01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Performance<br />

of the companies<br />

Policyholder benefits, which include both losses incurred and changes in underwriting<br />

reserves, more than doubled to €1.74 billion, rising from a prior-year figure – €0.83<br />

billion – significantly depressed by the financial crisis. After a year in which policy reserves<br />

were adjusted to take account of unrealised losses on unit-linked life policies of<br />

€368.5 million, 20<strong>09</strong> saw unrealised gains of €179.3 million factored into the adjustment.<br />

While the allocation to reserves for premium refunds showed a moderate improvement,<br />

benefits paid – as a result of increased index policy surrenders and<br />

maturities – also rose sharply to €1.33 billion (PY: €1.19 billion).<br />

In contrast to the positive development of premiums, acquisition expenses decreased<br />

to €137.6 million (PY: €146.9 million). This was due to the greater share of singlepremium<br />

business. Including increased administrative expenses of €47.8 million<br />

(PY: €43.2 million), total underwriting expenses amounted to €185.4 million (PY: €190.1<br />

million).<br />

Owing to the developments described above, the Life segment registered an operating<br />

loss of €11.2 million (PY: €27.0 million operating profit) in the year under review. After<br />

allowance for financing expenses and tax income of €22.2 million (PY: €8.4 million tax<br />

expense), the statement of income showed a net profit for the year of €6.9 million<br />

(PY: €13.3 million) prior to transfer of profits.<br />

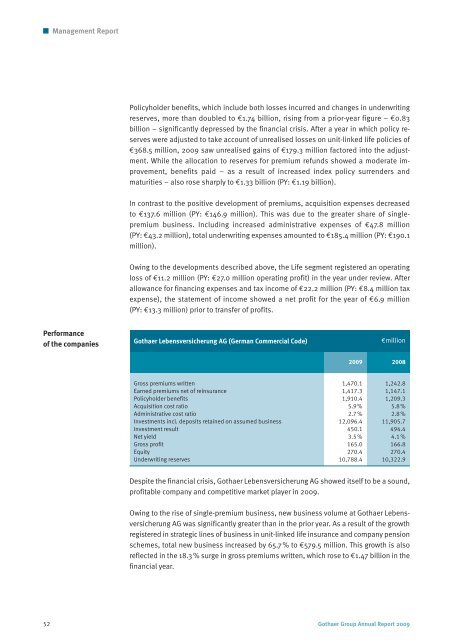

<strong>Gothaer</strong> Lebensversicherung AG (German Commercial Code)<br />

€million<br />

20<strong>09</strong> 2008<br />

Gross premiums written 1,470.1 1,242.8<br />

Earned premiums net of reinsurance 1,417.3 1,147.1<br />

Policyholder benefits 1,910.4 1,2<strong>09</strong>.3<br />

Acquisition cost ratio 5.9 % 5.8 %<br />

Administrative cost ratio 2.7 % 2.8 %<br />

Investments incl. deposits retained on assumed business 12,<strong>09</strong>6.4 11,905.7<br />

Investment result 450.1 494.4<br />

Net yield 3.5 % 4.1 %<br />

Gross profit 165.0 166.8<br />

Equity 270.4 270.4<br />

Underwriting reserves 10,788.4 10,322.9<br />

Despite the financial crisis, <strong>Gothaer</strong> Lebensversicherung AG showed itself to be a sound,<br />

profitable company and competitive market player in 20<strong>09</strong>.<br />

Owing to the rise of single-premium business, new business volume at <strong>Gothaer</strong> Lebensversicherung<br />

AG was significantly greater than in the prior year. As a result of the growth<br />

registered in strategic lines of business in unit-linked life insurance and company pension<br />

schemes, total new business increased by 65.7 % to €579.5 million. This growth is also<br />

reflected in the 18.3 % surge in gross premiums written, which rose to €1.47 billion in the<br />

financial year.<br />

52 <strong>Gothaer</strong> Group Annual Report 20<strong>09</strong>