ANNUAL REPORT 2004 - Luxottica Group

ANNUAL REPORT 2004 - Luxottica Group

ANNUAL REPORT 2004 - Luxottica Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

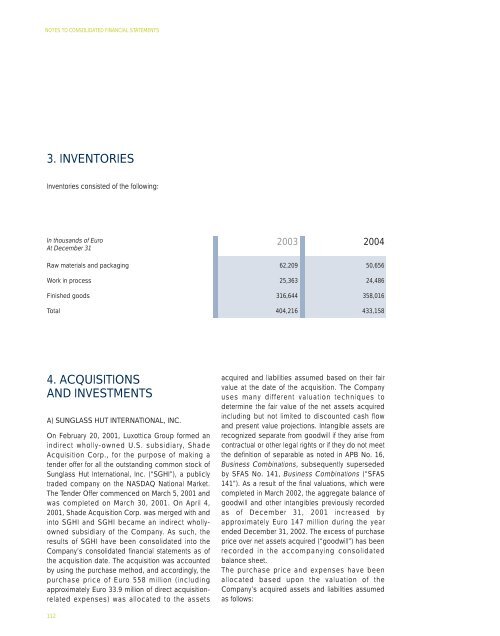

3. INVENTORIES<br />

Inventories consisted of the following:<br />

In thousands of Euro<br />

At December 31<br />

Raw materials and packaging<br />

Work in process<br />

Finished goods<br />

Total<br />

4. ACQUISITIONS<br />

AND INVESTMENTS<br />

A) SUNGLASS HUT INTERNATIONAL, INC.<br />

On February 20, 2001, <strong>Luxottica</strong> <strong>Group</strong> formed an<br />

indirect wholly-owned U.S. subsidiary, Shade<br />

Acquisition Corp., for the purpose of making a<br />

tender offer for all the outstanding common stock of<br />

Sunglass Hut International, Inc. (“SGHI”), a publicly<br />

traded company on the NASDAQ National Market.<br />

The Tender Offer commenced on March 5, 2001 and<br />

was completed on March 30, 2001. On April 4,<br />

2001, Shade Acquisition Corp. was merged with and<br />

into SGHI and SGHI became an indirect whollyowned<br />

subsidiary of the Company. As such, the<br />

results of SGHI have been consolidated into the<br />

Company’s consolidated financial statements as of<br />

the acquisition date. The acquisition was accounted<br />

by using the purchase method, and accordingly, the<br />

purchase price of Euro 558 million (including<br />

approximately Euro 33.9 million of direct acquisitionrelated<br />

expenses) was allocated to the assets<br />

112<br />

2003<br />

62,209<br />

25,363<br />

316,644<br />

404,216<br />

<strong>2004</strong><br />

50,656<br />

24,486<br />

358,016<br />

433,158<br />

acquired and liabilities assumed based on their fair<br />

value at the date of the acquisition. The Company<br />

uses many different valuation techniques to<br />

determine the fair value of the net assets acquired<br />

including but not limited to discounted cash flow<br />

and present value projections. Intangible assets are<br />

recognized separate from goodwill if they arise from<br />

contractual or other legal rights or if they do not meet<br />

the definition of separable as noted in APB No. 16,<br />

Business Combinations, subsequently superseded<br />

by SFAS No. 141, Business Combinations (“SFAS<br />

141”). As a result of the final valuations, which were<br />

completed in March 2002, the aggregate balance of<br />

goodwill and other intangibles previously recorded<br />

as of December 31, 2001 increased by<br />

approximately Euro 147 million during the year<br />

ended December 31, 2002. The excess of purchase<br />

price over net assets acquired (“goodwill”) has been<br />

recorded in the accompanying consolidated<br />

balance sheet.<br />

The purchase price and expenses have been<br />

allocated based upon the valuation of the<br />

Company’s acquired assets and liabilities assumed<br />

as follows: