Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OVERVIEW<br />

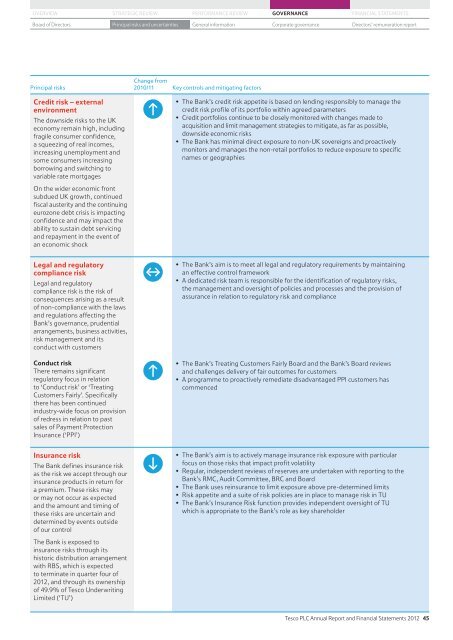

Principal risks<br />

Credit risk – external<br />

environment<br />

The downside risks to the UK<br />

economy remain high, including<br />

fragile consumer confidence,<br />

a squeezing of real incomes,<br />

increasing unemployment <strong>and</strong><br />

some consumers increasing<br />

borrowing <strong>and</strong> switching to<br />

variable rate mortgages<br />

On the wider economic front<br />

subdued UK growth, continued<br />

fiscal austerity <strong>and</strong> the continuing<br />

eurozone debt crisis is impacting<br />

confidence <strong>and</strong> may impact the<br />

ability to sustain debt servicing<br />

<strong>and</strong> repayment in the event of<br />

an economic shock<br />

Legal <strong>and</strong> regulatory<br />

compliance risk<br />

Legal <strong>and</strong> regulatory<br />

compliance risk is the risk of<br />

consequences arising as a result<br />

of non-compliance with the laws<br />

<strong>and</strong> regulations affecting the<br />

Bank’s governance, prudential<br />

arrangements, business activities,<br />

risk management <strong>and</strong> its<br />

conduct with customers<br />

Conduct risk<br />

There remains significant<br />

regulatory focus in relation<br />

to ‘Conduct risk’ or ‘Treating<br />

Customers Fairly’. Specifically<br />

there has been continued<br />

industry-wide focus on provision<br />

of redress in relation to past<br />

sales of Payment Protection<br />

Insurance (‘PPI’)<br />

Insurance risk<br />

The Bank defines insurance risk<br />

as the risk we accept through our<br />

insurance products in return for<br />

a premium. These risks may<br />

or may not occur as expected<br />

<strong>and</strong> the amount <strong>and</strong> timing of<br />

these risks are uncertain <strong>and</strong><br />

determined by events outside<br />

of our control<br />

The Bank is exposed to<br />

insurance risks through its<br />

historic distribution arrangement<br />

with RBS, which is expected<br />

to terminate in quarter four of<br />

<strong>2012</strong>, <strong>and</strong> through its ownership<br />

of 49.9% of <strong>Tesco</strong> Underwriting<br />

Limited (‘TU’)<br />

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

Board of Directors Principal risks <strong>and</strong> uncertainties General information Corporate governance<br />

Directors’ remuneration report<br />

Change from<br />

2010/11 Key controls <strong>and</strong> mitigating factors<br />

�� The Bank’s credit risk appetite is based on lending responsibly to manage the<br />

credit risk profile of its portfolio within agreed parameters<br />

�� Credit portfolios continue to be closely monitored with changes made to<br />

acquisition <strong>and</strong> limit management strategies to mitigate, as far as possible,<br />

downside economic risks<br />

�� The Bank has minimal direct exposure to non-UK sovereigns <strong>and</strong> proactively<br />

monitors <strong>and</strong> manages the non-retail portfolios to reduce exposure to specific<br />

names or geographies<br />

�� The Bank’s aim is to meet all legal <strong>and</strong> regulatory requirements by maintaining<br />

an effective control framework<br />

�� A dedicated risk team is responsible for the identification of regulatory risks,<br />

the management <strong>and</strong> oversight of policies <strong>and</strong> processes <strong>and</strong> the provision of<br />

assurance in relation to regulatory risk <strong>and</strong> compliance<br />

�� The Bank’s Treating Customers Fairly Board <strong>and</strong> the Bank’s Board reviews<br />

<strong>and</strong> challenges delivery of fair outcomes for customers<br />

�� A programme to proactively remediate disadvantaged PPI customers has<br />

commenced<br />

�� The Bank’s aim is to actively manage insurance risk exposure with particular<br />

focus on those risks that impact profit volatility<br />

�� Regular, independent reviews of reserves are undertaken with reporting to the<br />

Bank’s RMC, Audit Committee, BRC <strong>and</strong> Board<br />

�� The Bank uses reinsurance to limit exposure above pre-determined limits<br />

�� Risk appetite <strong>and</strong> a suite of risk policies are in place to manage risk in TU<br />

�� The Bank’s Insurance Risk function provides independent oversight of TU<br />

which is appropriate to the Bank’s role as key shareholder<br />

<strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong> 45