reconvene regular meeting: 7:00 pm - Irvine Unified School District

reconvene regular meeting: 7:00 pm - Irvine Unified School District

reconvene regular meeting: 7:00 pm - Irvine Unified School District

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This Preliminary Official Statement and the information contained herein are subject to completion or amendment without notice. Under no circumstances shall this Preliminary Official Statement constitute an offer<br />

to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the<br />

securities laws of such jurisdiction.<br />

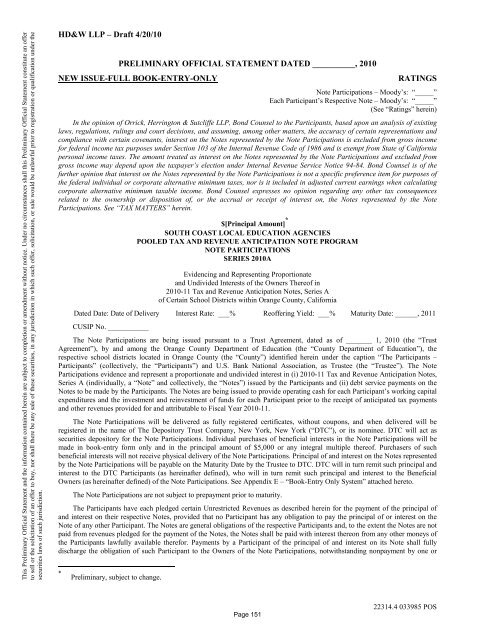

HD&W LLP – Draft 4/20/10<br />

PRELIMINARY OFFICIAL STATEMENT DATED __________, 2010<br />

NEW ISSUE-FULL BOOK-ENTRY-ONLY<br />

RATINGS<br />

Note Participations – Moody’s: “_____”<br />

Each Participant’s Respective Note – Moody’s: “_____”<br />

(See “Ratings” herein)<br />

In the opinion of Orrick, Herrington & Sutcliffe LLP, Bond Counsel to the Participants, based upon an analysis of existing<br />

laws, regulations, rulings and court decisions, and assuming, among other matters, the accuracy of certain representations and<br />

compliance with certain covenants, interest on the Notes represented by the Note Participations is excluded from gross income<br />

for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986 and is exempt from State of California<br />

personal income taxes. The amount treated as interest on the Notes represented by the Note Participations and excluded from<br />

gross income may depend upon the taxpayer’s election under Internal Revenue Service Notice 94-84. Bond Counsel is of the<br />

further opinion that interest on the Notes represented by the Note Participations is not a specific preference item for purposes of<br />

the federal individual or corporate alternative minimum taxes, nor is it included in adjusted current earnings when calculating<br />

corporate alternative minimum taxable income. Bond Counsel expresses no opinion regarding any other tax consequences<br />

related to the ownership or disposition of, or the accrual or receipt of interest on, the Notes represented by the Note<br />

Participations. See “TAX MATTERS” herein.<br />

$[Principal Amount] *<br />

SOUTH COAST LOCAL EDUCATION AGENCIES<br />

POOLED TAX AND REVENUE ANTICIPATION NOTE PROGRAM<br />

NOTE PARTICIPATIONS<br />

SERIES 2010A<br />

Evidencing and Representing Proportionate<br />

and Undivided Interests of the Owners Thereof in<br />

2010-11 Tax and Revenue Anticipation Notes, Series A<br />

of Certain <strong>School</strong> <strong>District</strong>s within Orange County, California<br />

Dated Date: Date of Delivery Interest Rate: ___% Reoffering Yield: ___% Maturity Date: ______, 2011<br />

CUSIP No. ___________<br />

The Note Participations are being issued pursuant to a Trust Agreement, dated as of _______ 1, 2010 (the “Trust<br />

Agreement”), by and among the Orange County Department of Education (the “County Department of Education”), the<br />

respective school districts located in Orange County (the “County”) identified herein under the caption “The Participants –<br />

Participants” (collectively, the “Participants”) and U.S. Bank National Association, as Trustee (the “Trustee”). The Note<br />

Participations evidence and represent a proportionate and undivided interest in (i) 2010-11 Tax and Revenue Anticipation Notes,<br />

Series A (individually, a “Note” and collectively, the “Notes”) issued by the Participants and (ii) debt service payments on the<br />

Notes to be made by the Participants. The Notes are being issued to provide operating cash for each Participant’s working capital<br />

expenditures and the investment and reinvestment of funds for each Participant prior to the receipt of anticipated tax payments<br />

and other revenues provided for and attributable to Fiscal Year 2010-11.<br />

The Note Participations will be delivered as fully registered certificates, without coupons, and when delivered will be<br />

registered in the name of The Depository Trust Company, New York, New York (“DTC”), or its nominee. DTC will act as<br />

securities depository for the Note Participations. Individual purchases of beneficial interests in the Note Participations will be<br />

made in book-entry form only and in the principal amount of $5,<strong>00</strong>0 or any integral multiple thereof. Purchasers of such<br />

beneficial interests will not receive physical delivery of the Note Participations. Principal of and interest on the Notes represented<br />

by the Note Participations will be payable on the Maturity Date by the Trustee to DTC. DTC will in turn remit such principal and<br />

interest to the DTC Participants (as hereinafter defined), who will in turn remit such principal and interest to the Beneficial<br />

Owners (as hereinafter defined) of the Note Participations. See Appendix E – “Book-Entry Only System” attached hereto.<br />

The Note Participations are not subject to prepayment prior to maturity.<br />

The Participants have each pledged certain Unrestricted Revenues as described herein for the payment of the principal of<br />

and interest on their respective Notes, provided that no Participant has any obligation to pay the principal of or interest on the<br />

Note of any other Participant. The Notes are general obligations of the respective Participants and, to the extent the Notes are not<br />

paid from revenues pledged for the payment of the Notes, the Notes shall be paid with interest thereon from any other moneys of<br />

the Participants lawfully available therefor. Payments by a Participant of the principal of and interest on its Note shall fully<br />

discharge the obligation of such Participant to the Owners of the Note Participations, notwithstanding nonpayment by one or<br />

*<br />

Preliminary, subject to change.<br />

Page 151<br />

22314.4 033985 POS