01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements<br />

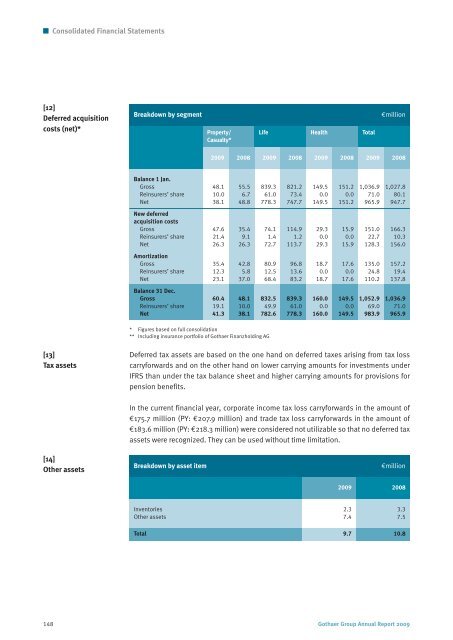

[12]<br />

Deferred acquisition<br />

costs (net)*<br />

[13]<br />

Tax assets<br />

[14]<br />

Other assets<br />

Breakdown by segment €million<br />

Property/<br />

Casualty*<br />

20<strong>09</strong><br />

* Figures based on full consolidation<br />

** Including insurance portfolio of <strong>Gothaer</strong> Finanzholding AG<br />

Life Health<br />

148 <strong>Gothaer</strong> Group Annual Report 20<strong>09</strong><br />

Total<br />

2008 20<strong>09</strong> 2008 20<strong>09</strong> 2008 20<strong>09</strong> 2008<br />

Balance 1 Jan.<br />

Gross 48.1 55.5 839.3 821.2 149.5 151.2 1,036.9 1,027.8<br />

Reinsurers’ share 10.0 6.7 61.0 73.4 0.0 0.0 71.0 80.1<br />

Net 38.1 48.8 778.3 747.7 149.5 151.2 965.9 947.7<br />

New deferred<br />

acquisition costs<br />

Gross 47.6 35.4 74.1 114.9 29.3 15.9 151.0 166.3<br />

Reinsurers’ share 21.4 9.1 1.4 1.2 0.0 0.0 22.7 10.3<br />

Net 26.3 26.3 72.7 113.7 29.3 15.9 128.3 156.0<br />

Amortization<br />

Gross 35.4 42.8 80.9 96.8 18.7 17.6 135.0 157.2<br />

Reinsurers’ share 12.3 5.8 12.5 13.6 0.0 0.0 24.8 19.4<br />

Net 23.1 37.0 68.4 83.2 18.7 17.6 110.2 137.8<br />

Balance 31 Dec.<br />

Gross 60.4 48.1 832.5 839.3 160.0 149.5 1,052.9 1,036.9<br />

Reinsurers’ share 19.1 10.0 49.9 61.0 0.0 0.0 69.0 71.0<br />

Net 41.3 38.1 782.6 778.3 160.0 149.5 983.9 965.9<br />

Deferred tax assets are based on the one hand on deferred taxes arising from tax loss<br />

carryforwards and on the other hand on lower carrying amounts for investments under<br />

IFRS than under the tax balance sheet and higher carrying amounts for provisions for<br />

pension benefits.<br />

In the current financial year, corporate income tax loss carryforwards in the amount of<br />

€175.7 million (PY: €207.9 million) and trade tax loss carryforwards in the amount of<br />

€183.6 million (PY: €218.3 million) were considered not utilizable so that no deferred tax<br />

assets were recognized. They can be used without time limitation.<br />

Breakdown by asset item €million<br />

20<strong>09</strong> 2008<br />

Inventories 2.3 3.3<br />

Other assets 7.4 7.5<br />

Total 9.7 10.8