Scania annual report 2004

Scania annual report 2004

Scania annual report 2004

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CASH FLOW<br />

Cash flow in Vehicles and Service<br />

amounted to SEK 2,685 m. (2,450). Tiedup<br />

working capital rose by SEK 1,153 m.<br />

(236) during <strong>2004</strong>, mainly due to increased<br />

inventory and receivables related to higher<br />

volume. Net investments totalled SEK<br />

2,847 m. (3,311), including SEK 316 m.<br />

(669) in capitalisation of development<br />

expenditures. The effects of acquisitions<br />

of businesses totalled SEK 49 m. (26).<br />

Cash flow in Customer Finance<br />

amounted to SEK – 285 m. (–1,456). Net<br />

investments in customer finance contracts<br />

amounted to SEK 478 m. (1,868).<br />

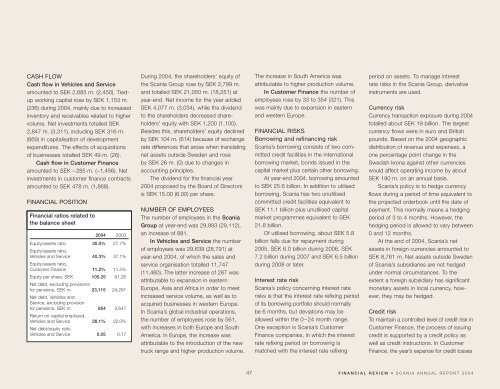

FINANCIAL POSITION<br />

Financial ratios related to<br />

the balance sheet<br />

<strong>2004</strong> 2003<br />

Equity/assets ratio 30.0% 27.7%<br />

Equity/assets ratio,<br />

Vehicles and Service 40.3% 37.1%<br />

Equity/assets ratio,<br />

Customer Finance 11.2% 11.5%<br />

Equity per share, SEK 105.25 91.26<br />

Net debt, excluding provisions<br />

for pensions, SEK m. 23,115 24,291<br />

Net debt, Vehicles and<br />

Service, excluding provision<br />

for pensions, SEK m. 854 2,647<br />

Return on capital employed,<br />

Vehicles and Service 28.1% 22.0%<br />

Net debt/equity ratio,<br />

Vehicles and Service 0.05 0.17<br />

During <strong>2004</strong>, the shareholders’ equity of<br />

the <strong>Scania</strong> Group rose by SEK 2,799 m.<br />

and totalled SEK 21,050 m. (18,251) at<br />

year-end. Net income for the year added<br />

SEK 4,077 m. (3,034), while the dividend<br />

to the shareholders decreased shareholders’<br />

equity with SEK 1,200 (1,100).<br />

Besides this, shareholders’ equity declined<br />

by SEK 104 m. (614) because of exchange<br />

rate differences that arose when translating<br />

net assets outside Sweden and rose<br />

by SEK 26 m. (0) due to changes in<br />

accounting principles.<br />

The dividend for the financial year<br />

<strong>2004</strong> proposed by the Board of Directors<br />

is SEK 15.00 (6.00) per share.<br />

NUMBER OF EMPLOYEES<br />

The number of employees in the <strong>Scania</strong><br />

Group at year-end was 29,993 (29,112),<br />

an increase of 881.<br />

In Vehicles and Service the number<br />

of employees was 29,639 (28,791) at<br />

year-end <strong>2004</strong>, of which the sales and<br />

service organisation totalled 11,747<br />

(11,460). The latter increase of 287 was<br />

attributable to expansion in eastern<br />

Europe, Asia and Africa in order to meet<br />

increased service volume, as well as to<br />

acquired businesses in western Europe.<br />

In <strong>Scania</strong>’s global industrial operations,<br />

the number of employees rose by 561,<br />

with increases in both Europe and South<br />

America. In Europe, the increase was<br />

attributable to the introduction of the new<br />

truck range and higher production volume.<br />

The increase in South America was<br />

attributable to higher production volume.<br />

In Customer Finance the number of<br />

employees rose by 33 to 354 (321). This<br />

was mainly due to expansion in eastern<br />

and western Europe.<br />

FINANCIAL RISKS<br />

Borrowing and refinancing risk<br />

<strong>Scania</strong>’s borrowing consists of two committed<br />

credit facilities in the international<br />

borrowing market, bonds issued in the<br />

capital market plus certain other borrowing.<br />

At year-end <strong>2004</strong>, borrowing amounted<br />

to SEK 25.6 billion. In addition to utilised<br />

borrowing, <strong>Scania</strong> has two unutilised<br />

committed credit facilities equivalent to<br />

SEK 11.1 billion plus unutilised capital<br />

market programmes equivalent to SEK<br />

21.8 billion.<br />

Of utilised borrowing, about SEK 5.8<br />

billion falls due for repayment during<br />

2005, SEK 6.0 billion during 2006, SEK<br />

7.2 billion during 2007 and SEK 6.5 billion<br />

during 2008 or later.<br />

Interest rate risk<br />

<strong>Scania</strong>’s policy concerning interest rate<br />

risks is that the interest rate refixing period<br />

of its borrowing portfolio should normally<br />

be 6 months, but deviations may be<br />

allowed within the 0–24 month range.<br />

One exception is <strong>Scania</strong>’s Customer<br />

Finance companies, in which the interest<br />

rate refixing period on borrowing is<br />

matched with the interest rate refixing<br />

period on assets. To manage interest<br />

rate risks in the <strong>Scania</strong> Group, derivative<br />

instruments are used.<br />

Currency risk<br />

Currency transaction exposure during <strong>2004</strong><br />

totalled about SEK 19 billion. The largest<br />

currency flows were in euro and British<br />

pounds. Based on the <strong>2004</strong> geographic<br />

distribution of revenue and expenses, a<br />

one percentage point change in the<br />

Swedish krona against other currencies<br />

would affect operating income by about<br />

SEK 190 m. on an <strong>annual</strong> basis.<br />

<strong>Scania</strong>’s policy is to hedge currency<br />

flows during a period of time equivalent to<br />

the projected orderbook until the date of<br />

payment. This normally means a hedging<br />

period of 3 to 4 months. However, the<br />

hedging period is allowed to vary between<br />

0 and 12 months.<br />

At the end of <strong>2004</strong>, <strong>Scania</strong>’s net<br />

assets in foreign currencies amounted to<br />

SEK 8,761 m. Net assets outside Sweden<br />

of <strong>Scania</strong>’s subsidiaries are not hedged<br />

under normal circumstances. To the<br />

extent a foreign subsidiary has significant<br />

monetary assets in local currency, however,<br />

they may be hedged.<br />

Credit risk<br />

To maintain a controlled level of credit risk in<br />

Customer Finance, the process of issuing<br />

credit is supported by a credit policy as<br />

well as credit instructions. In Customer<br />

Finance, the year’s expense for credit losses<br />

47 FINANCIAL REVIEW • SCANIA ANNUAL REPORT <strong>2004</strong>