Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DEBT REPORT: US BOND ISSUES<br />

52<br />

applied for court protection<br />

from its creditors under the<br />

US Chapter 11 bankruptcy<br />

code of practice.<br />

Dramatic as the investor<br />

reaction was, there is little<br />

risk that GM or Ford will<br />

have to contemplate this<br />

course – at least in the near<br />

to medium term. While<br />

most analysts believe that<br />

further downgrades are<br />

eminently possible (S&P<br />

has put both companies'<br />

ratings on negative watch)<br />

they still have large cash positions and substantial undrawn<br />

bank facilities.“The companies have a lot of liquidity and that<br />

is a source of hope,” maintains Scott Sprinzen, the S&P<br />

analyst in New York who covers the industry. “In the auto<br />

sector there have been examples of dramatic turnarounds.”<br />

Sprinzen adds that the big cash holdings combined with<br />

relatively light profiles of maturing debt make it unlikely that<br />

either company could seek Chapter 11 protection in the next<br />

two years.“You have to be able to demonstrate that you’re<br />

insolvent, and that’s hard to do when you are sitting on a lot<br />

of cash,”he points out.<br />

While the senior unsecured bond markets are probably<br />

closed to both companies for the foreseeable future, they<br />

can still raise further liquidity if required by selling more<br />

asset-backed securities. Almost all their main asset types<br />

(retail loans, wholesale loans, retail leases) are securitisable.<br />

Alternately, they can unload loan portfolios to third parties<br />

in the whole-loan markets. Nevertheless, the loss of<br />

investment grade status for two motor titans will have<br />

widespread ramifications for the corporate – and other –<br />

bond markets. It has already led to the downgrading of<br />

several collateralised debt obligations (CDOs) in which<br />

Ford and/or GM bonds formed part of the collateral.<br />

Following a review of 561 European synthetic CDOs, S&P<br />

said 19 of the 745 classes required downgrading and a<br />

further 25 needed to be placed on negative watch.<br />

While much of the reaction to date has focused on the<br />

CDO market – much of it down to hedge funds that<br />

misread arbitrage opportunities in the derivatives of the<br />

equity and mezzanine tranches covering positions –<br />

investment grade portfolio managers may well have to<br />

offload tens of billions of dollars' worth of the auto makers'<br />

bonds in the coming weeks.<br />

The picture is clouded, however, by the impending<br />

change in Lehman Brothers' US Aggregate Bond <strong>Index</strong>, the<br />

most widely used US measure for tracking investment<br />

grade credits. From July 1, the index will use the middle<br />

rating from the top three agencies (S&P, Moody’s and<br />

Fitch) rather than the lower of S&P's or Moody's as it does<br />

at present. Provided Moody’s and Fitch do not downgrade<br />

the companies to sub-investment grade in the meantime,<br />

their bonds could become eligible holdings again in a few<br />

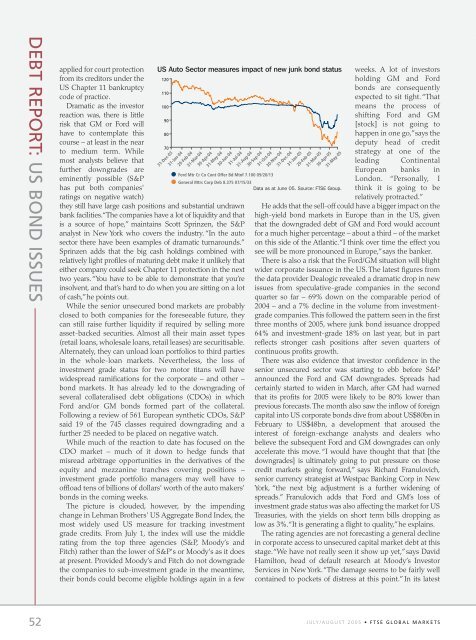

US Auto Sector measures impact of new junk bond status<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

31-Dec-03<br />

31-Jan-04<br />

29-Feb-04<br />

31-Mar-04<br />

30-Apr-04<br />

31-May-04<br />

30-Jun-04<br />

31-Jul-04<br />

31-Aug-04<br />

30-Sep-04<br />

31-Oct-04<br />

30-Nov-04<br />

Ford Mtr Cr Co Cont Offer Bd Mtnf 7.100 09/20/13<br />

31-Dec-04<br />

31-Jan-05<br />

29-Feb-05<br />

31-Mar-05<br />

30-Apr-05<br />

31-May-05<br />

General Mtrs Corp Deb 8.375 07/15/33<br />

Data as at June 05. Source: <strong>FTSE</strong> Group.<br />

weeks. A lot of investors<br />

holding GM and Ford<br />

bonds are consequently<br />

expected to sit tight.“That<br />

means the process of<br />

shifting Ford and GM<br />

[stock] is not going to<br />

happen in one go,”says the<br />

deputy head of credit<br />

strategy at one of the<br />

leading Continental<br />

European banks in<br />

London. “Personally, I<br />

think it is going to be<br />

relatively protracted.”<br />

He adds that the sell-off could have a bigger impact on the<br />

high-yield bond markets in Europe than in the US, given<br />

that the downgraded debt of GM and Ford would account<br />

for a much higher percentage – about a third – of the market<br />

on this side of the Atlantic.“I think over time the effect you<br />

see will be more pronounced in Europe,”says the banker.<br />

There is also a risk that the Ford/GM situation will blight<br />

wider corporate issuance in the US. The latest figures from<br />

the data provider Dealogic revealed a dramatic drop in new<br />

issues from speculative-grade companies in the second<br />

quarter so far – 69% down on the comparable period of<br />

2004 – and a 7% decline in the volume from investmentgrade<br />

companies.This followed the pattern seen in the first<br />

three months of 2005, where junk bond issuance dropped<br />

64% and investment-grade 18% on last year, but in part<br />

reflects stronger cash positions after seven quarters of<br />

continuous profits growth.<br />

There was also evidence that investor confidence in the<br />

senior unsecured sector was starting to ebb before S&P<br />

announced the Ford and GM downgrades. Spreads had<br />

certainly started to widen in March, after GM had warned<br />

that its profits for 2005 were likely to be 80% lower than<br />

previous forecasts. The month also saw the inflow of foreign<br />

capital into US corporate bonds dive from about US$80bn in<br />

February to US$48bn, a development that aroused the<br />

interest of foreign-exchange analysts and dealers who<br />

believe the subsequent Ford and GM downgrades can only<br />

accelerate this move. “I would have thought that that [the<br />

downgrades] is ultimately going to put pressure on those<br />

credit markets going forward,” says Richard Franulovich,<br />

senior currency strategist at Westpac Banking Corp in New<br />

York, “the next big adjustment is a further widening of<br />

spreads.” Franulovich adds that Ford and GM’s loss of<br />

investment grade status was also affecting the market for US<br />

Treasuries, with the yields on short term bills dropping as<br />

low as 3%.“It is generating a flight to quality,”he explains.<br />

The rating agencies are not forecasting a general decline<br />

in corporate access to unsecured capital market debt at this<br />

stage.“We have not really seen it show up yet,”says David<br />

Hamilton, head of default research at Moody’s Investor<br />

Services in New York.“The damage seems to be fairly well<br />

contained to pockets of distress at this point.” In its latest<br />

JULY/AUGUST 2005 • <strong>FTSE</strong> GLOBAL MARKETS