RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

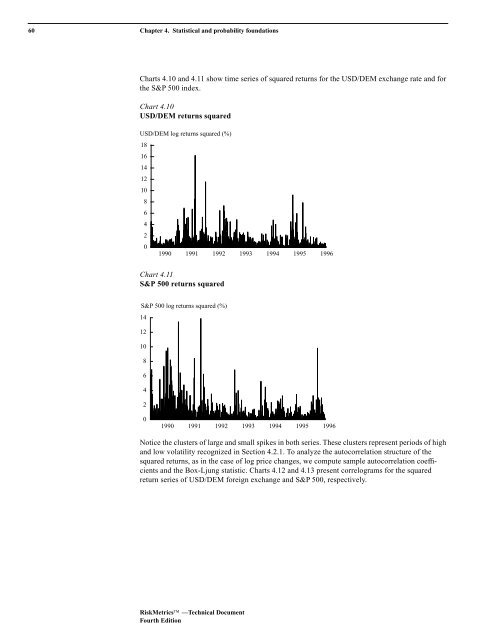

60 Chapter 4. Statistical and probability foundations<br />

Charts 4.10 and 4.11 show time series of squared returns for the USD/DEM exchange rate and for<br />

the S&P 500 index.<br />

Chart 4.10<br />

USD/DEM returns squared<br />

USD/DEM log returns squared (%)<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1990 1991 1992 1993 1994 1995 1996<br />

Chart 4.11<br />

S&P 500 returns squared<br />

S&P 500 log returns squared (%)<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1990 1991 1992 1993 1994 1995 1996<br />

Notice the clusters of large and small spikes in both series. These clusters represent periods of high<br />

and low volatility recognized in Section 4.2.1. To analyze the autocorrelation structure of the<br />

squared returns, as in the case of log price changes, we compute sample autocorrelation coefficients<br />

and the Box-Ljung statistic. Charts 4.12 and 4.13 present correlograms for the squared<br />

return series of USD/DEM foreign exchange and S&P 500, respectively.<br />

RiskMetrics —Technical <strong>Document</strong><br />

Fourth Edition