notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

notes to the financial statements - Food Empire Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Food</strong> <strong>Empire</strong> <strong>Holdings</strong> <strong>Limited</strong> Annual Report 2012<br />

NOTES TO THE FINANCIAL STATEMENTS (cont’d)<br />

For <strong>the</strong> year ended 31 December 2012<br />

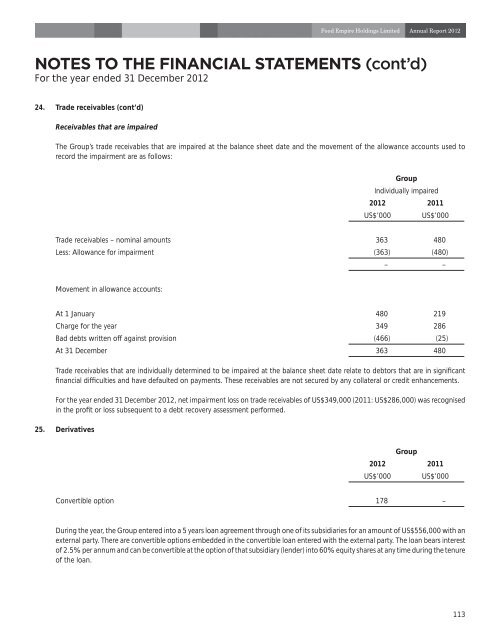

24. Trade receivables (cont’d)<br />

Receivables that are impaired<br />

The Group’s trade receivables that are impaired at <strong>the</strong> balance sheet date and <strong>the</strong> movement of <strong>the</strong> allowance accounts used <strong>to</strong><br />

record <strong>the</strong> impairment are as follows:<br />

Group<br />

Individually impaired<br />

2012 2011<br />

US$’000 US$’000<br />

Trade receivables – nominal amounts 363 480<br />

Less: Allowance for impairment (363) (480)<br />

– –<br />

Movement in allowance accounts:<br />

At 1 January 480 219<br />

Charge for <strong>the</strong> year 349 286<br />

Bad debts written off against provision (466) (25)<br />

At 31 December 363 480<br />

Trade receivables that are individually determined <strong>to</strong> be impaired at <strong>the</strong> balance sheet date relate <strong>to</strong> deb<strong>to</strong>rs that are in significant<br />

<strong>financial</strong> difficulties and have defaulted on payments. These receivables are not secured by any collateral or credit enhancements.<br />

For <strong>the</strong> year ended 31 December 2012, net impairment loss on trade receivables of US$349,000 (2011: US$286,000) was recognised<br />

in <strong>the</strong> profit or loss subsequent <strong>to</strong> a debt recovery assessment performed.<br />

25. Derivatives<br />

Group<br />

2012 2011<br />

US$’000 US$’000<br />

Convertible option 178 –<br />

During <strong>the</strong> year, <strong>the</strong> Group entered in<strong>to</strong> a 5 years loan agreement through one of its subsidiaries for an amount of US$556,000 with an<br />

external party. There are convertible options embedded in <strong>the</strong> convertible loan entered with <strong>the</strong> external party. The loan bears interest<br />

of 2.5% per annum and can be convertible at <strong>the</strong> option of that subsidiary (lender) in<strong>to</strong> 60% equity shares at any time during <strong>the</strong> tenure<br />

of <strong>the</strong> loan.<br />

113