Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BANK PROFILE: COMMERCE BANCORP<br />

80<br />

with Janney Montgomery Scott Inc. in Philadelphia, adding<br />

that unlike most banks, Commerce doesn’t depend on its<br />

own share price to fuel acquisitions and therefore growth.<br />

The bank attracts business, analysts said, because it<br />

stands apart from others in its hiring, its training and<br />

follow-through. Legend has it that job candidates are<br />

deemed unsuitable if they do not smile with the first 30<br />

seconds of an interview. At the other end of the process,<br />

“mystery shoppers” visit Commerce branches 100,000<br />

times a year, meaning that someone is sizing up each of<br />

more than 300 branches and writing a report about each<br />

one of them nearly every day.<br />

Not everyone, however, is convinced that the growth and<br />

market share gains are sustainable. For example, Thomas<br />

Monaco, an analyst with Moors & Cabot, a Boston-based<br />

brokerage firm, says that consumer deposit growth comes<br />

mostly from opening costly new branches. Once they are<br />

open a year or two, he said, consumer deposit growth trails<br />

off. That has been masked, he said, by a growing<br />

government deposit business. And the government<br />

business may have trouble ahead, he adds.<br />

Two Commerce executives were convicted in May of<br />

conspiracy charges in a municipal corruption case in<br />

Philadelphia. The executives were charged with helping a<br />

city official get personal loans on favorable terms in<br />

exchange for his steering city business to the bank.<br />

Whether Commerce backs off from pursuit of government<br />

business or local governments shy away from Commerce,<br />

the impact could be big, Monaco expands. Other analysts<br />

say they fear that additional improprieties in soliciting<br />

government business could surface, tarring the company<br />

directly next time around.<br />

In addition, analysts have expressed concern that a<br />

relatively unusual balance sheet could cause trouble if<br />

interest rates rise sharply. With loans on Commerce’s books<br />

totaling just 35% of deposits, the bank has a large portfolio<br />

of fixed-rate securities. The value of these securities could<br />

plummet if rates rise.That would deplete the equity that the<br />

bank needs to continue opening branches, Monaco adds.<br />

The biggest reasons for concern might be the possibility<br />

that the industry giants are getting their retail act together.<br />

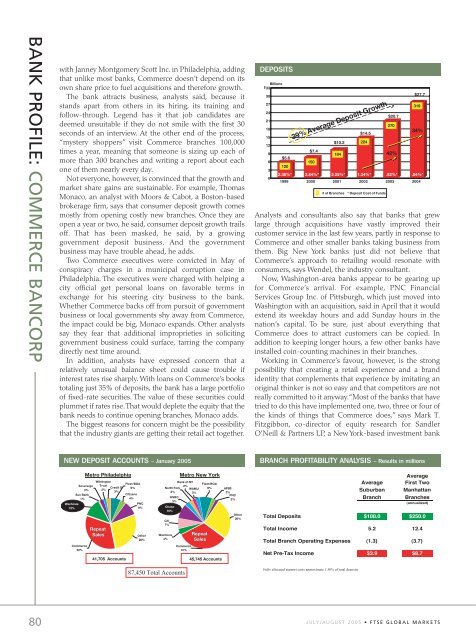

NEW DEPOSIT ACCOUNTS – January 2005<br />

Wachovia<br />

12%<br />

Sovereign<br />

3%<br />

Sun Bank<br />

1%<br />

Commerce<br />

32%<br />

Metro Philadelphia<br />

Wilmington<br />

Trust<br />

2%<br />

Repeat<br />

Sales<br />

Credit U<br />

3%<br />

41,705 Accounts<br />

Fleet/BOA<br />

6%<br />

Citizens<br />

4%<br />

PNC<br />

9%<br />

Other<br />

28%<br />

Bank of NY<br />

2%<br />

North Fork WAMU<br />

2%<br />

3%<br />

HSBC<br />

3%<br />

Chase<br />

10%<br />

Citi<br />

7%<br />

Wachovia<br />

4%<br />

Metro New York<br />

Commerce<br />

31%<br />

87,450 Total Accounts<br />

Repeat<br />

Sales<br />

Fleet/BOA<br />

8% AFSB<br />

2% PNC<br />

2%<br />

45,745 Accounts<br />

Other<br />

26%<br />

DEPOSITS<br />

Billions<br />

$ 33<br />

30<br />

27<br />

24<br />

21<br />

18<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

$5.6<br />

120<br />

39%<br />

A<br />

verage<br />

Deposit<br />

Growth<br />

$7.4<br />

150<br />

$10.2<br />

184<br />

2.38%* 2.84%* 2.25%*<br />

1999 2000 2001 2002 2003 2004<br />

# of Branches * Deposit Cost of Funds<br />

Analysts and consultants also say that banks that grew<br />

large through acquisitions have vastly improved their<br />

customer service in the last few years, partly in response to<br />

Commerce and other smaller banks taking business from<br />

them. Big New York banks just did not believe that<br />

Commerce’s approach to retailing would resonate with<br />

consumers, says Wendel, the industry consultant.<br />

Now, Washington-area banks appear to be gearing up<br />

for Commerce’s arrival. For example, PNC Financial<br />

Services Group Inc. of Pittsburgh, which just moved into<br />

Washington with an acquisition, said in April that it would<br />

extend its weekday hours and add Sunday hours in the<br />

nation’s capital. To be sure, just about everything that<br />

Commerce does to attract customers can be copied. In<br />

addition to keeping longer hours, a few other banks have<br />

installed coin-counting machines in their branches.<br />

Working in Commerce’s favour, however, is the strong<br />

possibility that creating a retail experience and a brand<br />

identity that complements that experience by imitating an<br />

original thinker is not so easy and that competitors are not<br />

really committed to it anyway.“Most of the banks that have<br />

tried to do this have implemented one, two, three or four of<br />

the kinds of things that Commerce does,” says Mark T.<br />

Fitzgibbon, co-director of equity research for Sandler<br />

O’Neill & Partners LP, a New York-based investment bank<br />

BRANCH PROFITABILITY ANALYSIS – Results in millions<br />

Fully allocated support costs approximate 1.50% of total deposits<br />

$14.5<br />

Average<br />

Average First Two<br />

Suburban Manhattan<br />

Branch Branches<br />

(annualized)<br />

Total Deposits $100.0 $250.0<br />

Total Income 5.2 12.4<br />

Total Branch Operating Expenses (1.3) (3.7)<br />

Net Pre-Tax Income $3.9 $8.7<br />

224<br />

1.34%*<br />

$20.7<br />

270<br />

42%<br />

.82%*<br />

$27.7<br />

319<br />

34%<br />

.84%*<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS