Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DEBT REPORT: JUMBO PFANDBRIEFE<br />

56<br />

It seems increasingly<br />

likely that issuance of 160<br />

covered Jumbos will soon 150<br />

spill out of Europe. A 140<br />

number of other countries, 130<br />

notably from central and<br />

120<br />

South America, have been<br />

110<br />

investigating the possibility<br />

100<br />

of issuing covered-bonds,<br />

90<br />

while delegates from US<br />

have also started to take an<br />

interest in the mechanics<br />

of constructing coveredbonds.<br />

“It will get very<br />

interesting if non-<br />

European countries come into the market, such as Mexico or<br />

a South American country. And of course if the US enters the<br />

mix then everything will change,”says Vortmueller.<br />

The growth of a larger market in covered-bonds has<br />

added length and depth to the covered-bond yield curve –<br />

in particular the Spanish cédulas have added mass and<br />

liquidity to the long end of the yield curve. Yet the market<br />

has also remained largely homogenous as a result of the<br />

adoption of similar legislation across the issuing countries.<br />

That is not expected to change.<br />

Juetten says: “The economic principles that drive the<br />

development of the product are the same and therefore a<br />

convergence of covered-bond legislation has taken place.”<br />

The exception to this has been Britain and Italy, both of<br />

which have issued covered bonds without the backing of<br />

legal infrastructure – though in the case of Italy that looks<br />

like a one off with new laws expected to be enacted soon.<br />

The success of the British bond has paved the way for more<br />

like it and importantly it has shown a way forward for banks<br />

in other countries, without specific covered bond legislation.<br />

“In (Britain and Italy) issuers have had to substitute the<br />

legislative framework with private law. Because they are<br />

effectively using structuring techniques and every issuer<br />

has a slightly different documentation more caution is<br />

needed when comparing one covered-bond with another,”<br />

says Karlo Fuchs, associate director Financial Institutions<br />

Ratings at Standard & Poor’s Frankfurt. The growth of<br />

covered-bonds outside Germany has given rise to another<br />

notable trend, namely the growth of the mortgage sector in<br />

the market. This too is expected to continue.<br />

Throughout the 1990s, the covered-bond market was<br />

dominated by German public-sector lending collateralised<br />

bonds. While the laws in the new issuing countries allow for<br />

the issuance of both mortgage and public sector based<br />

covered-bonds it is already evident that it is the former that<br />

will dominate. This development could have a negative<br />

impact on the market as it is attracting the interest of financial<br />

regulators, who are concerned that savings banks are issuing<br />

debt that ranks higher than the deposits of customers.<br />

The UK regulator has already issued guidelines that no<br />

more than 4% of total assets can be repackaged as debt.<br />

This has put the brakes on UK issuance of covered bonds<br />

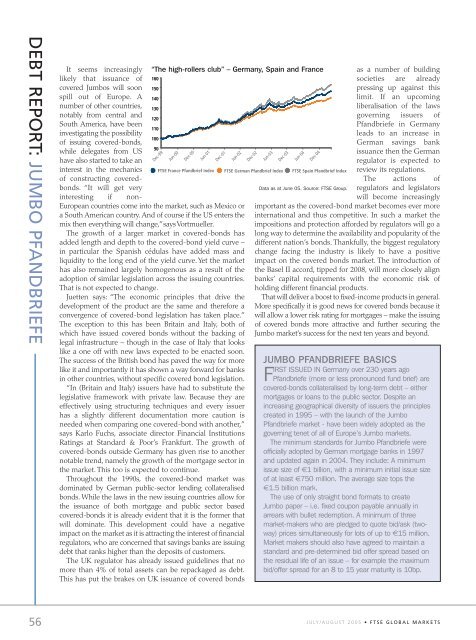

“The high-rollers club” – Germany, Spain and France<br />

Dec-99<br />

Jun-00<br />

Dec-00<br />

Jun-01<br />

Dec-01<br />

Jun-02<br />

as a number of building<br />

societies are already<br />

pressing up against this<br />

limit. If an upcoming<br />

liberalisation of the laws<br />

governing issuers of<br />

Pfandbriefe in Germany<br />

leads to an increase in<br />

German savings bank<br />

issuance then the German<br />

regulator is expected to<br />

review its regulations.<br />

The actions of<br />

Data as at June 05. Source: <strong>FTSE</strong> Group. regulators and legislators<br />

will become increasingly<br />

important as the covered-bond market becomes ever more<br />

international and thus competitive. In such a market the<br />

impositions and protection afforded by regulators will go a<br />

long way to determine the availability and popularity of the<br />

different nation’s bonds. Thankfully, the biggest regulatory<br />

change facing the industry is likely to have a positive<br />

impact on the covered bonds market. The introduction of<br />

the Basel II accord, tipped for 2008, will more closely align<br />

banks’ capital requirements with the economic risk of<br />

holding different financial products.<br />

That will deliver a boost to fixed-income products in general.<br />

More specifically it is good news for covered bonds because it<br />

will allow a lower risk rating for mortgages – make the issuing<br />

of covered bonds more attractive and further securing the<br />

Jumbo market’s success for the next ten years and beyond.<br />

Dec-02<br />

<strong>FTSE</strong> France Pfandbrief <strong>Index</strong> <strong>FTSE</strong> German Pfandbrief <strong>Index</strong> <strong>FTSE</strong> Spain Pfandbrief <strong>Index</strong><br />

Jun-03<br />

Dec-03<br />

Jun-04<br />

Dec-04<br />

JUMBO PFANDBRIEFE BASICS<br />

FIRST ISSUED IN Germany over 230 years ago<br />

Pfandbriefe (more or less pronounced fund brief) are<br />

covered-bonds collateralised by long-term debt – either<br />

mortgages or loans to the public sector. Despite an<br />

increasing geographical diversity of issuers the principles<br />

created in 1995 – with the launch of the Jumbo<br />

Pfandbriefe market - have been widely adopted as the<br />

governing tenet of all of Europe’s Jumbo markets.<br />

The minimum standards for Jumbo Pfandbriefe were<br />

officially adopted by German mortgage banks in 1997<br />

and updated again in 2004. They include: A minimum<br />

issue size of €1 billion, with a minimum initial issue size<br />

of at least €750 million. The average size tops the<br />

€1.5 billion mark.<br />

The use of only straight bond formats to create<br />

Jumbo paper – i.e. fixed coupon payable annually in<br />

arrears with bullet redemption. A minimum of three<br />

market-makers who are pledged to quote bid/ask (twoway)<br />

prices simultaneously for lots of up to €15 million.<br />

Market makers should also have agreed to maintain a<br />

standard and pre-determined bid offer spread based on<br />

the residual life of an issue – for example the maximum<br />

bid/offer spread for an 8 to 15 year maturity is 10bp.<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS