notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Annual Report 2012<br />

NOTES TO THE FINANCIAL STATEMENTS (cont’d)<br />

For <strong>the</strong> year ended 31 December 2012<br />

37. Financial risk management objectives and policies (cont’d)<br />

(a)<br />

Credit risk (cont’d)<br />

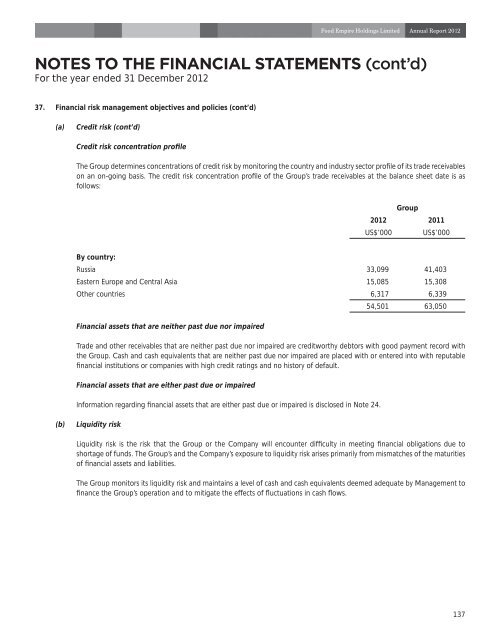

Credit risk concentration profile<br />

The Group determines concentrations of credit risk by moni<strong>to</strong>ring <strong>the</strong> country and industry sec<strong>to</strong>r profile of its trade receivables<br />

on an on-going basis. The credit risk concentration profile of <strong>the</strong> Group’s trade receivables at <strong>the</strong> balance sheet date is as<br />

follows:<br />

Group<br />

2012 2011<br />

US$’000 US$’000<br />

By country:<br />

Russia 33,099 41,403<br />

Eastern Europe and Central Asia 15,085 15,308<br />

O<strong>the</strong>r countries 6,317 6,339<br />

54,501 63,050<br />

Financial assets that are nei<strong>the</strong>r past due nor impaired<br />

Trade and o<strong>the</strong>r receivables that are nei<strong>the</strong>r past due nor impaired are creditworthy deb<strong>to</strong>rs with good payment record with<br />

<strong>the</strong> Group. Cash and cash equivalents that are nei<strong>the</strong>r past due nor impaired are placed with or entered in<strong>to</strong> with reputable<br />

<strong>financial</strong> institutions or companies with high credit ratings and no his<strong>to</strong>ry of default.<br />

Financial assets that are ei<strong>the</strong>r past due or impaired<br />

Information regarding <strong>financial</strong> assets that are ei<strong>the</strong>r past due or impaired is disclosed in Note 24.<br />

(b)<br />

Liquidity risk<br />

Liquidity risk is <strong>the</strong> risk that <strong>the</strong> Group or <strong>the</strong> Company will encounter difficulty in meeting <strong>financial</strong> obligations due <strong>to</strong><br />

shortage of funds. The Group’s and <strong>the</strong> Company’s exposure <strong>to</strong> liquidity risk arises primarily from mismatches of <strong>the</strong> maturities<br />

of <strong>financial</strong> assets and liabilities.<br />

The Group moni<strong>to</strong>rs its liquidity risk and maintains a level of cash and cash equivalents deemed adequate by Management <strong>to</strong><br />

finance <strong>the</strong> Group’s operation and <strong>to</strong> mitigate <strong>the</strong> effects of fluctuations in cash flows.<br />

137