Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

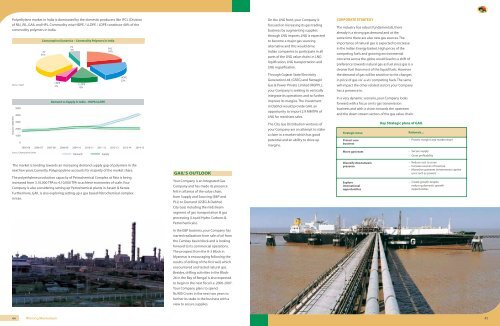

Polyethylene market in <strong>India</strong> is dominated by the domestic producers like IPCL (Division<br />

of RIL), RIL, <strong>GAIL</strong> and HPL. Commodity wise HDPE / LLDPE / LDPE constitute 40% of the<br />

commodity polymers in <strong>India</strong>.<br />

Source : Ingref<br />

Volume (‘000 MT)<br />

5000<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

Consumption Dynamics – Commodity Polymers in <strong>India</strong><br />

PP<br />

35%<br />

LDPE<br />

5%<br />

PS<br />

5%<br />

LLDPE<br />

12%<br />

Demand vs Supply in <strong>India</strong> – HDPE/LLDPE<br />

<strong>2005</strong>-<strong>06</strong> 20<strong>06</strong>-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15<br />

Source : Chemsystems Online<br />

Demand<br />

Supply<br />

PVC<br />

20%<br />

HDPE<br />

23%<br />

On the LNG front, your Company is<br />

focused on increasing its gas trading<br />

business by augmenting supplies<br />

through LNG imports. LNG is expected<br />

to become a major gas sourcing<br />

alternative and this would drive<br />

<strong>India</strong>n companies to participate in all<br />

parts of the LNG value chain i.e. LNG<br />

liquification, LNG transportation and<br />

LNG regasification.<br />

Through Gujarat State Electricity<br />

Generation Ltd. (GSEG) and Ratnagiri<br />

Gas & Power Private Limited (RGPPL),<br />

your Company is seeking to vertically<br />

integrate its operations and to further<br />

improve its margins. The investment<br />

in Dabhol would provide <strong>GAIL</strong> an<br />

opportunity to import 2.9 MMTPA of<br />

LNG for merchant sales.<br />

The City Gas Distribution ventures of<br />

your Company are an attempt to stake<br />

a claim in a market which has good<br />

potential and an ability to drive up<br />

margins.<br />

CORPORATE STRATEGY<br />

The industry has robust fundamentals, there<br />

already is a strong gas demand and at the<br />

same time there are also new gas sources. The<br />

importance of natural gas is expected to increase<br />

in the <strong>India</strong>n Energy basket. High prices of the<br />

competing fuels and growing environmental<br />

concerns across the globe would lead to a shift of<br />

preference towards natural gas as fuel since gas is a<br />

cleaner fuel than most of the liquid fuels. However<br />

the demand of gas will be sensitive to the changes<br />

in price of gas vis’-a-vis’ competing fuels. The same<br />

will impact the other related sectors your Company<br />

has a presence in.<br />

In a very dynamic scenario, your Company looks<br />

forward with a focus on its gas transmission<br />

business and with a vision towards the upstream<br />

and the down stream sectors of the gas value chain.<br />

Strategic move<br />

Protect core<br />

business<br />

Move upstream<br />

Key Strategic plans of <strong>GAIL</strong><br />

Rationale....<br />

– Protect margins and market share<br />

– Secure supply<br />

– Grow profitability<br />

The market is tending towards an increasing demand supply gap of polymers in the<br />

next few years.Currently, Polypropylene accounts for majority of the market share.<br />

The polyethylene production capacity of Petrochemical Complex at Pata is being<br />

increased from 3,10,000 TPA to 4,10,000 TPA to achieve economies of scale. Your<br />

Company is also considering setting up Petrochemical plants in Assam & Kerala.<br />

Furthermore, <strong>GAIL</strong> is also exploring setting up a gas based Petrochemical complex<br />

in Iran.<br />

<strong>GAIL</strong>’S OUTLOOK<br />

Your Company is an Integrated Gas<br />

Company and has made its presence<br />

felt in all areas of the value chain,<br />

from Supply and Sourcing (E&P and<br />

PLL) to Demand (GSEG & Dabhol;<br />

Diversify downstream<br />

presence<br />

Explore<br />

international<br />

opportunities<br />

– Reduce cost to serve<br />

– Increase sources of revenue<br />

– Monetise upstream investments (captive<br />

uses such as power)<br />

– Create growth despite<br />

reducing domestic growth<br />

opportunities<br />

City Gas) including the midstream<br />

segment of gas transportation & gas<br />

processing (Liquid Hydro Carbons &<br />

Petrochemicals).<br />

In the E&P business, your Company has<br />

started realizations from sale of oil from<br />

the Cambay basin block and is looking<br />

forward to its commercial operations.<br />

The prospect from the A-3 Block in<br />

Myanmar is encouraging following the<br />

results of drilling of the first well, which<br />

encountered and tested natural gas.<br />

Besides, drilling activities in the Block-<br />

26 in the Bay of Bengal is also expected<br />

to begin in the next fiscal i.e. 20<strong>06</strong>-2007.<br />

Your Company plans to spend<br />

Rs.900 Crores in the next two years to<br />

further its stake in the business with a<br />

view to secure supplies.<br />

44 Winning Momentum 45