01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

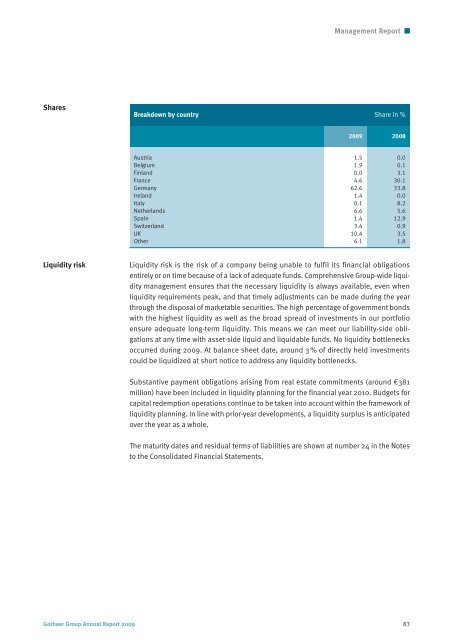

Shares<br />

Liquidity risk<br />

Management Report<br />

Breakdown by country Share in %<br />

20<strong>09</strong> 2008<br />

Austria 1.5 0.0<br />

Belgium 1.9 0.1<br />

Finland 0.0 3.1<br />

France 4.6 30.1<br />

Germany 62.6 33.8<br />

Ireland 1.4 0.0<br />

Italy 0.1 8.2<br />

Netherlands 6.6 5.6<br />

Spain 1.4 12.9<br />

Switzerland 3.4 0.9<br />

UK 10.4 3.5<br />

Other 6.1 1.8<br />

Liquidity risk is the risk of a company being unable to fulfil its financial obligations<br />

entirely or on time because of a lack of adequate funds. Comprehensive Group-wide liquidity<br />

management ensures that the necessary liquidity is always available, even when<br />

liquidity requirements peak, and that timely adjustments can be made during the year<br />

through the disposal of marketable securities. The high percentage of government bonds<br />

with the highest liquidity as well as the broad spread of investments in our portfolio<br />

ensure adequate long-term liquidity. This means we can meet our liability-side obligations<br />

at any time with asset-side liquid and liquidable funds. No liquidity bottlenecks<br />

occurred during 20<strong>09</strong>. At balance sheet date, around 3 % of directly held investments<br />

could be liquidized at short notice to address any liquidity bottlenecks.<br />

Substantive payment obligations arising from real estate commitments (around €381<br />

million) have been included in liquidity planning for the financial year 2<strong>01</strong>0. Budgets for<br />

capital redemption operations continue to be taken into account within the framework of<br />

liquidity planning. In line with prior-year developments, a liquidity surplus is anticipated<br />

over the year as a whole.<br />

The maturity dates and residual terms of liabilities are shown at number 24 in the Notes<br />

to the Consolidated Financial Statements.<br />

<strong>Gothaer</strong> Group Annual Report 20<strong>09</strong> 83