Opportunities for the smallholder sandalwood industry in ... - ACIAR

Opportunities for the smallholder sandalwood industry in ... - ACIAR

Opportunities for the smallholder sandalwood industry in ... - ACIAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

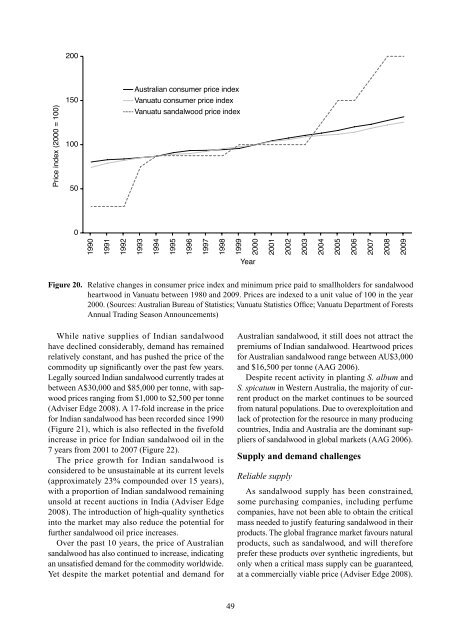

200<br />

Price <strong>in</strong>dex (2000 = 100)<br />

150<br />

100<br />

50<br />

Australian consumer price <strong>in</strong>dex<br />

Vanuatu consumer price <strong>in</strong>dex<br />

Vanuatu <strong>sandalwood</strong> price <strong>in</strong>dex<br />

0<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

Year<br />

Figure 20. Relative changes <strong>in</strong> consumer price <strong>in</strong>dex and m<strong>in</strong>imum price paid to <strong>smallholder</strong>s <strong>for</strong> <strong>sandalwood</strong><br />

heartwood <strong>in</strong> Vanuatu between 1980 and 2009. Prices are <strong>in</strong>dexed to a unit value of 100 <strong>in</strong> <strong>the</strong> year<br />

2000. (Sources: Australian Bureau of Statistics; Vanuatu Statistics Office; Vanuatu Department of Forests<br />

Annual Trad<strong>in</strong>g Season Announcements)<br />

While native supplies of Indian <strong>sandalwood</strong><br />

have decl<strong>in</strong>ed considerably, demand has rema<strong>in</strong>ed<br />

relatively constant, and has pushed <strong>the</strong> price of <strong>the</strong><br />

commodity up significantly over <strong>the</strong> past few years.<br />

Legally sourced Indian <strong>sandalwood</strong> currently trades at<br />

between A$30,000 and $85,000 per tonne, with sapwood<br />

prices rang<strong>in</strong>g from $1,000 to $2,500 per tonne<br />

(Adviser Edge 2008). A 17-fold <strong>in</strong>crease <strong>in</strong> <strong>the</strong> price<br />

<strong>for</strong> Indian <strong>sandalwood</strong> has been recorded s<strong>in</strong>ce 1990<br />

(Figure 21), which is also reflected <strong>in</strong> <strong>the</strong> fivefold<br />

<strong>in</strong>crease <strong>in</strong> price <strong>for</strong> Indian <strong>sandalwood</strong> oil <strong>in</strong> <strong>the</strong><br />

7 years from 2001 to 2007 (Figure 22).<br />

The price growth <strong>for</strong> Indian <strong>sandalwood</strong> is<br />

considered to be unsusta<strong>in</strong>able at its current levels<br />

(approximately 23% compounded over 15 years),<br />

with a proportion of Indian <strong>sandalwood</strong> rema<strong>in</strong><strong>in</strong>g<br />

unsold at recent auctions <strong>in</strong> India (Adviser Edge<br />

2008). The <strong>in</strong>troduction of high-quality syn<strong>the</strong>tics<br />

<strong>in</strong>to <strong>the</strong> market may also reduce <strong>the</strong> potential <strong>for</strong><br />

fur<strong>the</strong>r <strong>sandalwood</strong> oil price <strong>in</strong>creases.<br />

Over <strong>the</strong> past 10 years, <strong>the</strong> price of Australian<br />

<strong>sandalwood</strong> has also cont<strong>in</strong>ued to <strong>in</strong>crease, <strong>in</strong>dicat<strong>in</strong>g<br />

an unsatisfied demand <strong>for</strong> <strong>the</strong> commodity worldwide.<br />

Yet despite <strong>the</strong> market potential and demand <strong>for</strong><br />

Australian <strong>sandalwood</strong>, it still does not attract <strong>the</strong><br />

premiums of Indian <strong>sandalwood</strong>. Heartwood prices<br />

<strong>for</strong> Australian <strong>sandalwood</strong> range between AU$3,000<br />

and $16,500 per tonne (AAG 2006).<br />

Despite recent activity <strong>in</strong> plant<strong>in</strong>g S. album and<br />

S. spicatum <strong>in</strong> Western Australia, <strong>the</strong> majority of current<br />

product on <strong>the</strong> market cont<strong>in</strong>ues to be sourced<br />

from natural populations. Due to overexploitation and<br />

lack of protection <strong>for</strong> <strong>the</strong> resource <strong>in</strong> many produc<strong>in</strong>g<br />

countries, India and Australia are <strong>the</strong> dom<strong>in</strong>ant suppliers<br />

of <strong>sandalwood</strong> <strong>in</strong> global markets (AAG 2006).<br />

Supply and demand challenges<br />

Reliable supply<br />

As <strong>sandalwood</strong> supply has been constra<strong>in</strong>ed,<br />

some purchas<strong>in</strong>g companies, <strong>in</strong>clud<strong>in</strong>g perfume<br />

companies, have not been able to obta<strong>in</strong> <strong>the</strong> critical<br />

mass needed to justify featur<strong>in</strong>g <strong>sandalwood</strong> <strong>in</strong> <strong>the</strong>ir<br />

products. The global fragrance market favours natural<br />

products, such as <strong>sandalwood</strong>, and will <strong>the</strong>re<strong>for</strong>e<br />

prefer <strong>the</strong>se products over syn<strong>the</strong>tic <strong>in</strong>gredients, but<br />

only when a critical mass supply can be guaranteed,<br />

at a commercially viable price (Adviser Edge 2008).<br />

49