the mean and variance of the log price changes<br />

are homoskedastic, or unchanging over time.<br />

2. Log price changes are statistically independent of each other over time (independently distributed).<br />

That is to say, the values of returns sampled at different points are completely<br />

unrelated<br />

In this section we investigate the validity of these assumptions by analyzing real-world data. We<br />

find evidence that the IID assumptions do not hold. 11<br />

σ 2<br />

11 Recent (nonparametric) tests to determine whether a time series is IID are presented in Campbell and Dufour<br />

(1995).<br />

RiskMetrics —Technical <strong>Document</strong><br />

Fourth Edition