You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DERIVATIVES REPORT: CME<br />

70<br />

reported to have combined<br />

ETF assets under custody<br />

of some $226bn (as of the<br />

end of last year), with the<br />

S&P 500, NASDAQ-100<br />

and Russell 2000 ETFs<br />

accounting for about one<br />

third of that amount.<br />

New CME ETF futures<br />

contracts that are based on<br />

those indices began<br />

trading on the CME Globex<br />

electronic trading platform<br />

in June. Futures on the<br />

S&P 500 and NASDAQ-<br />

100 indices continue to<br />

trade exclusively at<br />

CME. “<strong>Equity</strong> market<br />

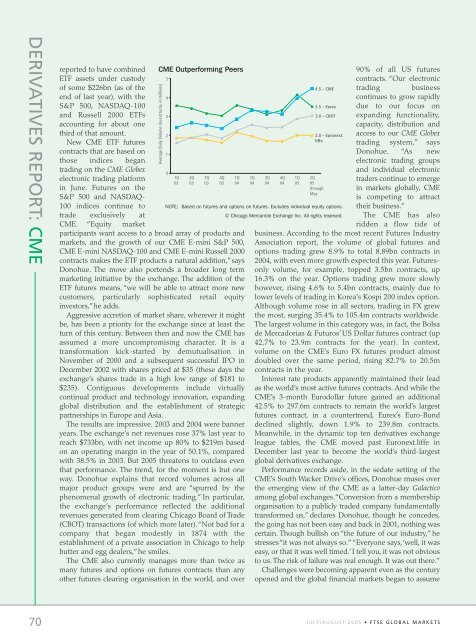

CME Outperforming Peers<br />

participants want access to a broad array of products and<br />

markets, and the growth of our CME E-mini S&P 500,<br />

CME E-mini NASDAQ-100 and CME E-mini Russell 2000<br />

contracts makes the ETF products a natural addition,”says<br />

Donohue. The move also portends a broader long term<br />

marketing initiative by the exchange. The addition of the<br />

ETF futures means, “we will be able to attract more new<br />

customers, particularly sophisticated retail equity<br />

investors,”he adds.<br />

Aggressive accretion of market share, wherever it might<br />

be, has been a priority for the exchange since at least the<br />

turn of this century. Between then and now the CME has<br />

assumed a more uncompromising character. It is a<br />

transformation kick-started by demutualisation in<br />

November of 2000 and a subsequent successful IPO in<br />

December 2002 with shares priced at $35 (these days the<br />

exchange’s shares trade in a high low range of $181 to<br />

$235). Contiguous developments include virtually<br />

continual product and technology innovation, expanding<br />

global distribution and the establishment of strategic<br />

partnerships in Europe and Asia.<br />

The results are impressive. 2003 and 2004 were banner<br />

years. The exchange’s net revenues rose 37% last year to<br />

reach $733bn, with net income up 80% to $219m based<br />

on an operating margin in the year of 50.1%, compared<br />

with 38.5% in 2003. But 2005 threatens to outclass even<br />

that performance. The trend, for the moment is but one<br />

way. Donohue explains that record volumes across all<br />

major product groups were and are “spurred by the<br />

phenomenal growth of electronic trading.” In particular,<br />

the exchange’s performance reflected the additional<br />

revenues generated from clearing Chicago Board of Trade<br />

(CBOT) transactions (of which more later).“Not bad for a<br />

company that began modestly in 1874 with the<br />

establishment of a private association in Chicago to help<br />

butter and egg dealers,”he smiles.<br />

The CME also currently manages more than twice as<br />

many futures and options on futures contracts than any<br />

other futures clearing organisation in the world, and over<br />

Average Daily Volume (round turns, in millions)<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

1Q<br />

03<br />

2Q<br />

03<br />

3Q<br />

03<br />

4Q<br />

03<br />

1Q<br />

04<br />

2Q<br />

04<br />

3Q<br />

04<br />

4Q<br />

04<br />

1Q<br />

05<br />

4.5 – CME<br />

3.5 – Eurex<br />

3.0 – CBOT<br />

2.0 – Euronext.<br />

liffe<br />

2Q<br />

05<br />

through<br />

May<br />

NOTE: Based on futures and options on futures. Excludes individual equity options.<br />

© Chicago Mercantile Exchange Inc. All rights reserved.<br />

90% of all US futures<br />

contracts. “Our electronic<br />

trading business<br />

continues to grow rapidly<br />

due to our focus on<br />

expanding functionality,<br />

capacity, distribution and<br />

access to our CME Globex<br />

trading system,” says<br />

Donohue. “As new<br />

electronic trading groups<br />

and individual electronic<br />

traders continue to emerge<br />

in markets globally, CME<br />

is competing to attract<br />

their business.”<br />

The CME has also<br />

ridden a flow tide of<br />

business. According to the most recent Futures Industry<br />

Association report, the volume of global futures and<br />

options trading grew 8.9% to total 8.89bn contracts in<br />

2004, with even more growth expected this year. Futuresonly<br />

volume, for example, topped 3.5bn contracts, up<br />

16.3% on the year. Options trading grew more slowly<br />

however, rising 4.6% to 5.4bn contracts, mainly due to<br />

lower levels of trading in Korea’s Kospi 200 index option.<br />

Although volume rose in all sectors, trading in FX grew<br />

the most, surging 35.4% to 105.4m contracts worldwide.<br />

The largest volume in this category was, in fact, the Bolsa<br />

de Mercadorias & Futuros’US Dollar futures contract (up<br />

42.7% to 23.9m contracts for the year). In context,<br />

volume on the CME’s Euro FX futures product almost<br />

doubled over the same period, rising 82.7% to 20.5m<br />

contracts in the year.<br />

Interest rate products apparently maintained their lead<br />

as the world’s most active futures contracts. And while the<br />

CME’s 3-month Eurodollar future gained an additional<br />

42.5% to 297.6m contracts to remain the world’s largest<br />

futures contract, in a countertrend, Eurex’s Euro-Bund<br />

declined slightly, down 1.9% to 239.8m contracts.<br />

Meanwhile, in the dynamic top ten derivatives exchange<br />

league tables, the CME moved past Euronext.liffe in<br />

December last year to become the world’s third-largest<br />

global derivatives exchange.<br />

Performance records aside, in the sedate setting of the<br />

CME’s South Wacker Drive’s offices, Donohue muses over<br />

the emerging view of the CME as a latter-day Galactico<br />

among global exchanges.“Conversion from a membership<br />

organisation to a publicly traded company fundamentally<br />

transformed us,” declares Donohue, though he concedes,<br />

the going has not been easy and back in 2001, nothing was<br />

certain. Though bullish on “the future of our industry,” he<br />

stresses “it was not always so.” “Everyone says,‘well, it was<br />

easy, or that it was well timed.’I tell you, it was not obvious<br />

to us. The risk of failure was real enough. It was out there.”<br />

Challenges were becoming apparent even as the century<br />

opened and the global financial markets began to assume<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS