Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OVERVIEW<br />

As announced in January <strong>2012</strong>, our plan for <strong>2012</strong>/13 is to substantially<br />

increase investment in the delivery of an even better shopping trip for<br />

customers – particularly in the UK. The objective is that this investment<br />

in customer experience will strengthen our underlying business <strong>and</strong><br />

generate long-term sustainable earnings growth <strong>and</strong> returns. In light<br />

of this the Committee has reviewed targets for the <strong>2012</strong> PSP award<br />

to ensure that they remain motivational for management while still<br />

representing long-term value creation for shareholders.<br />

While we have lowered the EPS growth vesting entry point compared<br />

to 2011/12 (from 7% p.a. to 5% p.a.) to ensure that it remains<br />

appropriate <strong>and</strong> motivational for management, we have kept the<br />

maximum vesting point the same, at 12% p.a. growth, to ensure that<br />

awards are only paid in full if there has been significant value creation<br />

for shareholders. In April 2011, we set a target to increase our already<br />

strong level of ROCE to 14.6% by 2014/15. We have improved ROCE<br />

from 12.9% to 13.3% in the last year <strong>and</strong> remain committed to our<br />

target. Therefore the ROCE target remains unchanged. The Committee<br />

believes the targets remain stretching <strong>and</strong> the combination of growing<br />

earnings while improving capital returns will result in value creation<br />

for shareholders.<br />

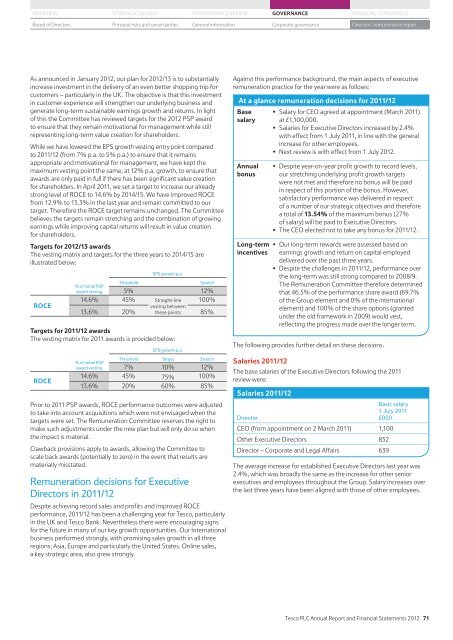

Targets for <strong>2012</strong>/13 awards<br />

The vesting matrix <strong>and</strong> targets for the three years to 2014/15 are<br />

illustrated below:<br />

ROCE<br />

% of initial PSP<br />

award vesting<br />

EPS growth p.a.<br />

Threshold Stretch<br />

5% 12%<br />

14.6% 45% Straight-line 100%<br />

13.6% 20%<br />

vesting between<br />

these points 85%<br />

Targets for 2011/12 awards<br />

The vesting matrix for 2011 awards is provided below:<br />

ROCE<br />

% of initial PSP<br />

award vesting<br />

EPS growth p.a.<br />

Threshold Target Stretch<br />

7% 10% 12%<br />

14.6% 45% 75% 100%<br />

13.6% 20% 60% 85%<br />

Prior to 2011 PSP awards, ROCE performance outcomes were adjusted<br />

to take into account acquisitions which were not envisaged when the<br />

targets were set. The Remuneration Committee reserves the right to<br />

make such adjustments under the new plan but will only do so when<br />

the impact is material.<br />

Clawback provisions apply to awards, allowing the Committee to<br />

scale back awards (potentially to zero) in the event that results are<br />

materially misstated.<br />

Remuneration decisions for Executive<br />

Directors in 2011/12<br />

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

Board of Directors Principal risks <strong>and</strong> uncertainties General information Corporate governance<br />

Directors’ remuneration report<br />

Despite achieving record sales <strong>and</strong> profits <strong>and</strong> improved ROCE<br />

performance, 2011/12 has been a challenging year for <strong>Tesco</strong>, particularly<br />

in the UK <strong>and</strong> <strong>Tesco</strong> Bank. Nevertheless there were encouraging signs<br />

for the future in many of our key growth opportunities. Our International<br />

business performed strongly, with promising sales growth in all three<br />

regions; Asia, Europe <strong>and</strong> particularly the United States. Online sales,<br />

a key strategic area, also grew strongly.<br />

Against this performance background, the main aspects of executive<br />

remuneration practice for the year were as follows:<br />

At a glance remuneration decisions for 2011/12<br />

Base<br />

salary<br />

<strong>Annual</strong><br />

bonus<br />

Long-term<br />

incentives<br />

�� Salary for CEO agreed at appointment (March 2011)<br />

��������������<br />

�� Salaries for Executive Directors increased by 2.4%<br />

with effect from 1 July 2011, in line with the general<br />

increase for other employees.<br />

�� Next review is with effect from 1 July <strong>2012</strong>.<br />

�� Despite year-on-year profit growth to record levels,<br />

our stretching underlying profit growth targets<br />

were not met <strong>and</strong> therefore no bonus will be paid<br />

in respect of this portion of the bonus. However,<br />

satisfactory performance was delivered in respect<br />

of a number of our strategic objectives <strong>and</strong> therefore<br />

a total of 13.54% of the maximum bonus (27%<br />

of salary) will be paid to Executive Directors.<br />

�� The CEO elected not to take any bonus for 2011/12.<br />

�� Our long-term rewards were assessed based on<br />

earnings growth <strong>and</strong> return on capital employed<br />

delivered over the past three years.<br />

�� Despite the challenges in 2011/12, performance over<br />

the long-term was still strong compared to 2008/9.<br />

The Remuneration Committee therefore determined<br />

that 46.5% of the performance share award (69.7%<br />

of the Group element <strong>and</strong> 0% of the international<br />

element) <strong>and</strong> 100% of the share options (granted<br />

under the old framework in 2009) would vest,<br />

reflecting the progress made over the longer term.<br />

The following provides further detail on these decisions.<br />

Salaries 2011/12<br />

The base salaries of the Executive Directors following the 2011<br />

review were:<br />

Salaries 2011/12<br />

Basic salary<br />

1 July 2011<br />

Director<br />

£000<br />

CEO (from appointment on 2 March 2011) 1,100<br />

Other Executive Directors 852<br />

Director – Corporate <strong>and</strong> Legal Affairs 639<br />

The average increase for established Executive Directors last year was<br />

2.4%, which was broadly the same as the increase for other senior<br />

executives <strong>and</strong> employees throughout the Group. Salary increases over<br />

the last three years have been aligned with those of other employees.<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong> 71