notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Annual Report 2012<br />

CORPORATE GOVERNANCE (cont’d)<br />

G) REMUNERATION MATTERS (cont’d)<br />

- Principle 7: Formal and transparent procedure for fixing remuneration packages of Direc<strong>to</strong>rs (cont’d)<br />

- Principle 8: Remuneration of Direc<strong>to</strong>rs should be adequate but not excessive (cont’d)<br />

- Principle 9: Remuneration policy, level and mix of remuneration and procedure for setting remuneration (cont’d)<br />

There is no change in <strong>the</strong> existing remuneration package for <strong>the</strong> Executive and Non-executive Direc<strong>to</strong>rs compared <strong>to</strong> <strong>the</strong> previous<br />

year. All Direc<strong>to</strong>rs, including Non-executive Direc<strong>to</strong>rs, who are not <strong>the</strong> controlling shareholders of <strong>the</strong> Group or are not appointed<br />

by <strong>the</strong> controlling shareholders of <strong>the</strong> Group, were eligible for share options under <strong>the</strong> current <strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Share<br />

Option Scheme (“2012 Option Scheme”). Additional information on <strong>the</strong> <strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Share Option Scheme (<strong>the</strong><br />

“2002 Option Scheme” and “2012 Option Scheme”) can be found on pages 44 <strong>to</strong> 47 and 119 <strong>to</strong> 123 of <strong>the</strong> annual report.<br />

Although <strong>the</strong> Code recommends <strong>the</strong> disclosure of <strong>the</strong> name of <strong>the</strong> individual Direc<strong>to</strong>rs and at least <strong>the</strong> <strong>to</strong>p five key executives<br />

(who are not <strong>the</strong> Direc<strong>to</strong>rs of <strong>the</strong> Group) within <strong>the</strong> bands of S$250,000 and a breakdown (in percentage terms) of each Direc<strong>to</strong>rs<br />

remuneration, <strong>the</strong> Board has decided not <strong>to</strong> adopt this practice because it is of <strong>the</strong> view that such disclosure may be detrimental <strong>to</strong><br />

<strong>the</strong> Group’s interest as it may lead <strong>to</strong> poaching of executives within a highly competitive industry.<br />

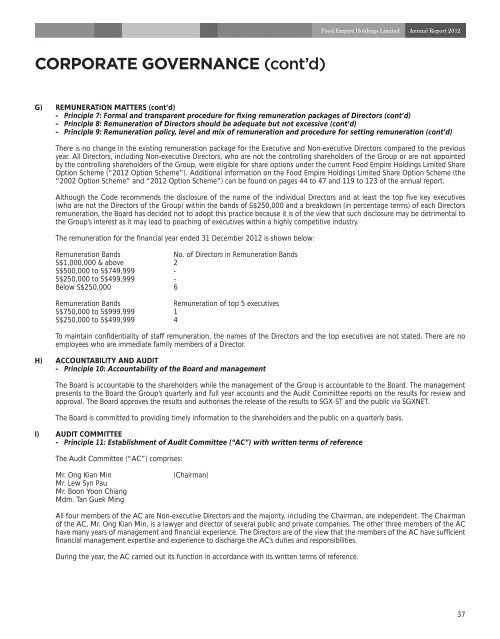

The remuneration for <strong>the</strong> <strong>financial</strong> year ended 31 December 2012 is shown below:<br />

Remuneration Bands<br />

No. of Direc<strong>to</strong>rs in Remuneration Bands<br />

S$1,000,000 & above 2<br />

S$500,000 <strong>to</strong> S$749,999 -<br />

S$250,000 <strong>to</strong> S$499,999 -<br />

Below S$250,000 6<br />

Remuneration Bands<br />

Remuneration of <strong>to</strong>p 5 executives<br />

S$750,000 <strong>to</strong> S$999,999 1<br />

S$250,000 <strong>to</strong> S$499,999 4<br />

To maintain confidentiality of staff remuneration, <strong>the</strong> names of <strong>the</strong> Direc<strong>to</strong>rs and <strong>the</strong> <strong>to</strong>p executives are not stated. There are no<br />

employees who are immediate family members of a Direc<strong>to</strong>r.<br />

H) ACCOUNTABILITY AND AUDIT<br />

- Principle 10: Accountability of <strong>the</strong> Board and management<br />

The Board is accountable <strong>to</strong> <strong>the</strong> shareholders while <strong>the</strong> management of <strong>the</strong> Group is accountable <strong>to</strong> <strong>the</strong> Board. The management<br />

presents <strong>to</strong> <strong>the</strong> Board <strong>the</strong> Group’s quarterly and full year accounts and <strong>the</strong> Audit Committee reports on <strong>the</strong> results for review and<br />

approval. The Board approves <strong>the</strong> results and authorises <strong>the</strong> release of <strong>the</strong> results <strong>to</strong> SGX-ST and <strong>the</strong> public via SGXNET.<br />

The Board is committed <strong>to</strong> providing timely information <strong>to</strong> <strong>the</strong> shareholders and <strong>the</strong> public on a quarterly basis.<br />

I) AUDIT COMMITTEE<br />

- Principle 11: Establishment of Audit Committee (“AC”) with written terms of reference<br />

The Audit Committee (“AC”) comprises:<br />

Mr. Ong Kian Min<br />

Mr. Lew Syn Pau<br />

Mr. Boon Yoon Chiang<br />

Mdm. Tan Guek Ming<br />

(Chairman)<br />

All four members of <strong>the</strong> AC are Non-executive Direc<strong>to</strong>rs and <strong>the</strong> majority, including <strong>the</strong> Chairman, are independent. The Chairman<br />

of <strong>the</strong> AC, Mr. Ong Kian Min, is a lawyer and direc<strong>to</strong>r of several public and private companies. The o<strong>the</strong>r three members of <strong>the</strong> AC<br />

have many years of management and <strong>financial</strong> experience. The Direc<strong>to</strong>rs are of <strong>the</strong> view that <strong>the</strong> members of <strong>the</strong> AC have sufficient<br />

<strong>financial</strong> management expertise and experience <strong>to</strong> discharge <strong>the</strong> AC’s duties and responsibilities.<br />

During <strong>the</strong> year, <strong>the</strong> AC carried out its function in accordance with its written terms of reference.<br />

37