Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

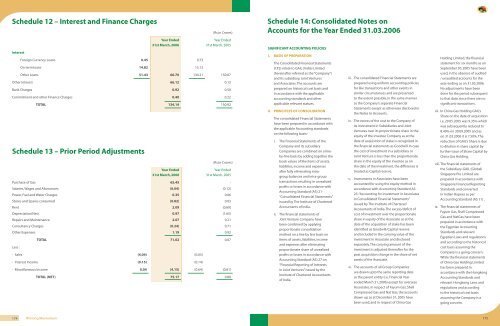

Schedule 12 – Interest and Finance Charges<br />

(Rs.in Crores)<br />

Schedule 14: Consolidated Notes on<br />

Accounts for the Year Ended 31.03.20<strong>06</strong><br />

Year Ended<br />

Year Ended<br />

31st March, 20<strong>06</strong> 31st March, <strong>2005</strong><br />

Interest<br />

Foreign Currency Loans 0.45 0.73<br />

On term loans 14.82 15.13<br />

Other Loans 51.43 66.70 134.21 150.07<br />

Other Interest 66.12 0.13<br />

Bank Charges 0.92 0.50<br />

Commitment and other Finance Charges 0.40 0.22<br />

TOTAL 134.14 150.92<br />

Schedule 13 – Prior Period Adjustments<br />

(Rs.in Crores)<br />

Year Ended<br />

Year Ended<br />

31st March, 20<strong>06</strong> 31st March, <strong>2005</strong><br />

Purchase of Gas 65.45 -<br />

Salaries, Wages and Allowances (0.04) (0.12)<br />

Power, Fuel and Water Charges 0.35 0.66<br />

Stores and Spares consumed (0.82) 0.03<br />

Rent 2.09 (0.69)<br />

Depreciation(Net) 0.97 (1.65)<br />

Repairs and Maintenance 2.07 0.21<br />

Consultancy Charges (0.24) 0.71<br />

Other Expenses 1.19 0.92<br />

TOTAL 71.02 0.07<br />

Less :<br />

- Sales (4.04) (0.03)<br />

- Interest Income (0.15) (0.14)<br />

- Miscellaneous Income 0.04 (4.15) (0.64) (0.81)<br />

TOTAL (NET) 75.17 0.88<br />

SIGNIFICANT ACCOUNTING POLICIES<br />

I. BASIS OF PREPARATION<br />

II.<br />

The Consolidated Financial Statements<br />

(CFS) relate to <strong>GAIL</strong> (<strong>India</strong>) Limited<br />

(hereinafter referred as the “Company”)<br />

and its subsidiary, Joint Ventures<br />

and Associates. The accounts are<br />

prepared on historical cost basis and<br />

in accordance with the applicable<br />

accounting standards and other<br />

applicable relevant statues.<br />

PRINCIPLES OF CONSOLIDATION<br />

The consolidated Financial Statements<br />

have been prepared in accordance with<br />

the applicable Accounting standards<br />

on the following basis:-<br />

i. The Financial Statements of the<br />

Company and its subsidiary<br />

Companies are combined on a lineby-line<br />

basis by adding together the<br />

book values of like items of assets,<br />

liabilities, income and expenses<br />

after fully eliminating intragroup<br />

balances and intra-group<br />

transactions resulting in unrealized<br />

profits or losses in accordance with<br />

Accounting Standard (AS) 21-<br />

“Consolidated Financial Statements”<br />

issued by The Institute of Chartered<br />

Accountants of <strong>India</strong>.<br />

ii.<br />

The financial statements of<br />

Joint Venture Company have<br />

been combined by applying<br />

proportionate consolidation<br />

method on a line by line basis on<br />

items of assets, liabilities, income<br />

and expenses after eliminating<br />

proportionate share of unrealized<br />

profits or losses in accordance with<br />

Accounting Standard (AS) 27 on<br />

“Financial <strong>Report</strong>ing of Interests<br />

in Joint Ventures” issued by the<br />

Institute of Chartered Accountants<br />

of <strong>India</strong>.<br />

iii. The consolidated Financial Statements are<br />

prepared using uniform accounting policies<br />

for like transactions and other events in<br />

similar circumstances and are presented<br />

to the extent possible, in the same manner<br />

as the Company’s separate Financial<br />

Statements except as otherwise disclosed in<br />

the Notes to Accounts.<br />

iv. The excess of the cost to the Company of<br />

its investment in Subsidiaries and Joint<br />

Ventures over its proportionate share in the<br />

equity of the investee Company as at the<br />

date of acquisition of stake is recognized in<br />

the financial statements as Goodwill. In case<br />

the cost of investment in a subsidiary or<br />

Joint Venture is less than the proportionate<br />

share in the equity of the investee as on<br />

the date of the investment, the difference is<br />

treated as Capital reserve.<br />

v. Investments in Associates have been<br />

accounted for using the equity method in<br />

accordance with Accounting Standard AS-<br />

23-“Accounting for investment in Associates<br />

in Consolidated Financial Statements”<br />

issued by The Institute of Chartered<br />

Accountants of <strong>India</strong>. The excess/deficit of<br />

cost of investment over the proportionate<br />

share in equity of the Associate as at the<br />

date of the acquisition of stake has been<br />

identified as Goodwill/Capital reserve<br />

and included in the carrying value of the<br />

investment in Associate and disclosed<br />

separately. The carrying amount of the<br />

investment is adjusted thereafter for the<br />

post acquisition change in the share of net<br />

assets of the Associate.<br />

vi. The accounts of all Group Companies<br />

are drawn upto the same reporting date<br />

as the parent entity (i.e. Financial Year<br />

ended March 31, 20<strong>06</strong>) except for overseas<br />

Associates. In respect of Fayum Gas, Shell<br />

Compressed Gas and Nat Gas, the accounts<br />

drawn up as at December 31, <strong>2005</strong> have<br />

been used, and in respect of China Gas<br />

Holding Limited, the financial<br />

statement for six months as on<br />

September 30, <strong>2005</strong> have been<br />

used, in the absence of audited<br />

/ unaudited accounts for the<br />

year ending as on 31.03.20<strong>06</strong>.<br />

No adjustments have been<br />

done for the period subsequent<br />

to that date, since there are no<br />

significant transactions.<br />

vii. In China Gas Holding <strong>GAIL</strong>’s<br />

Share on the date of acquisition<br />

i.e. 29.05.<strong>2005</strong> was 9.35% which<br />

was subsequently reduced to<br />

8.49% on 30.09.<strong>2005</strong> and as<br />

on 31.03.20<strong>06</strong> it is 7.50%. The<br />

reduction of <strong>GAIL</strong>’s Share is due<br />

to dilution in share capital by<br />

further issue of Share Capital by<br />

China Gas Holding.<br />

viii. The financial statements of<br />

the Subsidiary-<strong>GAIL</strong> (Global)<br />

Singapore Pte Limited are<br />

prepared in accordance with<br />

Singapore Financial <strong>Report</strong>ing<br />

Standards and converted<br />

in <strong>India</strong>n Rupees as per<br />

Accounting Standard (AS 11) .<br />

ix. The financial statements of<br />

Fayum Gas, Shell Compressed<br />

Gas and NatGas have been<br />

prepared in accordance with<br />

the Egyptian Accounting<br />

Standards and relevant<br />

Egyptian Laws and regulations<br />

and according to the historical<br />

cost basis assuming the<br />

Company is a going concern.<br />

While the financial statements<br />

of China Gas Holding Limited<br />

has been prepared in<br />

accordance with the Hongkong<br />

Accounting Standards and<br />

relevant Hongkong Laws and<br />

regulations and according<br />

to the historical cost basis<br />

assuming the Company is a<br />

going concern.<br />

174 Winning Momentum 175