notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS (cont’d)<br />

For <strong>the</strong> year ended 31 December 2012<br />

13. Investment properties (cont’d)<br />

The Group has no restrictions on <strong>the</strong> realisability of its investment properties and no contractual obligations <strong>to</strong> purchase, construct<br />

or develop investment property or for repairs, maintenance or enhancements.<br />

Properties pledged as security<br />

The portion of <strong>the</strong> freehold property at 31 Harrison Road, Singapore 369649 whose carrying amount is US$4,191,000 as at 31<br />

December 2012 (2011: US$3,976,000) was mortgaged <strong>to</strong> secure bank loans.<br />

The freehold property at 81 Playfair Road, Singapore 367999 whose carrying amount is US$6,568,000 as at 31 December 2012<br />

(2011: US$6,180,000) was mortgaged <strong>to</strong> secure bank loans.<br />

Valuation of investment properties<br />

Based on a valuation performed by independent appraisers, Allied Appraisal Consultants Pte Ltd and DTZ Debenham Tie Leung (Sea)<br />

Pte Ltd on 31 December 2012 and Nil (2011: 27 December 2011 and 7 Oc<strong>to</strong>ber 2011) respectively, <strong>the</strong>re are no impairment required<br />

for <strong>the</strong> carrying amounts of <strong>the</strong>se properties.<br />

The valuations are estimates of <strong>the</strong> amounts for which <strong>the</strong> assets could be exchanged between a knowledgeable willing buyer and<br />

knowledgeable willing seller on an arm’s length transaction at <strong>the</strong> valuation date. The fair value of <strong>the</strong> investment properties is<br />

determined at US$18,329,000 (2011: US$11,937,000).<br />

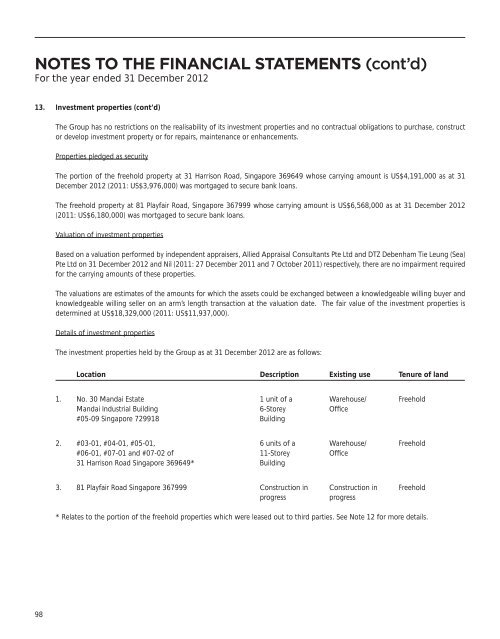

Details of investment properties<br />

The investment properties held by <strong>the</strong> Group as at 31 December 2012 are as follows:<br />

Location Description Existing use Tenure of land<br />

1. No. 30 Mandai Estate<br />

Mandai Industrial Building<br />

#05-09 Singapore 729918<br />

1 unit of a<br />

6-S<strong>to</strong>rey<br />

Building<br />

Warehouse/<br />

Office<br />

Freehold<br />

2. #03-01, #04-01, #05-01,<br />

#06-01, #07-01 and #07-02 of<br />

31 Harrison Road Singapore 369649*<br />

6 units of a<br />

11-S<strong>to</strong>rey<br />

Building<br />

Warehouse/<br />

Office<br />

Freehold<br />

3. 81 Playfair Road Singapore 367999 Construction in<br />

progress<br />

Construction in<br />

progress<br />

Freehold<br />

* Relates <strong>to</strong> <strong>the</strong> portion of <strong>the</strong> freehold properties which were leased out <strong>to</strong> third parties. See Note 12 for more details.<br />

98