Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OVERVIEW<br />

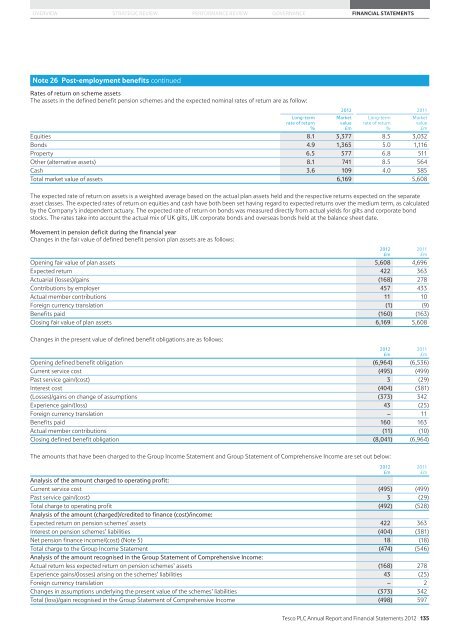

Note 26 Post-employment benefits continued<br />

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

Rates of return on scheme assets<br />

The assets in the defined benefit pension schemes <strong>and</strong> the expected nominal rates of return are as follow:<br />

Long-term<br />

rate of return<br />

%<br />

<strong>2012</strong> 2011<br />

Market<br />

value<br />

£m<br />

Long-term<br />

rate of return<br />

%<br />

Equities 8.1 3,377 8.5 3,032<br />

Bonds 4.9 1,365 5.0 1,116<br />

Property 6.5 577 6.8 511<br />

Other (alternative assets) 8.1 741 8.5 564<br />

Cash 3.6 109 4.0 385<br />

Total market value of assets 6,169 5,608<br />

The expected rate of return on assets is a weighted average based on the actual plan assets held <strong>and</strong> the respective returns expected on the separate<br />

asset classes. The expected rates of return on equities <strong>and</strong> cash have both been set having regard to expected returns over the medium term, as calculated<br />

by the Company’s independent actuary. The expected rate of return on bonds was measured directly from actual yields for gilts <strong>and</strong> corporate bond<br />

stocks. The rates take into account the actual mix of UK gilts, UK corporate bonds <strong>and</strong> overseas bonds held at the balance sheet date.<br />

Movement in pension deficit during the financial year<br />

Changes in the fair value of defined benefit pension plan assets are as follows:<br />

Opening fair value of plan assets 5,608 4,696<br />

Expected return 422 363<br />

Actuarial (losses)/gains (168) 278<br />

Contributions by employer 457 433<br />

Actual member contributions 11 10<br />

Foreign currency translation (1) (9)<br />

Benefits paid (160) (163)<br />

Closing fair value of plan assets 6,169 5,608<br />

Changes in the present value of defined benefit obligations are as follows:<br />

Opening defined benefit obligation (6,964) (6,536)<br />

Current service cost (495) (499)<br />

Past service gain/(cost) 3 (29)<br />

Interest cost (404) (381)<br />

(Losses)/gains on change of assumptions (373) 342<br />

Experience gain/(loss) 43 (25)<br />

Foreign currency translation – 11<br />

Benefits paid 160 163<br />

Actual member contributions (11) (10)<br />

Closing defined benefit obligation (8,041) (6,964)<br />

The amounts that have been charged to the Group Income Statement <strong>and</strong> Group Statement of Comprehensive Income are set out below:<br />

<strong>2012</strong><br />

2011<br />

£m<br />

Analysis of the amount charged to operating profit:<br />

£m<br />

Current service cost (495) (499)<br />

Past service gain/(cost) 3 (29)<br />

Total charge to operating profit<br />

Analysis of the amount (charged)/credited to finance (cost)/income:<br />

(492) (528)<br />

Expected return on pension schemes’ assets 422 363<br />

Interest on pension schemes’ liabilities (404) (381)<br />

Net pension finance income/(cost) (Note 5) 18 (18)<br />

Total charge to the Group Income Statement<br />

Analysis of the amount recognised in the Group Statement of Comprehensive Income:<br />

(474) (546)<br />

Actual return less expected return on pension schemes’ assets (168) 278<br />

Experience gains/(losses) arising on the schemes’ liabilities 43 (25)<br />

Foreign currency translation – 2<br />

Changes in assumptions underlying the present value of the schemes’ liabilities (373) 342<br />

Total (loss)/gain recognised in the Group Statement of Comprehensive Income (498) 597<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

Market<br />

value<br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong> 135