01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

Reclassification<br />

in accordance with<br />

IAS 39.50<br />

Anticipated cash flows<br />

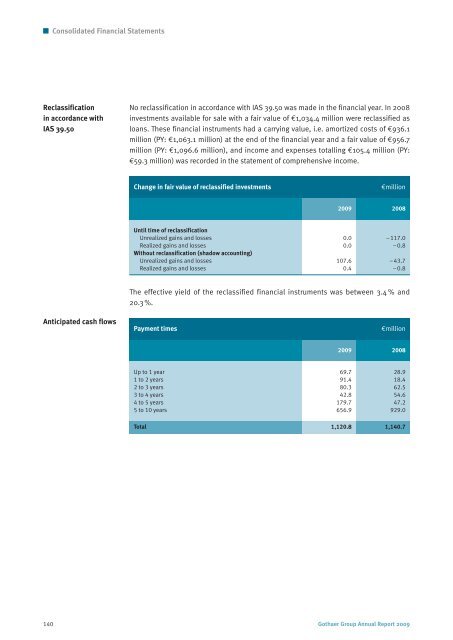

No reclassification in accordance with IAS 39.50 was made in the financial year. In 2008<br />

investments available for sale with a fair value of €1,034.4 million were reclassified as<br />

loans. These financial instruments had a carrying value, i.e. amortized costs of €936.1<br />

million (PY: €1,063.1 million) at the end of the financial year and a fair value of €956.7<br />

million (PY: €1,<strong>09</strong>6.6 million), and income and expenses totalling €105.4 million (PY:<br />

€59.3 million) was recorded in the statement of comprehensive income.<br />

Change in fair value of reclassified investments €million<br />

20<strong>09</strong> 2008<br />

Until time of reclassification<br />

Unrealized gains and losses 0.0 –117.0<br />

Realized gains and losses 0.0 –0.8<br />

Without reclassification (shadow accounting)<br />

Unrealized gains and losses 107.6 –43.7<br />

Realized gains and losses 0.4 –0.8<br />

The effective yield of the reclassified financial instruments was between 3.4 % and<br />

20.3 %.<br />

Payment times €million<br />

20<strong>09</strong> 2008<br />

Up to 1 year 69.7 28.9<br />

1 to 2 years 91.4 18.4<br />

2 to 3 years 80.3 62.5<br />

3 to 4 years 42.8 54.6<br />

4 to 5 years 179.7 47.2<br />

5 to 10 years 656.9 929.0<br />

Total 1,120.8 1,140.7<br />

140 <strong>Gothaer</strong> Group Annual Report 20<strong>09</strong>