Scania annual report 2004

Scania annual report 2004

Scania annual report 2004

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 7 continued<br />

Research<br />

and<br />

develop- Soft-<br />

Goodwill ment 1 ware<br />

<strong>2004</strong><br />

Accumulated acquisition value<br />

1 January 1,746 1,233 255<br />

Acquisitions/divestments<br />

of businesses 15 – –<br />

New acquisitions 6 316 48<br />

Divestments and disposals – – 3 – 33<br />

Reclassifications – – 7<br />

Exchange rate differences – 20 – 3<br />

Total 1,747 1,546 280<br />

Accumulated amortisation<br />

1 January 740 2 97<br />

Amortisation for the year<br />

– Vehicles and Service 166 84 45<br />

– Customer Finance – – 5<br />

Divestments and disposals – – 1 – 22<br />

Reclassifications – – 1<br />

Exchange rate differences – 5 – 1<br />

Total 901 85 127<br />

Carrying amount, 31 December 846 1 461 153<br />

1 The portion of the <strong>Scania</strong> Group’s research and development expenditures that<br />

arises during the development phase is capitalised on a continuous basis as the<br />

requirements for capitalisation are fulfilled. See the table below for a specification<br />

of <strong>Scania</strong>’s research and development expenditures. Amortisation occurs only<br />

when the asset is placed in service.<br />

<strong>2004</strong> 2003 2002<br />

Specification of research and<br />

development expenses<br />

Expenditures – 2,219 – 2,151 – 2,010<br />

Capitalisation 316 669 573<br />

Amortisation – 84 – 2 –<br />

Research and development<br />

expenses – 1,987 – 1,484 – 1,437<br />

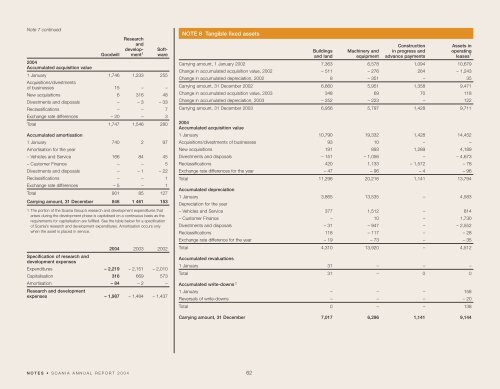

NOTE 8 Tangible fixed assets<br />

Construction<br />

Assets in<br />

Buildings Machinery and in progress and operating<br />

and land equipment advance payments leases 1<br />

Carrying amount, 1 January 2002 7,363 6,578 1,094 10,679<br />

Change in accumulated acquisition value, 2002 – 511 – 276 264 – 1,243<br />

Change in accumulated depreciation, 2002 8 – 351 – 35<br />

Carrying amount, 31 December 2002 6,860 5,951 1,358 9,471<br />

Change in accumulated acquisition value, 2003 348 69 70 118<br />

Change in accumulated depreciation, 2003 – 252 – 223 – 122<br />

Carrying amount, 31 December 2003 6,956 5,797 1,428 9,711<br />

<strong>2004</strong><br />

Accumulated acquisition value<br />

1 January 10,790 19,332 1,428 14,452<br />

Acquisitions/divestments of businesses 93 10 – –<br />

New acquisitions 191 893 1,289 4,189<br />

Divestments and disposals – 151 – 1,056 – – 4,673<br />

Reclassifications 420 1,133 – 1,572 – 78<br />

Exchange rate differences for the year – 47 – 96 – 4 – 96<br />

Total 11,296 20,216 1,141 13,794<br />

Accumulated depreciation<br />

1 January 3,865 13,535 – 4,583<br />

Depreciation for the year<br />

– Vehicles and Service 377 1,512 – 814<br />

– Customer Finance – 10 – 1,730<br />

Divestments and disposals – 31 – 947 – – 2,552<br />

Reclassifications 118 – 117 – – 28<br />

Exchange rate difference for the year – 19 – 73 – – 35<br />

Total 4,310 13,920 – 4,512<br />

Accumulated revaluations<br />

1 January 31 – – –<br />

Total 31 – 0 0<br />

Accumulated write-downs 2<br />

1 January – – – 158<br />

Reversals of write-downs – – – – 20<br />

Total 0 – – 138<br />

Carrying amount, 31 December 7,017 6,296 1,141 9,144<br />

NOTES • SCANIA ANNUAL REPORT <strong>2004</strong> 62