You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INDEX REVIEW: CORPORATE GOVERNANCE<br />

84<br />

benchmark indexes although the underlying differences<br />

are marginal with high correlations. Each index is closely<br />

correlated to its underlying benchmark index. Over a fiveyear<br />

period the tracking errors are higher with the<br />

individual country indexes, while the regional indexes of<br />

<strong>FTSE</strong> ISS Developed, <strong>FTSE</strong> ISS Europe, and <strong>FTSE</strong> ISS Euro<br />

CGI show a five-year tracking error of 1.09%, 1.32%, and<br />

1.11% respectively.<br />

Although separate from the index methodology, analysis<br />

based around a sample portfolio containing the top 50 and<br />

bottom 50 constituents from each theme within the <strong>FTSE</strong><br />

US <strong>Index</strong> universe has shown that the bottom 50<br />

underperform the top 50 in four out of five themes over a<br />

five-year period. The analysis based on equally weighting<br />

the portfolios on a daily basis using FactSet Software,<br />

shows this out-performance when using the overall<br />

company CGI rating. Apart from the theme Board Structure<br />

each bottom 50 portfolio also under-performs an equally<br />

weighted <strong>FTSE</strong> US <strong>Index</strong>. The Compensation theme<br />

interestingly has a negative performance over the period of<br />

one year, with the highest volatility of all the themes over<br />

the five-year period.<br />

Given the level of specific information available at<br />

present, there is no definitive link between corporate<br />

governance and stock returns. The performance analysis<br />

on the US is only a starting point, and by no means<br />

conclusive over a five year period. But, over reasonable<br />

time periods it is likely that governance factors will show<br />

themselves in investment returns. There are a number of<br />

reasons put forward for this. One is that sufficient<br />

information to make detailed decisions by all investors has<br />

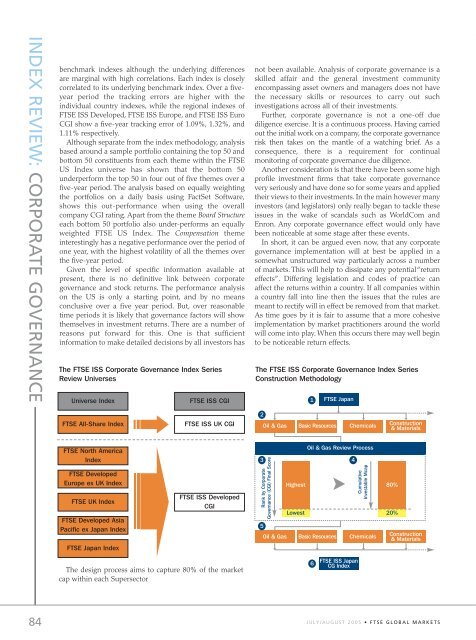

The <strong>FTSE</strong> ISS Corporate Governance <strong>Index</strong> <strong>Series</strong><br />

Review Universes<br />

Universe <strong>Index</strong><br />

<strong>FTSE</strong> All-Share <strong>Index</strong><br />

<strong>FTSE</strong> North America<br />

<strong>Index</strong><br />

<strong>FTSE</strong> Developed<br />

Europe ex UK <strong>Index</strong><br />

<strong>FTSE</strong> UK <strong>Index</strong><br />

<strong>FTSE</strong> Developed Asia<br />

Pacific ex Japan <strong>Index</strong><br />

<strong>FTSE</strong> Japan <strong>Index</strong><br />

<strong>FTSE</strong> ISS CGI<br />

<strong>FTSE</strong> ISS UK CGI<br />

<strong>FTSE</strong> ISS Developed<br />

CGI<br />

The design process aims to capture 80% of the market<br />

cap within each Supersector<br />

not been available. Analysis of corporate governance is a<br />

skilled affair and the general investment community<br />

encompassing asset owners and managers does not have<br />

the necessary skills or resources to carry out such<br />

investigations across all of their investments.<br />

Further, corporate governance is not a one-off due<br />

diligence exercise. It is a continuous process. Having carried<br />

out the initial work on a company, the corporate governance<br />

risk then takes on the mantle of a watching brief. As a<br />

consequence, there is a requirement for continual<br />

monitoring of corporate governance due diligence.<br />

Another consideration is that there have been some high<br />

profile investment firms that take corporate governance<br />

very seriously and have done so for some years and applied<br />

their views to their investments. In the main however many<br />

investors (and legislators) only really began to tackle these<br />

issues in the wake of scandals such as WorldCom and<br />

Enron. Any corporate governance effect would only have<br />

been noticeable at some stage after these events.<br />

In short, it can be argued even now, that any corporate<br />

governance implementation will at best be applied in a<br />

somewhat unstructured way particularly across a number<br />

of markets. This will help to dissipate any potential “return<br />

effects”. Differing legislation and codes of practice can<br />

affect the returns within a country. If all companies within<br />

a country fall into line then the issues that the rules are<br />

meant to rectify will in effect be removed from that market.<br />

As time goes by it is fair to assume that a more cohesive<br />

implementation by market practitioners around the world<br />

will come into play. When this occurs there may well begin<br />

to be noticeable return effects.<br />

The <strong>FTSE</strong> ISS Corporate Governance <strong>Index</strong> <strong>Series</strong><br />

Construction Methodology<br />

2<br />

3<br />

Oil & Gas<br />

Rank by Corporate<br />

Governance (CGI) Final Score<br />

Highest<br />

Lowest<br />

1<br />

Basic Resources<br />

<strong>FTSE</strong> Japan<br />

Oil & Gas Review Process<br />

<strong>FTSE</strong> ISS Japan<br />

CG <strong>Index</strong><br />

Chemicals<br />

5<br />

Oil & Gas Basic Resources Chemicals<br />

6<br />

4<br />

Cumulative<br />

Investable Mcap<br />

Construction<br />

& Materials<br />

80%<br />

20%<br />

Construction<br />

& Materials<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS