Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUNDRY DEBTORS<br />

The debtors (net of provision) of your<br />

Company as on 31 st March, 20<strong>06</strong> stood at<br />

Rs.753.47 Crores.<br />

Particulars <strong>2005</strong>-20<strong>06</strong> 2004-<strong>2005</strong> Change<br />

Sundry Debtors (Rs in Crores) 753.47 822.86 (8%)<br />

Debtors collection period 20 days 23 days 3 days<br />

Debtors as a % of Turnover (net of ED) 5% 7% -<br />

There has been a marginal decrease in<br />

debtors outstanding as compared to the<br />

previous year. The collection period from<br />

debtors has also reduced by 3 days.<br />

CASH AND BANK BALANCES<br />

The growth of your Company has been<br />

largely financed through cash generated<br />

from operations and to a lesser extent<br />

from external proceeds. Your Company’s<br />

cash and bank balances as at the end<br />

of <strong>2005</strong>-20<strong>06</strong> were Rs.4496 Crores as<br />

against Rs.3447 Crores in 2004-<strong>2005</strong> which<br />

represents a 30% increase. Your Company<br />

has maintained higher cash and bank balances<br />

in order to meet the future CAPEX plans. Your<br />

Company’s treasury policy calls for investing the<br />

surplus funds with the highly rated banks for short<br />

term maturities. Your Company has earned Interest<br />

on Deposits with banks of Rs.221 Crores which has<br />

increased by 100% as compared to the previous<br />

year figure of Rs.100.5 Crores. Investments made by<br />

your Company are through the e-investment mode<br />

which is quick and transparent.<br />

Particulars <strong>2005</strong>-<strong>06</strong> 2004-05<br />

Cash and cash equivalents as % of total assets 27% 22%<br />

Cash and cash equivalents as % of revenue 31% 28%<br />

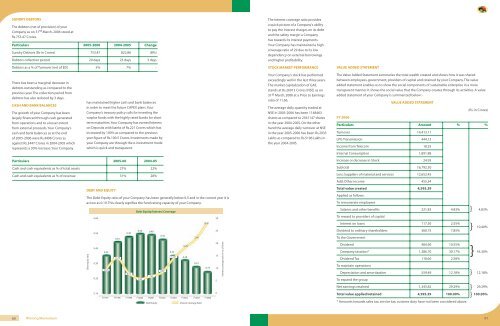

DEBT AND EQUITY<br />

The Debt-Equity ratio of your Company has been generally below 0.5 and in the current year it is<br />

as low as 0.19. This clearly signifies the fund raising capacity of your Company.<br />

Debt equity ratio<br />

0.60<br />

0.50<br />

0.40<br />

0.30<br />

0.20<br />

0.10<br />

0.32<br />

10.25<br />

0.43<br />

14.73<br />

0.48<br />

8.51<br />

Debt Equity/Interest Coverage<br />

0.50 0.49<br />

6.25<br />

7.25<br />

FY1997 FY1998 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 FY<strong>2005</strong> FY20<strong>06</strong><br />

Debt Equity<br />

0.45<br />

8.90<br />

0.32<br />

14.51<br />

18.77<br />

0.29<br />

22.41<br />

0.23<br />

Interest Coverage Ratio<br />

28.91<br />

0.19<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Interest coverage ratio in no. of times<br />

The interest coverage ratio provides<br />

a quick picture of a Company’s ability<br />

to pay the interest charges on its debt<br />

and the safety margin a Company<br />

has towards its interest payments.<br />

Your Company has maintained a high<br />

coverage ratio of 29 due to its low<br />

dependency on external borrowings<br />

and higher profitability.<br />

STOCK MARKET PERFORMANCE<br />

Your Company’s stock has performed<br />

exceedingly well in the last three years.<br />

The market capitalization of <strong>GAIL</strong><br />

stands at Rs.26913 Crores (NSE) as on<br />

31st March, 20<strong>06</strong> at a Price to Earnings<br />

ratio of 11.66.<br />

The average daily quantity traded at<br />

NSE in <strong>2005</strong>-20<strong>06</strong> has been 1148463<br />

shares as compared to 2561147 shares<br />

in the year 2004-<strong>2005</strong>. On the other<br />

hand the average daily turnover at NSE<br />

in the year <strong>2005</strong>-20<strong>06</strong> has been Rs.2933<br />

Lakhs as compared to Rs.5196 Lakhs in<br />

the year 2004-<strong>2005</strong>.<br />

VALUE ADDED STATEMENT<br />

The Value Added Statement summaries the total wealth created and shows how it was shared<br />

between employees, government, providers of capital and retained by your Company. The value<br />

added statement enables us to show the social components of sustainable enterprise in a more<br />

transparent manner. It shows the social value that the Company creates through its activities. A value<br />

added statement of your Company is summarized below: -<br />

FY 20<strong>06</strong><br />

VALUE ADDED STATEMENT<br />

(Rs. in Crores)<br />

Particulars Amount % %<br />

Turnover 14,413.11<br />

LPG Transmission 444.13<br />

Income from Telecom 18.25<br />

Internal Consumption 1,891.88<br />

Increase or decrease in Stock 24.93<br />

Subtotal 16,792.30<br />

Less: Suppliers of material and services 12,652.45<br />

Add: Other income 455.54<br />

Total value created 4,595.39<br />

Applied as follows:<br />

To remunerate employees<br />

Salaries and other benefits 221.83 4.83% 4.83%<br />

To reward to providers of capital<br />

Interest on loans 117.30 2.55%<br />

Dividend to ordinary shareholders 360.75 7.85%<br />

10.40%<br />

To the Government<br />

Dividend 484.90 10.55%<br />

}<br />

Company taxation* 1,386.70 30.17% 43.30%<br />

Dividend Tax 118.60 2.58%<br />

To maintain operations<br />

Depreciation and amortization 559.49 12.18% 12.18%<br />

To expand the group<br />

Net earnings retained 1,345.82 29.29% 29.29%<br />

Total value applied/retained 4,595.39 100.00% 100.00%<br />

* Amounts towards sales tax, service tax, customs duty have not been considered above.<br />

}<br />

}<br />

}<br />

}<br />

}<br />

60 Winning Momentum 61