01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

01 Gothaer Konzern_E_09_Umschl - Gothaer Allgemeine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

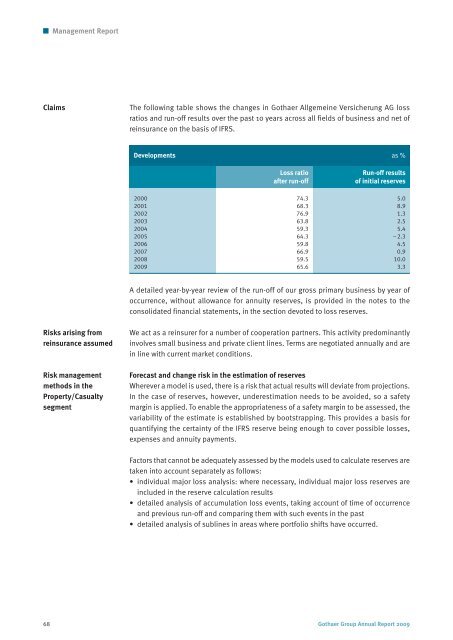

Claims The following table shows the changes in <strong>Gothaer</strong> <strong>Allgemeine</strong> Versicherung AG loss<br />

ratios and run-off results over the past 10 years across all fields of business and net of<br />

reinsurance on the basis of IFRS.<br />

Risks arising from<br />

reinsurance assumed<br />

Risk management<br />

methods in the<br />

Property/Casualty<br />

segment<br />

Developments as %<br />

Loss ratio<br />

after run-off<br />

Run-off results<br />

of initial reserves<br />

2000 74.3 5.0<br />

20<strong>01</strong> 68.3 8.9<br />

2002 76.9 1.3<br />

2003 63.8 2.5<br />

2004 59.3 5.4<br />

2005 64.3 –2.3<br />

2006 59.8 4.5<br />

2007 66.9 0.9<br />

2008 59.5 10.0<br />

20<strong>09</strong> 65.6 3.3<br />

A detailed year-by-year review of the run-off of our gross primary business by year of<br />

occurrence, without allowance for annuity reserves, is provided in the notes to the<br />

consolidated financial statements, in the section devoted to loss reserves.<br />

We act as a reinsurer for a number of cooperation partners. This activity predominantly<br />

involves small business and private client lines. Terms are negotiated annually and are<br />

in line with current market conditions.<br />

Forecast and change risk in the estimation of reserves<br />

Wherever a model is used, there is a risk that actual results will deviate from projections.<br />

In the case of reserves, however, underestimation needs to be avoided, so a safety<br />

margin is applied. To enable the appropriateness of a safety margin to be assessed, the<br />

variability of the estimate is established by bootstrapping. This provides a basis for<br />

quantifying the certainty of the IFRS reserve being enough to cover possible losses,<br />

expenses and annuity payments.<br />

Factors that cannot be adequately assessed by the models used to calculate reserves are<br />

taken into account separately as follows:<br />

• individual major loss analysis: where necessary, individual major loss reserves are<br />

included in the reserve calculation results<br />

• detailed analysis of accumulation loss events, taking account of time of occurrence<br />

and previous run-off and comparing them with such events in the past<br />

• detailed analysis of sublines in areas where portfolio shifts have occurred.<br />

68 <strong>Gothaer</strong> Group Annual Report 20<strong>09</strong>