You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SECTOR REPORT: DISTILLERS<br />

66<br />

global companies need a full<br />

range of spirits, single malts<br />

and aged rums and brandies<br />

even before you get to the<br />

modern liquid candy<br />

confections striving for<br />

market share. Bacardi’s<br />

purchase of Grey Goose and<br />

other brands such as<br />

Bombay Sapphire and<br />

Dewars shows that it realises<br />

that the fairly generic white<br />

rum that it is usually<br />

associated with does not pull<br />

in the growth and dollars it<br />

wants. Bacardi, itself one of<br />

the world’s most recognisable brands, has also grown<br />

apace, but not perhaps as fast as its rivals, or indeed as fast<br />

as the family. There are constant hints that its 600-plus<br />

(and increasingly extended) family shareholders may want<br />

to go public so they can take a quick shot from the stock<br />

markets. Bacardi executives meanwhile are looking<br />

askance at their declining market share as the major, stockmarket-funded<br />

giants merge and acquire.<br />

And of course, to add a little spritz to the mix, Bacardi has<br />

been fighting its own grudge fight against Pernod-Ricard<br />

over the American rights to Havana Club. Pernod-Ricard<br />

has the worldwide rights, except in the USA, where the<br />

courts and Congress share the Bacardi family’s antipathy to<br />

Fidel Castro.<br />

Some cynics also suggest that Havana Club’s distinctive<br />

nose shows up the blandness of Bacardi – which might<br />

explain how, without selling a single bottle legally in the<br />

world’s biggest marketplace (i.e. the USA) Havana Club<br />

sales have been steadily rising until it is now 44th in the<br />

world’s top hundred spirits list.<br />

Among the quoted spirit companies meanwhile, the<br />

present reshuffle began when Edgar Bronfman Jr decided to<br />

pull out of the family’s Seagram’s spirits empire, whose<br />

success had been built on the proximity of Canadian<br />

distilleries to Prohibition-era America. Diageo and Pernod-<br />

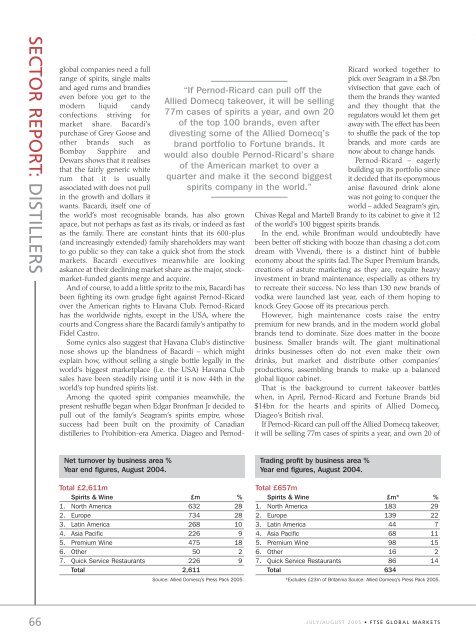

Net turnover by business area %<br />

Year end figures, August 2004.<br />

Total £2,611m<br />

Spirits & Wine £m %<br />

1. North America 632 28<br />

2. Europe 734 28<br />

3. Latin America 268 10<br />

4. Asia Pacific 226 9<br />

5. Premium Wine 475 18<br />

6. Other 50 2<br />

7. Quick Service Restaurants 226 9<br />

Total 2,611<br />

“If Pernod-Ricard can pull off the<br />

Allied Domecq takeover, it will be selling<br />

77m cases of spirits a year, and own 20<br />

of the top 100 brands, even after<br />

divesting some of the Allied Domecq’s<br />

brand portfolio to Fortune brands. It<br />

would also double Pernod-Ricard’s share<br />

of the American market to over a<br />

quarter and make it the second biggest<br />

spirits company in the world.”<br />

Source: Allied Domecq’s Press Pack 2005.<br />

Ricard worked together to<br />

pick over Seagram in a $8.7bn<br />

vivisection that gave each of<br />

them the brands they wanted<br />

and they thought that the<br />

regulators would let them get<br />

away with.The effect has been<br />

to shuffle the pack of the top<br />

brands, and more cards are<br />

now about to change hands.<br />

Pernod-Ricard – eagerly<br />

building up its portfolio since<br />

it decided that its eponymous<br />

anise flavoured drink alone<br />

was not going to conquer the<br />

world – added Seagram’s gin,<br />

Chivas Regal and Martell Brandy to its cabinet to give it 12<br />

of the world’s 100 biggest spirits brands.<br />

In the end, while Bronfman would undoubtedly have<br />

been better off sticking with booze than chasing a dot.com<br />

dream with Vivendi, there is a distinct hint of bubble<br />

economy about the spirits fad. The Super Premium brands,<br />

creations of astute marketing as they are, require heavy<br />

investment in brand maintenance, especially as others try<br />

to recreate their success. No less than 130 new brands of<br />

vodka were launched last year, each of them hoping to<br />

knock Grey Goose off its precarious perch.<br />

However, high maintenance costs raise the entry<br />

premium for new brands, and in the modern world global<br />

brands tend to dominate. Size does matter in the booze<br />

business. Smaller brands wilt. The giant multinational<br />

drinks businesses often do not even make their own<br />

drinks, but market and distribute other companies’<br />

productions, assembling brands to make up a balanced<br />

global liquor cabinet.<br />

That is the background to current takeover battles<br />

when, in April, Pernod-Ricard and Fortune Brands bid<br />

$14bn for the hearts and spirits of Allied Domecq,<br />

Diageo’s British rival.<br />

If Pernod-Ricard can pull off the Allied Domecq takeover,<br />

it will be selling 77m cases of spirits a year, and own 20 of<br />

Trading profit by business area %<br />

Year end figures, August 2004.<br />

Total £657m<br />

Spirits & Wine £m* %<br />

1. North America 183 29<br />

2. Europe 139 22<br />

3. Latin America 44 7<br />

4. Asia Pacific 68 11<br />

5. Premium Wine 98 15<br />

6. Other 16 2<br />

7. Quick Service Restaurants 86 14<br />

Total 634<br />

*Excludes £23m of Britannia Source: Allied Domecq’s Press Pack 2005.<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS