sain t-gobain annu al report 2008 annual report

sain t-gobain annu al report 2008 annual report

sain t-gobain annu al report 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

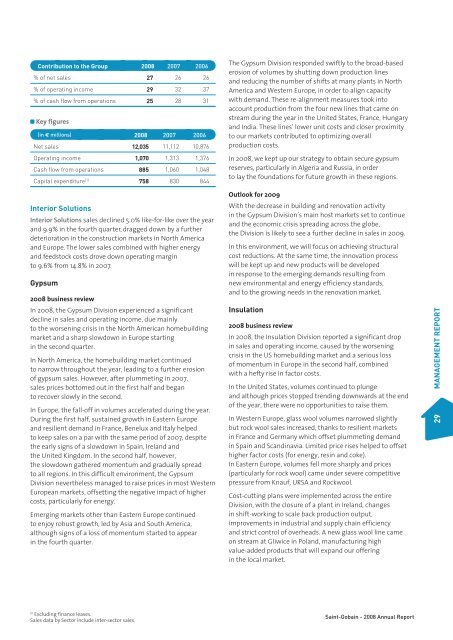

Contribution to the Group <strong>2008</strong> 2007 2006<br />

% of net s<strong>al</strong>es 27 26 26<br />

% of operating income 29 32 37<br />

% of cash flow from operations 25 28 31<br />

Key figures<br />

(in € millions) <strong>2008</strong> 2007 2006<br />

Net s<strong>al</strong>es 12,035 11,112 10,876<br />

Operating income 1,070 1,313 1,376<br />

Cash flow from operations 885 1,060 1,048<br />

Capit<strong>al</strong> expenditure (1) 758 830 844<br />

Interior Solutions<br />

Interior Solutions s<strong>al</strong>es declined 5.0% like-for-like over the year<br />

and 9.9% in the fourth quarter, dragged down by a further<br />

deterioration in the construction markets in North America<br />

and Europe. The lower s<strong>al</strong>es combined with higher energy<br />

and feedstock costs drove down operating margin<br />

to 9.6% from 14.8% in 2007.<br />

Gypsum<br />

<strong>2008</strong> business review<br />

In <strong>2008</strong>, the Gypsum Division experienced a significant<br />

decline in s<strong>al</strong>es and operating income, due mainly<br />

to the worsening crisis in the North American homebuilding<br />

market and a sharp slowdown in Europe starting<br />

in the second quarter.<br />

In North America, the homebuilding market continued<br />

to narrow throughout the year, leading to a further erosion<br />

of gypsum s<strong>al</strong>es. However, after plummeting in 2007,<br />

s<strong>al</strong>es prices bottomed out in the first h<strong>al</strong>f and began<br />

to recover slowly in the second.<br />

In Europe, the f<strong>al</strong>l-off in volumes accelerated during the year.<br />

During the first h<strong>al</strong>f, sustained growth in Eastern Europe<br />

and resilient demand in France, Benelux and It<strong>al</strong>y helped<br />

to keep s<strong>al</strong>es on a par with the same period of 2007, despite<br />

the early signs of a slowdown in Spain, Ireland and<br />

the United Kingdom. In the second h<strong>al</strong>f, however,<br />

the slowdown gathered momentum and gradu<strong>al</strong>ly spread<br />

to <strong>al</strong>l regions. In this difficult environment, the Gypsum<br />

Division nevertheless managed to raise prices in most Western<br />

European markets, offsetting the negative impact of higher<br />

costs, particularly for energy.<br />

Emerging markets other than Eastern Europe continued<br />

to enjoy robust growth, led by Asia and South America,<br />

<strong>al</strong>though signs of a loss of momentum started to appear<br />

in the fourth quarter.<br />

The Gypsum Division responded swiftly to the broad-based<br />

erosion of volumes by shutting down production lines<br />

and reducing the number of shifts at many plants in North<br />

America and Western Europe, in order to <strong>al</strong>ign capacity<br />

with demand. These re-<strong>al</strong>ignment measures took into<br />

account production from the four new lines that came on<br />

stream during the year in the United States, France, Hungary<br />

and India. These lines’ lower unit costs and closer proximity<br />

to our markets contributed to optimizing over<strong>al</strong>l<br />

production costs.<br />

In <strong>2008</strong>, we kept up our strategy to obtain secure gypsum<br />

reserves, particularly in Algeria and Russia, in order<br />

to lay the foundations for future growth in these regions.<br />

Outlook for 2009<br />

With the decrease in building and renovation activity<br />

in the Gypsum Division’s main host markets set to continue<br />

and the economic crisis spreading across the globe,<br />

the Division is likely to see a further decline in s<strong>al</strong>es in 2009.<br />

In this environment, we will focus on achieving structur<strong>al</strong><br />

cost reductions. At the same time, the innovation process<br />

will be kept up and new products will be developed<br />

in response to the emerging demands resulting from<br />

new environment<strong>al</strong> and energy efficiency standards,<br />

and to the growing needs in the renovation market.<br />

Insulation<br />

<strong>2008</strong> business review<br />

In <strong>2008</strong>, the Insulation Division <strong>report</strong>ed a significant drop<br />

in s<strong>al</strong>es and operating income, caused by the worsening<br />

crisis in the US homebuilding market and a serious loss<br />

of momentum in Europe in the second h<strong>al</strong>f, combined<br />

with a hefty rise in factor costs.<br />

In the United States, volumes continued to plunge<br />

and <strong>al</strong>though prices stopped trending downwards at the end<br />

of the year, there were no opportunities to raise them.<br />

In Western Europe, glass wool volumes narrowed slightly<br />

but rock wool s<strong>al</strong>es increased, thanks to resilient markets<br />

in France and Germany which offset plummeting demand<br />

in Spain and Scandinavia. Limited price rises helped to offset<br />

higher factor costs (for energy, resin and coke).<br />

In Eastern Europe, volumes fell more sharply and prices<br />

(particularly for rock wool) came under severe competitive<br />

pressure from Knauf, URSA and Rockwool.<br />

Cost-cutting plans were implemented across the entire<br />

Division, with the closure of a plant in Ireland, changes<br />

in shift-working to sc<strong>al</strong>e back production output,<br />

improvements in industri<strong>al</strong> and supply chain efficiency<br />

and strict control of overheads. A new glass wool line came<br />

on stream at Gliwice in Poland, manufacturing high<br />

v<strong>al</strong>ue-added products that will expand our offering<br />

in the loc<strong>al</strong> market.<br />

MANAGEMENT REPORT<br />

29<br />

(1)<br />

Excluding finance leases.<br />

S<strong>al</strong>es data by Sector include inter-sector s<strong>al</strong>es.<br />

Saint-Gobain - <strong>2008</strong> Annu<strong>al</strong> Report