RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

RiskMetrics⢠âTechnical Document

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

58 Chapter 4. Statistical and probability foundations<br />

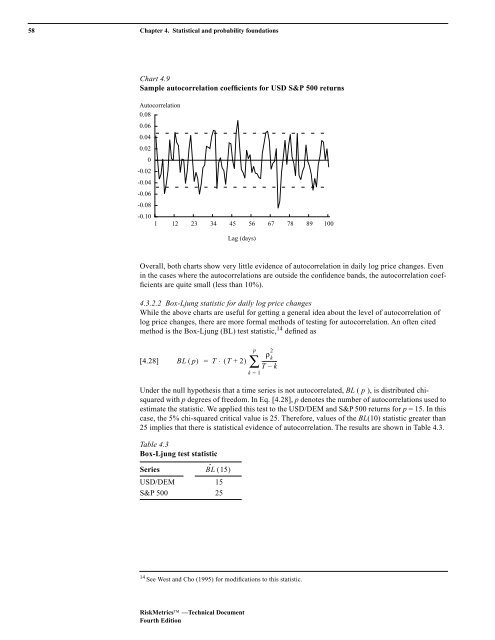

Chart 4.9<br />

Sample autocorrelation coefficients for USD S&P 500 returns<br />

Autocorrelation<br />

0.08<br />

0.06<br />

0.04<br />

0.02<br />

0<br />

-0.02<br />

-0.04<br />

-0.06<br />

-0.08<br />

-0.10<br />

1 12 23 34 45 56 67 78 89 100<br />

Lag (days)<br />

Overall, both charts show very little evidence of autocorrelation in daily log price changes. Even<br />

in the cases where the autocorrelations are outside the confidence bands, the autocorrelation coefficients<br />

are quite small (less than 10%).<br />

4.3.2.2 Box-Ljung statistic for daily log price changes<br />

While the above charts are useful for getting a general idea about the level of autocorrelation of<br />

log price changes, there are more formal methods of testing for autocorrelation. An often cited<br />

method is the Box-Ljung (BL) test statistic, 14 defined as<br />

[4.28]<br />

BL ( p) = T ⋅ ( T + 2)<br />

p<br />

∑<br />

k = 1<br />

ρ k<br />

2<br />

-----------<br />

T – k<br />

Under the null hypothesis that a time series is not autocorrelated, BL ( p ), is distributed chisquared<br />

with p degrees of freedom. In Eq. [4.28], p denotes the number of autocorrelations used to<br />

estimate the statistic. We applied this test to the USD/DEM and S&P 500 returns for p = 15. In this<br />

case, the 5% chi-squared critical value is 25. Therefore, values of the BL(10) statistic greater than<br />

25 implies that there is statistical evidence of autocorrelation. The results are shown in Table 4.3.<br />

Table 4.3<br />

Box-Ljung test statistic<br />

Series<br />

BL ˆ ( 15)<br />

USD/DEM 15<br />

S&P 500 25<br />

14 See West and Cho (1995) for modifications to this statistic.<br />

RiskMetrics —Technical <strong>Document</strong><br />

Fourth Edition