Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The other income represents a very small<br />

amount of the total earnings of your<br />

Company. This is limited to around 2 to 3%<br />

of the total earnings, which implies that<br />

the earnings of your Company are more<br />

sensitive towards the ability to maximize<br />

the production and marketing of products.<br />

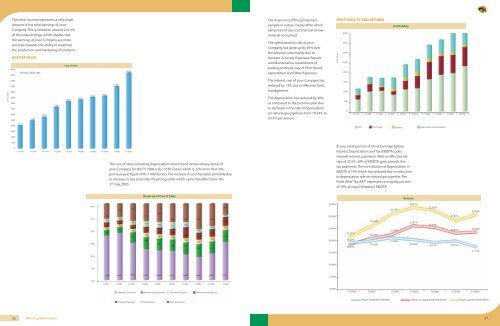

COST OF SALES<br />

14000<br />

13000<br />

10 Year CAGR 13%<br />

Cost of Sales<br />

13530<br />

The major cost of the Company is<br />

variable in nature (nearly 90%) which<br />

comprises of Gas cost and cost of raw<br />

material consumed.<br />

The administrative cost of your<br />

Company has gone up by 49% over<br />

the previous year mainly due to<br />

increase in Survey Expenses, Repairs<br />

and Maintenance, restatement of<br />

trading profits by way of Prior Period<br />

expenditure and Other Expenses.<br />

PROFITABILITY AND RETURNS<br />

in Rs. Crores<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

Profitability<br />

in Rs. Crores<br />

12000<br />

11000<br />

10000<br />

9000<br />

8000<br />

7000<br />

6000<br />

5000<br />

4946<br />

5590<br />

7365<br />

8415<br />

8717<br />

9144<br />

9372<br />

11<strong>06</strong>9<br />

The interest cost of your Company has<br />

reduced by 13% due to effective fund<br />

management.<br />

The depreciation has reduced by 40%<br />

as compared to the previous year due<br />

to decrease in the rate of depreciation<br />

on natural gas pipelines from 10.34% to<br />

3.17% per annum.<br />

1500<br />

1000<br />

500<br />

0<br />

FY1997 FY1998 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 FY<strong>2005</strong> FY20<strong>06</strong><br />

4000<br />

4115<br />

PAT Tax Charges Interest Depreciation & Amortization<br />

3000<br />

2000<br />

1000<br />

0<br />

FY1997 FY1998 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 FY<strong>2005</strong> FY20<strong>06</strong><br />

The cost of sales (including Depreciation, Interest and extraordinary items) of<br />

your Company for the FY 20<strong>06</strong> is Rs.13530 Crores which is 22% more than the<br />

previous year figure of Rs.11<strong>06</strong>9 Crores. The increase in cost has been primarily due<br />

to increase in Gas Cost vide the pricing order which came into effect from the<br />

1st July, <strong>2005</strong>.<br />

A very small portion of 3% of Earnings before<br />

Interest, Depreciation and Tax (EBIDTA) goes<br />

towards interest payments. With an effective tax<br />

rate of 29.5%, 24% of EBIDTA goes towards the<br />

tax payments. The contribution of depreciation in<br />

EBIDTA is 14% which has reduced due to reduction<br />

in depreciation rate on natural gas pipeline. The<br />

Profit After Tax (PAT) represents a majority portion<br />

of 59% of your Company’s EBIDTA.<br />

Break-up of Cost of Sales<br />

Returns<br />

100%<br />

95%<br />

90%<br />

85%<br />

235<br />

61<br />

5<br />

76<br />

41<br />

94<br />

251<br />

65<br />

5<br />

74<br />

56<br />

116<br />

381<br />

92<br />

4<br />

87<br />

79<br />

238<br />

492<br />

167<br />

18<br />

158<br />

127<br />

348<br />

587<br />

197<br />

29<br />

183<br />

146<br />

395<br />

613<br />

227<br />

42<br />

183<br />

148<br />

389<br />

643<br />

186<br />

47<br />

348<br />

158<br />

432<br />

664<br />

138<br />

51<br />

215<br />

174<br />

486<br />

947<br />

134<br />

54<br />

285<br />

2<strong>06</strong><br />

520<br />

559<br />

117<br />

55<br />

424<br />

222<br />

632<br />

35.00%<br />

30.00%<br />

25.00%<br />

20.00%<br />

15.00%<br />

21.21%<br />

18.27%<br />

18.91%<br />

25.36%<br />

20.59%<br />

19.63%<br />

30.53%<br />

22.24%<br />

21.04%<br />

33.27%<br />

25.87%<br />

20.26%<br />

32.02%<br />

25.22%<br />

19.17%<br />

27.87%<br />

22.83%<br />

19.75%<br />

30.49%<br />

23.39%<br />

17.13%<br />

80%<br />

10.00%<br />

75%<br />

70%<br />

3,639<br />

4,445<br />

4,937<br />

6,103<br />

6,932 7,133<br />

7,348<br />

7,660<br />

8,925<br />

11,521<br />

FY1997 FY1998 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 FY<strong>2005</strong> FY20<strong>06</strong><br />

5.00%<br />

Material Consumed Manufacturing Expenses Personnel Expenses Administrative Expenses<br />

0.00%<br />

FY2000 FY2001 FY2002 FY2003 FY2004 FY<strong>2005</strong> FY20<strong>06</strong><br />

Financial Expenses Depreciation Selling Expenses<br />

Return of Net Worth (RONW) Return on Capital Employed (ROCE) Return Capital Invested (ROIC)<br />

56 Winning Momentum 57