Scania annual report 2004

Scania annual report 2004

Scania annual report 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

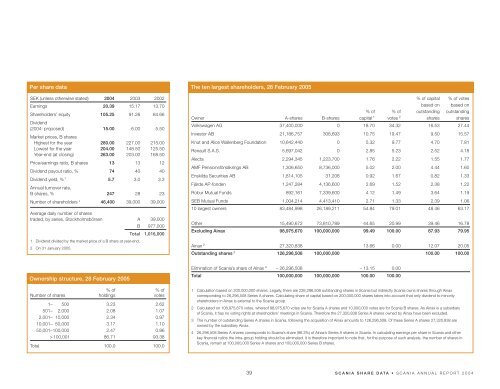

Per share data<br />

SEK (unless otherwise stated) <strong>2004</strong> 2003 2002<br />

Earnings 20.39 15.17 13.70<br />

Shareholders’ equity 105.25 91.26 84.66<br />

Dividend<br />

(<strong>2004</strong>: proposed) 15.00 6.00 5.50<br />

Market prices, B shares<br />

Highest for the year 280.00 227.00 215.00<br />

Lowest for the year 204.00 148.50 125.50<br />

Year-end (at closing) 263.00 203.00 168.50<br />

Price/earnings ratio, B shares 13 13 12<br />

Dividend payout ratio, % 74 40 40<br />

Dividend yield, % 1 5.7 3.0 3.3<br />

Annual turnover rate,<br />

B shares, % 247 28 23<br />

Number of shareholders 2 46,400 39,000 39,000<br />

Average daily number of shares<br />

traded, by series, Stockholmsbörsen A 39,000<br />

B 977,000<br />

Total 1,016,000<br />

1 Dividend divided by the market price of a B share at year-end.<br />

2 On 31 January 2005.<br />

The ten largest shareholders, 28 February 2005<br />

% of capital % of votes<br />

based on based on<br />

% of % of outstanding outstanding<br />

Owner A-shares B-shares capital 1 votes 2 shares shares<br />

Volkswagen AG 37,400,000 0 18.70 34.32 16.53 27.44<br />

Investor AB 21,186,757 308,693 10.75 19.47 9.50 15.57<br />

Knut and Alice Wallenberg Foundation 10,642,440 0 5.32 9.77 4.70 7.81<br />

Renault S.A.S. 5,697,042 0 2.85 5.23 2.52 4.18<br />

Alecta 2,294,345 1,223,700 1.76 2.22 1.55 1.77<br />

AMF Pensionsförsäkrings AB 1,306,650 8,736,000 5.02 2.00 4.44 1.60<br />

Enskilda Securities AB 1,814,105 31,208 0.92 1.67 0.82 1.33<br />

Fjärde AP-fonden 1,247,284 4,136,600 2.69 1.52 2.38 1.22<br />

Robur Mutual Funds 892,161 7,339,600 4.12 1.49 3.64 1.19<br />

SEB Mutual Funds 1,004,214 4,413,410 2.71 1.33 2.39 1.06<br />

10 largest owners 83,484,998 26,189,211 54.84 79.01 48.46 63.17<br />

Other 15,490,672 73,810,789 44.65 20.99 39.46 16.78<br />

Excluding Ainax 98,975,670 100,000,000 99.49 100.00 87.93 79.95<br />

Ainax 2 27,320,838 13.66 0.00 12.07 20.05<br />

Outstanding shares 3 126,296,508 100,000,000 100.00 100.00<br />

Ownership structure, 28 February 2005<br />

% of % of<br />

Number of shares holdings votes<br />

1– 500 3.23 2.62<br />

501– 2,000 2.08 1.07<br />

2,001– 10,000 2.34 0.97<br />

10,001– 50,000 3.17 1.10<br />

50,001–100,000 2.47 0.86<br />

> 100,001 86.71 93.38<br />

Total 100.0 100.0<br />

Elimination of <strong>Scania</strong>’s share of Ainax 4 – 26,296,508 – 13.15 0.00<br />

Total 100,000,000 100,000,000 100.00 100.00<br />

1 Calculation based on 200,000,000 shares. Legally, there are 226,296,508 outstanding shares in <strong>Scania</strong> but indirectly <strong>Scania</strong> owns shares through Ainax<br />

corresponding to 26,296,508 Series A shares. Calculating share of capital based on 200,000,000 shares takes into account that only dividend to minority<br />

shareholders in Ainax is external to the <strong>Scania</strong> group.<br />

2 Calculated on 108,975,670 votes, whereof 98,975,670 votes are for <strong>Scania</strong> A shares and 10,000,000 votes are for <strong>Scania</strong> B shares. As Ainax is a subsidiary<br />

of <strong>Scania</strong>, it has no voting rights at shareholders’ meetings in <strong>Scania</strong>. Therefore the 27,320,838 Series A shares owned by Ainax have been excluded.<br />

3 The number of outstanding Series A shares in <strong>Scania</strong>, following the acquisition of Ainax amounts to 126,296,508. Of these Series A shares 27,320,838 are<br />

owned by the subsidiary Ainax.<br />

4 26,296,508 Series A shares corresponds to <strong>Scania</strong>’s share (96.3%) of Ainax’s Series A shares in <strong>Scania</strong>. In calculating earnings per share in <strong>Scania</strong> and other<br />

key financial ratios the intra-group holding should be eliminated. It is therefore important to note that, for the purpose of such analysis, the number of shares in<br />

<strong>Scania</strong>, remain at 100,000,000 Series A shares and 100,000,000 Series B shares.<br />

39 SCANIA SHARE DATA • SCANIA ANNUAL REPORT <strong>2004</strong>