notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (cont’d)<br />

For <strong>the</strong> year ended 31 December 2012<br />

17. Intangible assets (cont’d)<br />

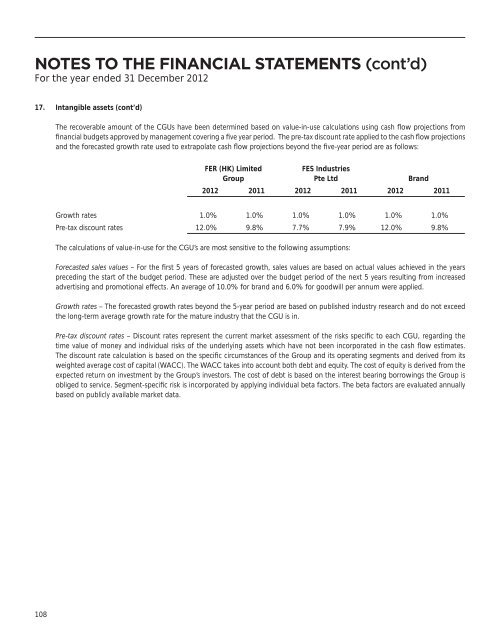

The recoverable amount of <strong>the</strong> CGUs have been determined based on value-in-use calculations using cash flow projections from<br />

<strong>financial</strong> budgets approved by management covering a five year period. The pre-tax discount rate applied <strong>to</strong> <strong>the</strong> cash flow projections<br />

and <strong>the</strong> forecasted growth rate used <strong>to</strong> extrapolate cash flow projections beyond <strong>the</strong> five-year period are as follows:<br />

FER (HK) <strong>Limited</strong><br />

Group<br />

FES Industries<br />

Pte Ltd<br />

Brand<br />

2012 2011 2012 2011 2012 2011<br />

Growth rates 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%<br />

Pre-tax discount rates 12.0% 9.8% 7.7% 7.9% 12.0% 9.8%<br />

The calculations of value-in-use for <strong>the</strong> CGU’s are most sensitive <strong>to</strong> <strong>the</strong> following assumptions:<br />

Forecasted sales values – For <strong>the</strong> first 5 years of forecasted growth, sales values are based on actual values achieved in <strong>the</strong> years<br />

preceding <strong>the</strong> start of <strong>the</strong> budget period. These are adjusted over <strong>the</strong> budget period of <strong>the</strong> next 5 years resulting from increased<br />

advertising and promotional effects. An average of 10.0% for brand and 6.0% for goodwill per annum were applied.<br />

Growth rates – The forecasted growth rates beyond <strong>the</strong> 5-year period are based on published industry research and do not exceed<br />

<strong>the</strong> long-term average growth rate for <strong>the</strong> mature industry that <strong>the</strong> CGU is in.<br />

Pre-tax discount rates – Discount rates represent <strong>the</strong> current market assessment of <strong>the</strong> risks specific <strong>to</strong> each CGU, regarding <strong>the</strong><br />

time value of money and individual risks of <strong>the</strong> underlying assets which have not been incorporated in <strong>the</strong> cash flow estimates.<br />

The discount rate calculation is based on <strong>the</strong> specific circumstances of <strong>the</strong> Group and its operating segments and derived from its<br />

weighted average cost of capital (WACC). The WACC takes in<strong>to</strong> account both debt and equity. The cost of equity is derived from <strong>the</strong><br />

expected return on investment by <strong>the</strong> Group’s inves<strong>to</strong>rs. The cost of debt is based on <strong>the</strong> interest bearing borrowings <strong>the</strong> Group is<br />

obliged <strong>to</strong> service. Segment-specific risk is incorporated by applying individual beta fac<strong>to</strong>rs. The beta fac<strong>to</strong>rs are evaluated annually<br />

based on publicly available market data.<br />

108