Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

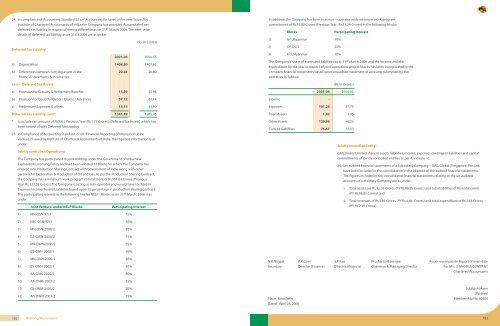

24. In compliance of Accounting Standard 22 on “Accounting for taxes on Income” issued by<br />

Institute of Chartered Accountants of <strong>India</strong>, the Company has provided Accumulated net<br />

deferred tax liability in respect of timing difference as on 31st March, 20<strong>06</strong>. The item- wise<br />

details of deferred tax liability as on 31.03.20<strong>06</strong> are as under:<br />

Deferred Tax Liability<br />

(Rs. in Crores)<br />

<strong>2005</strong>-<strong>06</strong> 2004-05<br />

a) Depreciation 1408.89 1407.65<br />

b) Differences between carrying assets in the 20.44 26.80<br />

financial statements & Income tax<br />

Less :- Deferred Tax Assets<br />

a) Provision for Gratuity & Retirement Benefits 15.59 15.96<br />

b) Provision for Doubtful Debts / Claims / Advances 57.12 61.14<br />

c) Preliminary Expenses & others 15.13 71.90<br />

Deferred Tax Liability (net)* 1341.49 1285.45<br />

* It includes an amount of Rs.NIL ( Previous Year :Rs.1.77 Crores) (Deferred Tax Assets) which has<br />

been netted of with Deferred Tax Liability.<br />

25. In Compliance of Accounting Standard 27 on “Financial <strong>Report</strong>ing of Interests in Joint<br />

Ventures” issued by Institute of Chartered Accountants of <strong>India</strong>, the required information is as<br />

under :<br />

Jointly controlled Operations:<br />

The Company has participated in joint bidding under the Government of <strong>India</strong> New<br />

Exploration Licensing Policy and had been allotted 12 Blocks for which the Company has<br />

entered into Production Sharing Contract with Government of <strong>India</strong> along with other<br />

partners for Exploration & Production of Oil and Gas. As per the Production Sharing Contract,<br />

the Company has a minimum work program commitment of Rs.551.61 Crores (Previous<br />

Year: Rs.137.18 Crores). The Company is acting as non-operator and would have to share in<br />

Expense/Income/Assets/Liabilities based upon its percentage in production sharing contract.<br />

The participating interest in the following twelve NELP - Blocks as on 31st March, 20<strong>06</strong> is as<br />

under:<br />

Joint Venture under NELP Blocks<br />

Participating Interest<br />

In addition, the Company has farm-in as non – operator with minimum work program<br />

commitment of Rs.41.80 Crores (Previous Year : Rs.11.24 Crores) in the following blocks:<br />

Blocks<br />

1) A-1,Myanmar 10%<br />

2) CY-OS/2 25%<br />

3) A-3, Myanmar 10%<br />

Participating Interest<br />

The Company’s share of assets and liabilities as at 31st March, 20<strong>06</strong> and the Income and the<br />

expenditure for the year in respect of joint operations project blocks has been incorporated in the<br />

Company financial statements based upon unaudited statement of accounts submitted by the<br />

operators as follows:<br />

(Rs. in Crores)<br />

<strong>2005</strong>-<strong>06</strong> 2004-05<br />

Income - -<br />

Expenses 101.28 37.79<br />

Fixed Assets 1.42 1.05<br />

Other Assets 139.95 45.25<br />

Current Liabilities 76.67 33.53<br />

Jointly controlled Entity:<br />

<strong>GAIL</strong> (<strong>India</strong>) Limited share in assets, liabilities, income, expenses contingent liabilities and capital<br />

commitments of jointly controlled entities as per Annexure - C<br />

26. Un-audited financial statements of a Subsidiary Company – <strong>GAIL</strong> Global (Singapore) Pte. Ltd.<br />

have been included in the consolidation in the absence of the audited financial statements.<br />

The figures included in the consolidated financial statements relating to the un-audited<br />

accounts of subsidiary Company are as under:<br />

i. Total assets are Rs.92.03 Crores (PY Rs.88.85 Crores) and total liabilities of Rs.92.03 Crores<br />

(PY Rs.88.85 Crores) and<br />

ii.<br />

Total revenues of Rs.5.84 Crores (PY Rs.4.66 Crores) and total expenditure of Rs.3.68 Crores<br />

(PY Rs.2.39 Crores)<br />

1) MN-OSN-97/3 15%<br />

2) NEC-OSN-97/1 50%<br />

3) MN-OSN-2000/2 20%<br />

4) GS-DWN-2000/2 15%<br />

5) MB-DWN-2000/2 15%<br />

6) CB-ONN-2000/1 50%<br />

7) MN-ONN-2000/1 20%<br />

8) CY-ONN-2002/1 50%<br />

9) AA-ONN-2002/1 80%<br />

N.K.Nagpal R.K.Goel S.P. Rao Proshanto Banerjee As per our separate <strong>Report</strong> of even date<br />

Secretary Director (Finance) Director (Projects) Chairman & Managing Director For M/s S. MANN & COMPANY<br />

Chartered Accountants<br />

10) AA-ONM-2003/2 35%<br />

11) CB-ONM-2003/2 20%<br />

12) AN-DWN-2003/2 15%<br />

Subhash Mann<br />

(Partner)<br />

Place : New Delhi Membership No. 80500<br />

Dated : April 28, 20<strong>06</strong><br />

182 Winning Momentum 183