Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OVERVIEW<br />

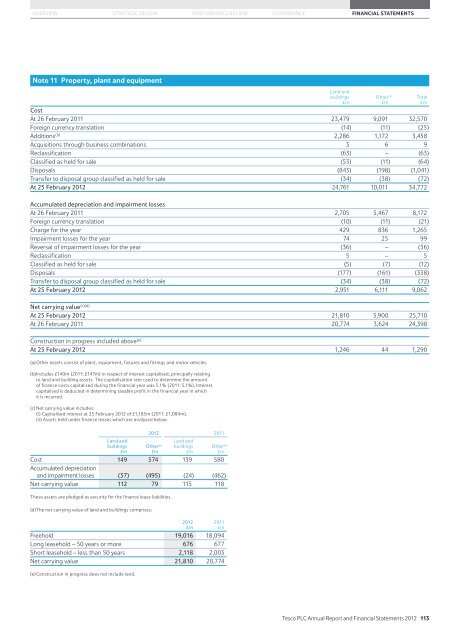

Note 11 Property, plant <strong>and</strong> equipment<br />

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

L<strong>and</strong> <strong>and</strong><br />

buildings<br />

£m<br />

Cost<br />

At 26 February 2011 23,479 9,091 32,570<br />

Foreign currency translation (14) (11) (25)<br />

Additions (b) 2,286 1,172 3,458<br />

Acquisitions through business combinations 3 6 9<br />

Reclassification (63) – (63)<br />

Classified as held for sale (53) (11) (64)<br />

Disposals (843) (198) (1,041)<br />

Transfer to disposal group classified as held for sale (34) (38) (72)<br />

At 25 February <strong>2012</strong> 24,761 10,011 34,772<br />

Accumulated depreciation <strong>and</strong> impairment losses<br />

At 26 February 2011 2,705 5,467 8,172<br />

Foreign currency translation (10) (11) (21)<br />

Charge for the year 429 836 1,265<br />

Impairment losses for the year 74 25 99<br />

Reversal of impairment losses for the year (36) – (36)<br />

Reclassification 5 – 5<br />

Classified as held for sale (5) (7) (12)<br />

Disposals (177) (161) (338)<br />

Transfer to disposal group classified as held for sale (34) (38) (72)<br />

At 25 February <strong>2012</strong> 2,951 6,111 9,062<br />

Net carrying value (c)(d)<br />

At 25 February <strong>2012</strong> 21,810 3,900 25,710<br />

At 26 February 2011 20,774 3,624 24,398<br />

Construction in progress included above (e)<br />

At 25 February <strong>2012</strong> 1,246 44 1,290<br />

(a) Other assets consist of plant, equipment, fixtures <strong>and</strong> fittings <strong>and</strong> motor vehicles.<br />

(b) Includes £140m (2011: £147m) in respect of interest capitalised, principally relating<br />

to l<strong>and</strong> <strong>and</strong> building assets. The capitalisation rate used to determine the amount<br />

of finance costs capitalised during the financial year was 5.1% (2011: 5.1%). Interest<br />

capitalised is deducted in determining taxable profit in the financial year in which<br />

it is incurred.<br />

(c) Net carrying value includes:<br />

(i) Capitalised interest at 25 February <strong>2012</strong> of £1,185m (2011: £1,084m).<br />

(ii) Assets held under finance leases which are analysed below:<br />

L<strong>and</strong> <strong>and</strong><br />

buildings<br />

£m<br />

<strong>2012</strong> 2011<br />

Other (a)<br />

£m<br />

L<strong>and</strong> <strong>and</strong><br />

buildings<br />

£m<br />

Other (a)<br />

£m<br />

Cost 149 574 139 580<br />

Accumulated depreciation<br />

<strong>and</strong> impairment losses (37) (495) (24) (462)<br />

Net carrying value 112 79 115 118<br />

These assets are pledged as security for the finance lease liabilities.<br />

(d) The net carrying value of l<strong>and</strong> <strong>and</strong> buildings comprises:<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Freehold 19,016 18,094<br />

Long leasehold – 50 years or more 676 677<br />

Short leasehold – less than 50 years 2,118 2,003<br />

Net carrying value 21,810 20,774<br />

(e) Construction in progress does not include l<strong>and</strong>.<br />

Other (a)<br />

£m<br />

Total<br />

£m<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong> 113