notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Annual Report 2012<br />

NOTES TO THE FINANCIAL STATEMENTS (cont’d)<br />

For <strong>the</strong> year ended 31 December 2012<br />

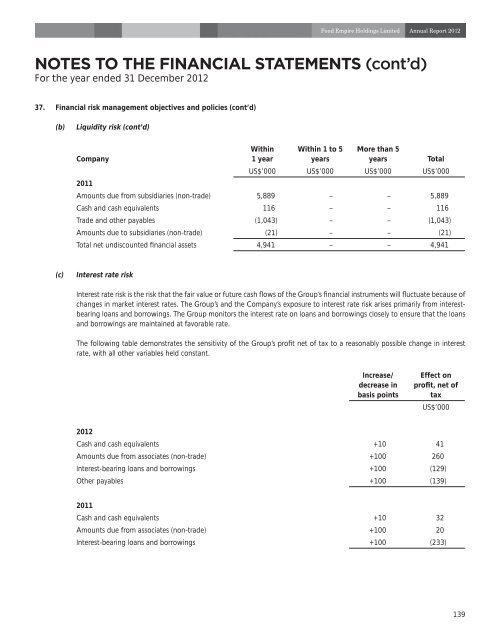

37. Financial risk management objectives and policies (cont’d)<br />

(b)<br />

Liquidity risk (cont’d)<br />

Within<br />

1 year<br />

Within 1 <strong>to</strong> 5<br />

years<br />

More than 5<br />

years<br />

Company<br />

Total<br />

US$’000 US$’000 US$’000 US$’000<br />

2011<br />

Amounts due from subsidiaries (non-trade) 5,889 – – 5,889<br />

Cash and cash equivalents 116 – – 116<br />

Trade and o<strong>the</strong>r payables (1,043) – – (1,043)<br />

Amounts due <strong>to</strong> subsidiaries (non-trade) (21) – – (21)<br />

Total net undiscounted <strong>financial</strong> assets 4,941 – – 4,941<br />

(c)<br />

Interest rate risk<br />

Interest rate risk is <strong>the</strong> risk that <strong>the</strong> fair value or future cash flows of <strong>the</strong> Group’s <strong>financial</strong> instruments will fluctuate because of<br />

changes in market interest rates. The Group’s and <strong>the</strong> Company’s exposure <strong>to</strong> interest rate risk arises primarily from interestbearing<br />

loans and borrowings. The Group moni<strong>to</strong>rs <strong>the</strong> interest rate on loans and borrowings closely <strong>to</strong> ensure that <strong>the</strong> loans<br />

and borrowings are maintained at favorable rate.<br />

The following table demonstrates <strong>the</strong> sensitivity of <strong>the</strong> Group’s profit net of tax <strong>to</strong> a reasonably possible change in interest<br />

rate, with all o<strong>the</strong>r variables held constant.<br />

Increase/<br />

decrease in<br />

basis points<br />

Effect on<br />

profit, net of<br />

tax<br />

US$’000<br />

2012<br />

Cash and cash equivalents +10 41<br />

Amounts due from associates (non-trade) +100 260<br />

Interest-bearing loans and borrowings +100 (129)<br />

O<strong>the</strong>r payables +100 (139)<br />

2011<br />

Cash and cash equivalents +10 32<br />

Amounts due from associates (non-trade) +100 20<br />

Interest-bearing loans and borrowings +100 (233)<br />

139