Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

Annual Report - 2005-06 - GAIL (India)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

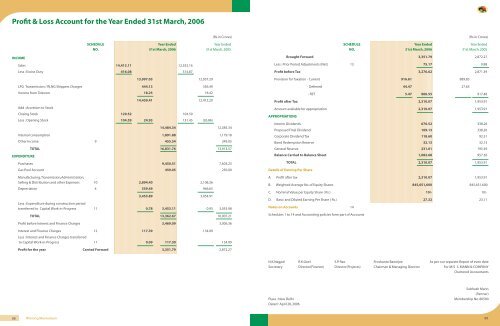

Profit & Loss Account for the Year Ended 31st March, 20<strong>06</strong><br />

INCOME<br />

(Rs.in Crores)<br />

SCHEDULE Year Ended Year Ended<br />

NO. 31st March, 20<strong>06</strong> 31st March, <strong>2005</strong><br />

Sales 14,413.11 12,552.16<br />

Less : Excise Duty 416.08 514.87<br />

13,997.03 12,037.29<br />

LPG Transmission / RLNG Shippers Charges 444.13 356.49<br />

Income from Telecom 18.25 18.42<br />

14,459.41 12,412.20<br />

Add : Accretion to Stock<br />

Closing Stock 129.52 104.59<br />

Less : Opening Stock 104.59 24.93 131.45 (26.86)<br />

14,484.34 12,385.34<br />

Internal consumption 1,891.88 1,179.18<br />

Other Income 9 455.54 349.05<br />

EXPENDITURE<br />

TOTAL 16,831.76 13,913.57<br />

Purchases 9,450.51 7,603.23<br />

Gas Pool Account 459.05 250.00<br />

Manufacturing, Transmission,Administration,<br />

Selling & Distribution and other Expenses 10 2,894.40 2,108.26<br />

Depreciation 4 559.49 946.65<br />

3,453.89 3,054.91<br />

Less : Expenditure during construction period<br />

transferred to Capital Work-in-Progress 11 0.78 3,453.11 0.93 3,053.98<br />

TOTAL 13,362.67 10,907.21<br />

(Rs.in Crores)<br />

SCHEDULE Year Ended Year Ended<br />

NO. 31st March, 20<strong>06</strong> 31st March, <strong>2005</strong><br />

Brought Forward 3,351.79 2,872.27<br />

Less : Prior Period Adjustments (Net) 13 75.17 0.88<br />

Profit before Tax 3,276.62 2,871.39<br />

Provision for Taxation - Current 916.61 889.83<br />

- Deferred 44.47 27.65<br />

- FBT 5.47 966.55 - 917.48<br />

Profit after Tax 2,310.07 1,953.91<br />

Amount available for appropriation 2,310.07 1,953.91<br />

APPROPRIATIONS<br />

Interim Dividends 676.52 338.26<br />

Proposed Final Dividend 169.13 338.26<br />

Corporate Dividend Tax 118.60 92.51<br />

Bond Redemption Reserve 32.13 32.13<br />

General Reserve 231.01 195.39<br />

Balance Carried to Balance Sheet 1,082.68 957.36<br />

TOTAL 2,310.07 1,953.91<br />

Details of Earning Per Share<br />

A. Profit after tax 2,310.07 1,953.91<br />

B. Weighted Average No. of Equity Shares 845,651,600 845,651,600<br />

C. Nominal Value per Equity Share ( Rs.) 10/- 10/-<br />

D. Basic and Diluted Earning Per Share ( Rs.) 27.32 23.11<br />

Notes on Accounts 14<br />

Schedules 1 to 14 and Accounting policies form part of Accounts<br />

Profit before Interest and Finance Charges 3,469.09 3,0<strong>06</strong>.36<br />

Interest and Finance Charges 12 117.39 134.09<br />

Less : Interest and Finance Charges transferred<br />

to Capital Work-in-Progress 11 0.09 117.30 - 134.09<br />

Profit for the year Carried Forward 3,351.79 2,872.27<br />

N.K.Nagpal R.K.Goel S.P. Rao Proshanto Banerjee As per our separate <strong>Report</strong> of even date<br />

Secretary Director(Finance) Director(Projects) Chairman & Managing Director For M/S S. MANN & COMPANY<br />

Chartered Accountants<br />

Subhash Mann<br />

(Partner)<br />

Place : New Delhi Membership No. 80500<br />

Dated : April 28, 20<strong>06</strong><br />

88 Winning Momentum 89