ANNUAL REPORT 2004 - Luxottica Group

ANNUAL REPORT 2004 - Luxottica Group

ANNUAL REPORT 2004 - Luxottica Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

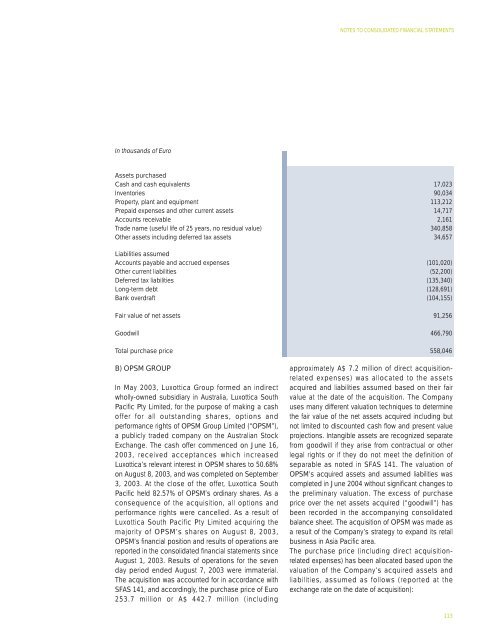

In thousands of Euro<br />

Assets purchased<br />

Cash and cash equivalents<br />

Inventories<br />

Property, plant and equipment<br />

Prepaid expenses and other current assets<br />

Accounts receivable<br />

Trade name (useful life of 25 years, no residual value)<br />

Other assets including deferred tax assets<br />

Liabilities assumed<br />

Accounts payable and accrued expenses<br />

Other current liabilities<br />

Deferred tax liabilities<br />

Long-term debt<br />

Bank overdraft<br />

Fair value of net assets<br />

Goodwill<br />

Total purchase price<br />

B) OPSM GROUP<br />

In May 2003, <strong>Luxottica</strong> <strong>Group</strong> formed an indirect<br />

wholly-owned subsidiary in Australia, <strong>Luxottica</strong> South<br />

Pacific Pty Limited, for the purpose of making a cash<br />

offer for all outstanding shares, options and<br />

performance rights of OPSM <strong>Group</strong> Limited (“OPSM”),<br />

a publicly traded company on the Australian Stock<br />

Exchange. The cash offer commenced on June 16,<br />

2003, received acceptances which increased<br />

<strong>Luxottica</strong>’s relevant interest in OPSM shares to 50.68%<br />

on August 8, 2003, and was completed on September<br />

3, 2003. At the close of the offer, <strong>Luxottica</strong> South<br />

Pacific held 82.57% of OPSM’s ordinary shares. As a<br />

consequence of the acquisition, all options and<br />

performance rights were cancelled. As a result of<br />

<strong>Luxottica</strong> South Pacific Pty Limited acquiring the<br />

majority of OPSM’s shares on August 8, 2003,<br />

OPSM’s financial position and results of operations are<br />

reported in the consolidated financial statements since<br />

August 1, 2003. Results of operations for the seven<br />

day period ended August 7, 2003 were immaterial.<br />

The acquisition was accounted for in accordance with<br />

SFAS 141, and accordingly, the purchase price of Euro<br />

253.7 million or A$ 442.7 million (including<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

17,023<br />

90,034<br />

113,212<br />

14,717<br />

2,161<br />

340,858<br />

34,657<br />

(101,020)<br />

(52,200)<br />

(135,340)<br />

(128,691)<br />

(104,155)<br />

91,256<br />

466,790<br />

558,046<br />

approximately A$ 7.2 million of direct acquisitionrelated<br />

expenses) was allocated to the assets<br />

acquired and liabilities assumed based on their fair<br />

value at the date of the acquisition. The Company<br />

uses many different valuation techniques to determine<br />

the fair value of the net assets acquired including but<br />

not limited to discounted cash flow and present value<br />

projections. Intangible assets are recognized separate<br />

from goodwill if they arise from contractual or other<br />

legal rights or if they do not meet the definition of<br />

separable as noted in SFAS 141. The valuation of<br />

OPSM’s acquired assets and assumed liabilities was<br />

completed in June <strong>2004</strong> without significant changes to<br />

the preliminary valuation. The excess of purchase<br />

price over the net assets acquired (“goodwill”) has<br />

been recorded in the accompanying consolidated<br />

balance sheet. The acquisition of OPSM was made as<br />

a result of the Company’s strategy to expand its retail<br />

business in Asia Pacific area.<br />

The purchase price (including direct acquisitionrelated<br />

expenses) has been allocated based upon the<br />

valuation of the Company’s acquired assets and<br />

liabilities, assumed as follows (reported at the<br />

exchange rate on the date of acquisition):<br />

113