Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Group financial statements<br />

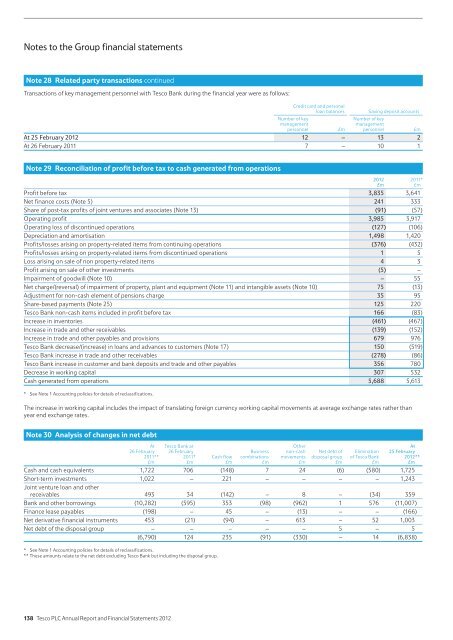

Note 28 Related party transactions continued<br />

Transactions of key management personnel with <strong>Tesco</strong> Bank during the financial year were as follows:<br />

Credit card <strong>and</strong> personal<br />

loan balances<br />

Saving deposit accounts<br />

Number of key<br />

Number of key<br />

management<br />

management<br />

personnel £m personnel £m<br />

At 25 February <strong>2012</strong> 12 – 13 2<br />

At 26 February 2011 7 – 10 1<br />

Note 29 Reconciliation of profit before tax to cash generated from operations<br />

Profit before tax 3,835 3,641<br />

Net finance costs (Note 5) 241 333<br />

Share of post-tax profits of joint ventures <strong>and</strong> associates (Note 13) (91) (57)<br />

Operating profit 3,985 3,917<br />

Operating loss of discontinued operations (127) (106)<br />

Depreciation <strong>and</strong> amortisation 1,498 1,420<br />

Profits/losses arising on property-related items from continuing operations (376) (432)<br />

Profits/losses arising on property-related items from discontinued operations 1 5<br />

Loss arising on sale of non property-related items 4 3<br />

Profit arising on sale of other investments (5) –<br />

Impairment of goodwill (Note 10) – 55<br />

Net charge/(reversal) of impairment of property, plant <strong>and</strong> equipment (Note 11) <strong>and</strong> intangible assets (Note 10) 75 (13)<br />

Adjustment for non-cash element of pensions charge 35 95<br />

Share-based payments (Note 25) 125 220<br />

<strong>Tesco</strong> Bank non-cash items included in profit before tax 166 (83)<br />

Increase in inventories (461) (467)<br />

Increase in trade <strong>and</strong> other receivables (139) (152)<br />

Increase in trade <strong>and</strong> other payables <strong>and</strong> provisions 679 976<br />

<strong>Tesco</strong> Bank decrease/(increase) in loans <strong>and</strong> advances to customers (Note 17) 150 (519)<br />

<strong>Tesco</strong> Bank increase in trade <strong>and</strong> other receivables (278) (86)<br />

<strong>Tesco</strong> Bank increase in customer <strong>and</strong> bank deposits <strong>and</strong> trade <strong>and</strong> other payables 356 780<br />

Decrease in working capital 307 532<br />

Cash generated from operations 5,688 5,613<br />

* See Note 1 Accounting policies for details of reclassifications.<br />

The increase in working capital includes the impact of translating foreign currency working capital movements at average exchange rates rather than<br />

year end exchange rates.<br />

Note 30 Analysis of changes in net debt<br />

At<br />

26 February<br />

2011**<br />

£m<br />

<strong>Tesco</strong> Bank at<br />

26 February<br />

2011*<br />

£m<br />

Cash flow<br />

£m<br />

Business<br />

combinations<br />

£m<br />

Other<br />

non-cash<br />

movements<br />

£m<br />

Net debt of<br />

disposal group<br />

£m<br />

<strong>2012</strong><br />

£m<br />

Elimination<br />

of <strong>Tesco</strong> Bank<br />

£m<br />

2011*<br />

£m<br />

At<br />

25 February<br />

<strong>2012</strong>**<br />

£m<br />

Cash <strong>and</strong> cash equivalents 1,722 706 (148) 7 24 (6) (580) 1,725<br />

Short-term investments 1,022 – 221 – – – – 1,243<br />

Joint venture loan <strong>and</strong> other<br />

receivables 493 34 (142) – 8 – (34) 359<br />

Bank <strong>and</strong> other borrowings (10,282) (595) 353 (98) (962) 1 576 (11,007)<br />

Finance lease payables (198) – 45 – (13) – – (166)<br />

Net derivative financial instruments 453 (21) (94) – 613 – 52 1,003<br />

Net debt of the disposal group – – – – – 5 – 5<br />

(6,790) 124 235 (91) (330) – 14 (6,838)<br />

* See Note 1 Accounting policies for details of reclassifications.<br />

** These amounts relate to the net debt excluding <strong>Tesco</strong> Bank but including the disposal group.<br />

138 <strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong>