01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

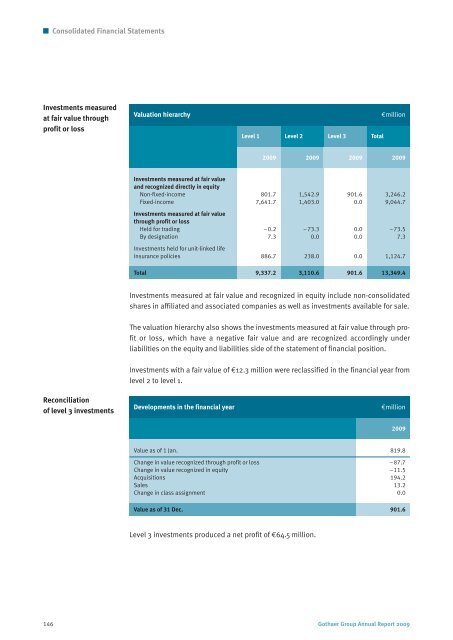

Consolidated Financial Statements<br />

Investments measured<br />

at fair value through<br />

profit or loss<br />

Reconciliation<br />

of level 3 investments<br />

Valuation hierarchy €million<br />

Level 1 Level 2 Level 3 Total<br />

Investments measured at fair value and recognized in equity include non-consolidated<br />

shares in affiliated and associated companies as well as investments available for sale.<br />

The valuation hierarchy also shows the investments measured at fair value through profit<br />

or loss, which have a negative fair value and are recognized accordingly under<br />

liabilities on the equity and liabilities side of the statement of financial position.<br />

Investments with a fair value of €12.3 million were reclassified in the financial year from<br />

level 2 to level 1.<br />

Developments in the financial year €million<br />

Level 3 investments produced a net profit of €64.5 million.<br />

146 <strong>Gothaer</strong> Group Annual Report 20<strong>09</strong><br />

20<strong>09</strong><br />

20<strong>09</strong> 20<strong>09</strong> 20<strong>09</strong><br />

Investments measured at fair value<br />

and recognized directly in equity<br />

Non-fixed-income 8<strong>01</strong>.7 1,542.9 9<strong>01</strong>.6 3,246.2<br />

Fixed-income 7,641.7 1,403.0 0.0 9,044.7<br />

Investments measured at fair value<br />

through profit or loss<br />

Held for trading –0.2 –73.3 0.0 –73.5<br />

By designation 7.3 0.0 0.0 7.3<br />

Investments held for unit-linked life<br />

insurance policies 886.7 238.0 0.0 1,124.7<br />

Total 9,337.2 3,110.6 9<strong>01</strong>.6 13,349.4<br />

20<strong>09</strong><br />

Value as of 1 Jan. 819.8<br />

Change in value recognized through profit or loss –87.7<br />

Change in value recognized in equity –11.5<br />

Acquisitions 194.2<br />

Sales 13.2<br />

Change in class assignment 0.0<br />

Value as of 31 Dec. 9<strong>01</strong>.6